In the current gloomy market environment, our research is as valuable as ever. When there are no major momentum forces pushing stocks up or down, the market gets more efficient and focuses on fundamentals.

We realize the market has not been kind to investors’ portfolios this year. Many of the can’t-miss popular stocks like Nvidia (NVDA) and Tesla (TSLA) have done more damage than good lately – with no resurgence expected.

We cannot turn back the clock, fix your portfolio, and recoup your losses, but we can help you improve performance in the future.

Regardless of what narratives are being spun, and how the market reacts to such events, the best way to protect your portfolio is to know the true fundamentals of the stocks you’re holding. If you do the hard work to calculate the true cash flows of the business and the expectations baked into its stock price, you will have a better understanding of whether a particular stock is a ticking time bomb or a safe haven in a volatile time. And, we do that diligence better than any other firm in the world.

For example, avoiding our Danger Zone Stocks, companies with poor fundamentals and overvalued stock prices, should be a top priority for investors these days.

This week’s Danger Zone pick is no exception. The company’s valuation, as measured by the cash flow growth implied by its current stock price, remains disconnected from the fundamentals of its business. We believe the downside risk at current prices could be 100%.

We first put Trupanion (TRUP: $35/share) in the Danger Zone and named it a Zombie Stock on May 1, 2023, and most recently reiterated our bearish opinion on the stock in April 1, 2024. Since our original report, TRUP has outperformed as a short by 35%, gaining 2% while the S&P 500 is up 37%.

The stock’s price dropped 25% the day after reporting 4Q24 earnings, so investors may think now is a great time to buy the dip. Think again. We’re here to remind investors of this stock’s large downside risk.

No Longer a Zombie Stock, But Still in the Danger Zone

When we first named Trupanion a Zombie Stock it had enough cash to sustain its cash burn for another 23 months.

Trupanion slowed its FCF burn from -$109 million in 2023 to -$46 million in 2024. The lower, yet still negative, FCF means Trupanion no longer qualifies as a Zombie Stock because it has enough cash to sustain its 2024 FCF burn for 78 months from the end of March 2025.

The Full Zombie Stock List

We started our Zombie Stock list in June 2022 and have added a total of 33 stocks to the list. After this report, 13 stocks remain on the list. Companies are removed because:

- they have extended their cash runway before running out of cash,

- their stock prices are near $0,

- they have been acquired, thereby saved from going to $0, or

- they have turned their businesses around and look like they will avoid bankruptcy.

Prior reports where we removed stocks from the Zombie Stock List are here, here, here, here, here, here, here, here, and here.

As a reminder, to make the Zombie Stock list, companies must:

- have less than 24 months of cash to sustain their high cash burn, and

- have a negative interest coverage ratio (EBIT/Interest expense).

Figure 7 shows all 33 Zombie Stocks. We mark those that have been removed from the list with an asterisk.

Figure 7: Zombie Stock Reports: Performance Since Publish Date Through 3/14/25

| Company Name | Ticker | Date Added | Return Since Add Date | Return as Short Vs. S&P 500 |

| Freshpet Inc.* | FRPT | 6/23/22 | -16% | 9% |

| Peloton Interactive | PTON | 6/23/22 | -36% | 80% |

| Carvana Co. | CVNA | 6/23/22 | 475% | -431% |

| Snap Inc.* | SNAP | 7/22/22 | 9% | 36% |

| Beyond Meat, Inc. | BYND | 8/1/22 | -90% | 128% |

| Rivian Automotive* | RIVN | 8/8/22 | -61% | 94% |

| DoorDash, Inc. | DASH | 8/10/22 | 136% | -102% |

| Shake Shack, Inc.* | SHAK | 8/10/22 | 112% | -75% |

| AMC Entertainment | AMC | 8/15/22 | -99% | 130% |

| GameStop Corporation* | GME | 8/15/22 | -68% | 69% |

| Chewy Inc.* | CHWY | 8/17/22 | -55% | 57% |

| Uber Technologies* | UBER | 8/17/22 | 146% | -112% |

| Robinhood Markets* | HOOD | 8/22/22 | 307% | -261% |

| Tilray Brands* | TLRY | 9/7/22 | -49% | 92% |

| Affirm | AFRM | 9/19/22 | 126% | -80% |

| Sunrun | RUN | 9/21/22 | -79% | 132% |

| Blue Apron * | APRN | 9/26/22 | -79% | 95% |

| RingCentral | RNG | 10/3/22 | -37% | 85% |

| Allbirds Inc.* | BIRD | 10/17/22 | -71% | 89% |

| Wayfair | W | 11/14/22 | -24% | 66% |

| Atlassian* | TEAM | 11/16/22 | 43% | -32% |

| Bill.com | BILL | 11/16/22 | -61% | 103% |

| Okta* | OKTA | 11/16/22 | 47% | -2% |

| Oatly* | OTLY | 11/21/22 | -62% | 71% |

| Twilio* | TWLO | 11/23/22 | 39% | 4% |

| Ceridian* | CDAY | 11/23/22 | -3% | 11% |

| Redfin | RDFN | 11/30/22 | 94% | -56% |

| Five9 Inc.* | FIVN | 12/5/22 | -37% | 72% |

| Opendoor* | OPEN | 1/30/23 | -9% | 50% |

| Compass Inc. | COMP | 2/6/23 | 107% | -72% |

| Sweetgreen Inc. | SG | 3/13/23 | 240% | -197% |

| Lucid Group* | LCID | 4/10/23 | -23% | 31% |

| Trupanion* | TRUP | 5/1/23 | 2% | 35% |

| Overall Portfolio Return | 3% | 44% | ||

Sources: New Constructs, LLC and company filings.

*Stocks removed from the Zombie Stock List. Performance tracked through the date each was removed. Linked report goes to the report in which the stock was removed.

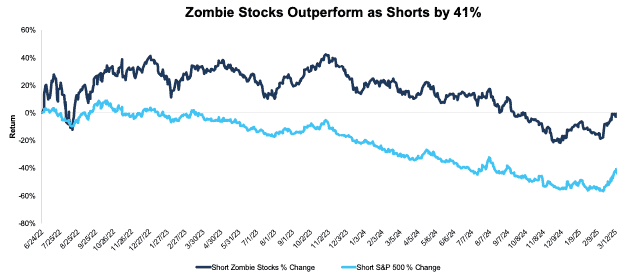

Since our first report on June 23, 2022, the Zombie Stocks as shorts have fallen 3% while shorting the S&P 500 is down 44%. See Figure 8.

Figure 8: Combined Performance of Zombie Stocks List Through 3/14/25

Sources: New Constructs, LLC and company filings.

This article was originally published on March 17, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.