How To Survive the Euro Crisis

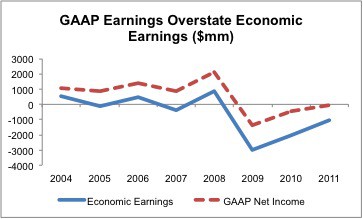

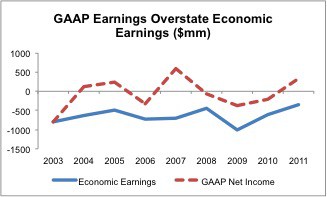

As I wrote in “Don’t Be Fooled: Get Short Now”, the euro is not that different from Enron, WorldCom or the Madoff fund. All of these organizations were able to pretend they were profitable or solvent long after they were insolvent.

Now markets are finally acknowledging the intractability of the Euro debacle.

David Trainer, Founder & CEO