Our Long Idea this week features a rather unknown stock in an overlooked corner of the technology sector, where we see strong growth, market share expansion, long-term demand and major profit potential – all while making the world safer.

And, let’s face it. We need a safer world more than ever these days…

In any market, it’s very difficult to find good companies making money by making the world safer. In the current market, finding any good companies that are also good stocks is nearly impossible.

That’s why we built the first-ever AI agent for Investing – that investors can trust – because we trained it exclusively on proven-superior fundamental data and a proven alpha-generating ontology. Our Robo-Analyst technology allows us to uncover compelling investment opportunities in any kind of market.

This week’s Long Idea is an excellent example.

Seemingly everything we own can be connected to the internet. You can stream movies on your refrigerator (though that sounds uncomfortable to watch), check the weather on your thermostat, and use countless other everyday items (smart toasters anyone?) that come with built-in connectivity.

The auto industry is no different, and telematics is at the heart of this connectivity trend. From vehicle tracking and stolen vehicle recovery to operational optimization, telematics is emerging as a cornerstone of the connected vehicle revolution.

The market is overlooking the potential profits in this fast-growing corner of the technology industry that’s making the world safer and protecting assets. Furthermore, we love to see companies create value for all stakeholders. We believe companies focused on creating value for all stakeholders will create the most value for shareholders.

This week’s Long Idea is one of the telematics industry’s leaders that continues to expand and grow profits, while its stock remains undervalued. Ituran Location and Control (ITRN: $35/share) is this week’s Long Idea.

ITRN offers favorable Risk/Reward based on the company’s:

- #1 market share in quickly growing telematics markets,

- expansion into new markets with large OEM deals,

- growing subscriber count,

- best in class profitability and top-tier balance sheet,

- attractiveness as an acquisition target, and

- cheap stock valuation.

Long-Term Demand Drivers of Growth

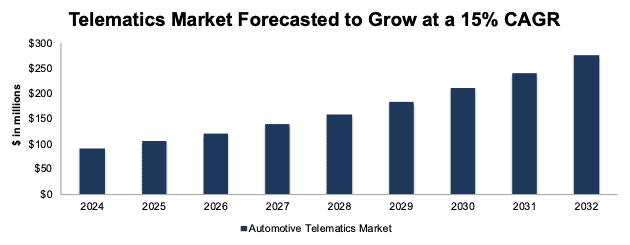

Research and Markets forecasts the automotive telematics market will grow 15% compounded annually between 2024 and 2032. Rising demand for connected vehicles and the broader shift toward digital mobility are the primary drivers of this growth. In McKinsey’s 2023 Global Automotive Connectivity Executive Survey, 55% of auto executives ranked connected cars among the top two trends shaping the future of mobility, second only to electrification.

We think these sources of demand will remain in place and drive growth for many years to come:

- consumer demand for safety, convenience, and efficiency;

- OEM adoption of embedded telematics; and

- the increasing reliance on data-driven navigation, diagnostics, and safety systems.

Technological progress is also wind in the sails of the telematics market as advances in the internet of things (IoT), AI, and cloud computing increase use cases beyond basic GPS and into predictive maintenance, usage-based insurance, fleet optimization, and real-time safety features.

Young Industry with Lots of Room to Expand

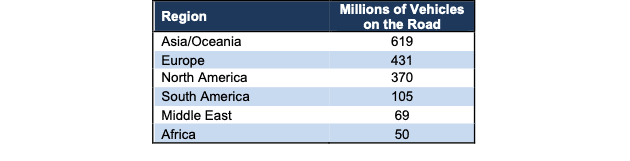

The telematics market, in particular, is ripe to expand into more of the total amount of cars on the road. In 2024, there were 287 million global embedded telematics subscriptions, while there are ~1.6 billion cars on the road.

In other words, only 17% of cars on the road have some kind of telematics system, which leaves a large untapped market. Given the large market opportunity, Berg Insight forecasts the number of embedded telematics subscriptions will grow 13% compounded annually from 2024-2029.

When we look at just new cars, rather than all cars on the road, we see greater adoption but still expect more in the future. In 2024, 79% of new cars had an embedded telematics unit, which is expected to rise to 93% in 2029.

Figure 1: Telematics Market Growth Forecast: 2024 – 2032

Sources: Research and Markets

New Vehicle Production on the Rise

Ituran’s telematics products and services are often installed before or immediately after an auto sale. As a result, the business grows when new vehicle sales rise. Good news for potential investors: S&P Mobility forecasts global light vehicle production from 2024-2032 will rise:

- 5% compounded annually in South America.

- 5% compounded annually in South Asia.

- 3% compounded annually in the Middle East/Africa.

- 1% compounded annually across the entire globe.

Ituran is well-positioned to capitalize on the growth in these markets given its #1 market share in both Brazil and Israel, as well as strong presences in South America and Asia.

Multiple Buyers Support This Business Model

Stolen vehicle recovery (SVR) operations accounted for 70% of revenue in 2024, as Ituran operates in regions with relatively high vehicle theft rates.

In these regions, consumers drive demand, along with other stakeholders in an auto purchase, such as financing and insurance companies.

Consumers want to ensure their vehicle is safe and can be recovered in the event of a theft. Auto lenders want to ensure loan collateral is not lost, while insurance providers want to reduce the likelihood of a claim for lost property.

Accordingly, Ituran holds strategic partnerships with lenders and insurers alike. In Israel (52% of revenue in 2024), insurance companies encourage and, in some cases, require customers to subscribe to SVR services for mid-to-high end vehicles. Additionally, they provide insurance premium discounts to customers that subscribe to an SVR service. In Brazil (25% of revenue in 2024), insurance companies directly lease telematics products and require their customers to subscribe to Ituran’s SVR services.

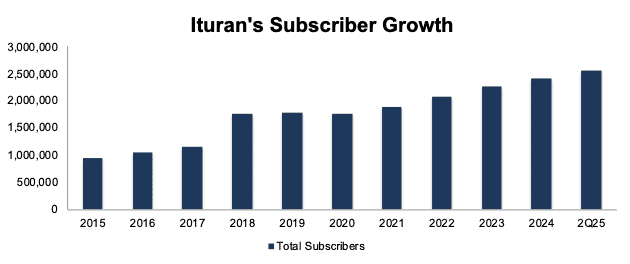

With demand driven by both consumers and other stakeholders, Ituran has steadily grown its subscriptions base 11% compounded annually since 2015, from 948,000 in 2015 to 2.5 million at the end of 2Q25.

Importantly, these subscribers are quite sticky as well. Ituran notes in its 20-F that “assuming no additional growth in our subscriber base and based on our historical average churn rates of 3% per month in this segment, we can anticipate that at least 90% of our subscription fees generated in a prior quarter will recur in the following quarter.”

Figure 2: Ituran’s Total Number of Subscribers: 2015 – TTM ended 2Q25

Sources: New Constructs, LLC and company filings

Hardware Sales Drive Recurring Subscriptions

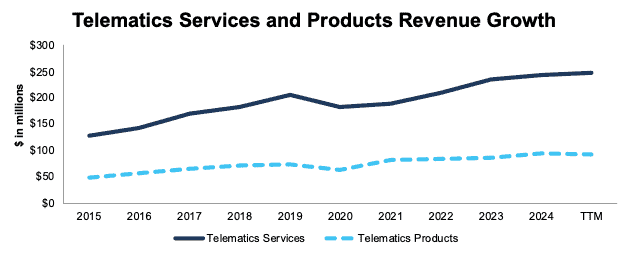

Through its telematics products segment, Ituran installs its hardware at the time of vehicle purchase or during the original manufacturing and generates recurring revenue in its telematics services segment through subscription services that leverage the installed hardware.

This model provides a predictable stream of recurring revenue, as hardware sales drive subscriber growth, which in turn fuels the expansion of recurring subscription revenue.

Ituran has grown both its telematics services and products revenue by 7% compounded annually since 2015. See Figure 3.

Figure 3: Ituran’s Telematics Services and Products Revenue: 2015 – TTM ended 2Q25

Sources: New Constructs, LLC and company filings

A Leader in a Fragmented Market

Ituran is the largest OEM telematics provider in Latin America and Israel.

Beyond its core markets, Ituran also operates in the United States, Argentina, Colombia, Mexico, Ecuador, and several other Latin American countries.

The telematics market is highly fragmented, with many region-specific competitors. At the end of 2Q25, Ituran has more than 2.5 million subscribers, which is comparable to most other competitors. For instance:

- Karooooo (KARO), which operates in South Africa, Southeast Asia, and Europe, has 2.4 million subscribers as of July 2025

- PowerFleet (AIOT), which operates mainly in the U.S., Europe, and Australia, has 2.8 million subscribers as of June 2025

- Verizon Connect, which is Verizon’s (VZ) telematics business that focuses on fleet management services operating mainly in North America, Europe, and the APAC region, with additional offices in Australia and China, currently tracks 2+ million vehicles.

- Geotab has 4.7 million subscribers in over 150 countries as of September 2025.

- LoJack Europe, which is owned by CalAmp, has 1 million subscribers in Europe as of January 2025.

- Spireon, which owns the LoJack U.S SVR business, currently has 3.5 million subscribers.

- Though the company doesn’t provide information on its subscription numbers, Samsara (IOT) is a large competitor in the telematics space as well, with partnerships with Stellantis in Europe, Hyundai in North America, and Rivian in the U.S.

The fragmented nature of the market is largely due to the expertise required to build out successful SVR operations. Ituran not only sells hardware and subscriptions but operates its own dedicated recovery teams as part of its vehicle tracking and recovery. These teams have developed important market-specific knowledge about:

- where vehicles are more likely to be stolen,

- which roads are likely to be used during/after a theft, and

- general information about how to best navigate a city.

This knowledge enables quicker and more efficient SVR services. It is also difficult to replicate without years of operational experience.

We think market share leaders will continue to accumulate knowledge and best-practices that drive superior SVR and more market share gains. Figure 4 shows the number of vehicles (and market share for the taking) on the road by region as of January 2025.

Figure 4: Vehicles on the Road by Region as of January 2025

Sources: New Constructs, LLC and Hedges Company

Wheelie Into New Markets

As the company maintains leading share in its existing markets, it is strategically leveraging its expertise in each region to expand into adjacent, but higher-growth markets. First up, the company is expanding into the Latin America motorcycle market, specifically in Brazil, which is the largest market within Latin America.

Latin American motorcycle sales are forecasted to grow 13% compounded annually between 2025 and 2033, while the passenger car sales are forecasted to grow 5% compounded annually between 2025 and 2030.

In June 2025, the company reached a new deal with BMW Motorrad Brasil (BMW’s motorcycle business in Brazil), a leader in premium motorcycle sales in Brazil. Through the deal, Ituran will offer rider safety, security, and connectivity services to BMW’s customers.

On the company’s 2Q25 earnings call, management noted (emphasis added): “based on the relationship, the negotiation and the discussions, we are quite confident that we are talking about tens of thousands of new subscribers every year in the coming years.”

In August 2025, Ituran reached a similar deal with Yamaha. Management emphasized the importance of this opportunity by saying “This is more than a product deployment; it’s the start of a much larger market opportunity.”

These two partnerships significantly expand Ituran’s total addressable market, with the addition of a large base of motorcycle customers. The company plans to scale into other high-growth two-wheeler markets through partnerships with local OEMs as well as sales to the aftermarket.

OEM Deals to Expand into Other Regions

Most notably, in March 2025, Ituran reached a new service deal with Stellantis in South America. As an initial part of the agreement, Stellantis switched their SVR subscriber base to Ituran. The contract covers multiple countries in the region and is set for a multi-year period, with the potential for expansion into additional markets and extended service periods.

Stellantis, the largest car manufacturer in Latin America and parent company of Fiat, Jeep, Peugeot, Opel, and others, provides a strong platform for growth. Management expects this partnership to significantly expand Ituran’s subscriber base over the coming years.

The Stellantis deal builds on top of the deal that was made with Nissan in the Chilean market in November 2024. Ituran leveraged its existing long-term partnership with Nissan in Mexico and signed a 5-year contract with Nissan Chile, in which Nissan’s customers will enjoy a one-year free trial of Ituran’s service, which Nissan pays for. The telematics unit will be pre-installed in the agreed upon models before reaching the dealers.

Lastly, Ituran is in the early stages of entering the Indian market with a joint venture deal with Lumax. The JV successfully completed a validation trial with Daimler India Commercial Vehicles (DICV) in December 2024. The JV provides Ituran the opportunity to expand into the most populous region in the world.

Improving Fundamentals

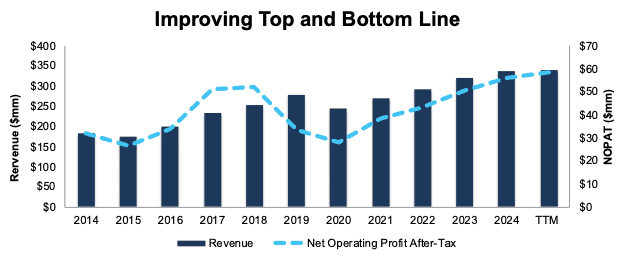

Ituran has grown both revenue and net operating profit after-tax (NOPAT) by 6% compounded annually since 2014. See Figure 5. Additionally, the company has grown its Core Earnings 12% and 6% compounded annually in the last 5 and 10 years, respectively.

The company’s NOPAT margin improved from 12% in 2019 to 17% in the TTM, while invested capital turns rose from 1.1 to 1.3 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 13% in 2019 to 23% in the TTM.

Figure 5: Ituran’s Revenue and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

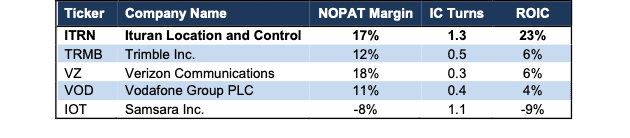

Sole Leader in Profitability

In such a competitive market, profit margins provide a key competitive advantage.

Companies that can maintain superior profitability have greater flexibility to compete on price and invest in growth, simultaneously. This ability positions them to pull ahead of rivals in the race for market share.

Ituran has the second highest NOPAT margin (operational efficiency) and the highest invested capital turns (capital efficiency). Together, these drivers propel Ituran’s ROIC to rank highest among publicly-traded peers, which include Trimble (TRMB), Verizon (VZ), Vodafone Group (VOD), and Samsara (IOT). See Figure 6.

Figure 6: Ituran’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

Potential for 5.5%+ Yield

Ituran increased its quarterly dividend from $0.14/share in 2Q21 to $0.50/share in 2Q25. The company paid over $93 million (13% of market cap) in cumulative dividends since 2021. The company’s current dividend, when annualized, provides a 5.5% yield.

Ituran also returned capital to shareholders through share repurchases from 2021 through 2023. During that time, the company repurchased a total of $22 million of shares. Though the company was still authorized to repurchase ~$7 million shares at the time, it has not completed any repurchases since 2023.

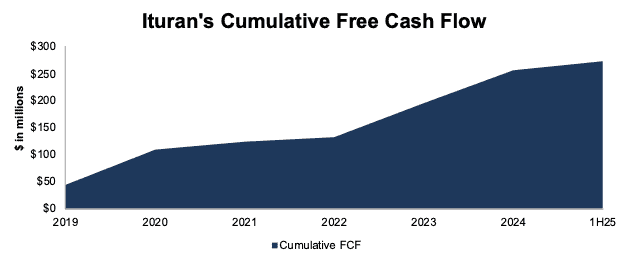

Ample Cash Flow Generation

Since 2019, Ituran has generated a cumulative $273 million in free cash flow (FCF), which equals 44% of its enterprise value. See Figure 7.

Ituran’s $165 million in FCF since 2021 is more than enough to cover its $116 million in combined dividend payments ($93 million) and share repurchases ($22 million).

Figure 7: Ituran’s Cumulative Free Cash Flow

Sources: New Constructs, LLC and company filings

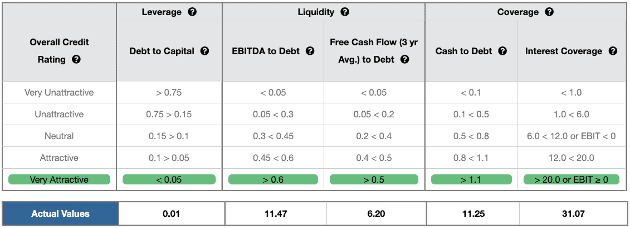

Strong Balance Sheet and Declining Debt

Ituran earns a Very Attractive overall Credit Rating, and it scores a Very Attractive rating in each of the five credit rating metrics. See Figure 8.

Of note, Ituran achieved the growth in revenue and profits noted above while reducing its debt. Ituran’s total debt fell from $87 million in 2018 to $8 million in the TTM while its cash and equivalents increased from $53 million to $89 million over the same time.

Even if economic conditions deteriorate, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 8: Ituran’s Credit Rating Details

Sources: New Constructs, LLC and company filings

Potential Smart Money Acquisition

Fast growing industries that are highly fragmented are no stranger to acquisitions. The telematics industry has and is undergoing a consolidation of sorts already.

For instance:

- CalAmp acquired LoJack in 2016 for approximately $134 million.

- Spireon acquired the LoJack U.S. stolen vehicle recovery business from CalAmp in 2021.

- Powerfleet acquired Mix Telematics in April 2024 for approximately $200 million.

- Powerfleet acquired Fleet Complete in October 2024 for approximately $200 million.

- Platform Science acquired Trimble’s global transportation telematics business in February 2025.

Ituran is an appealing acquisition target, given its growing subscriber base, leading market share, and superior profitability.

As an example of a potential acquirer, Samsara, a competitor mentioned earlier in the report, is not a pure-play telematics company. It operates a broader connected cloud platform that collects data from a wide range of sources, such as monitoring temperature in industrial machinery, tracking freight delivery trucks to optimize space usage, and providing AI-enabled video solutions, among others.

Since vehicle recovery and tracking is not one Samsara’s current strengths, we could see how adding Ituran into its larger connected cloud platform is synergistic. With Samsara’s ROIC of -9%, the company could benefit from owning a business as profitable as Ituran.

Geographic Concentration Risk

One risk for Ituran is its heavy reliance on revenue from Israel and Brazil. While the company currently holds the leading market share in both regions and there are no immediate signs of share erosion, any loss of share in these core markets could materially impact revenue. Furthermore, any geopolitical issues in these regions could have material impact on the company’s business. For instance, in 2Q25, product sales were impacted “due to a cessation of news sales during the 12-day war between Israel and Iran.”

While this geographic concentration is largely by design (going where the most cars are stolen), it is worth noting.

To mitigate some of this risk, Ituran is actively pursuing expansion into new markets, as discussed earlier. Successful execution of these initiatives would help mitigate its geographic concentration risk over time.

Growth Relies on Relationships with OEM’s and Insurance Companies

For Ituran, as with all telematics companies, growth depends heavily on strong relationships with OEMs and insurance providers. Given the highly competitive nature of the industry, securing and maintaining these partnerships is critical.

Failure to renew existing agreements or establish new ones would significantly limit a telematics company’s growth opportunities. Ituran is in a strong competitive position to win new business, with proven technology, leading profitability (more pricing power), and long-term relationships.

However, even if Ituran’s growth were to slow, it’s already more than priced into its current stock price, as we’ll show below.

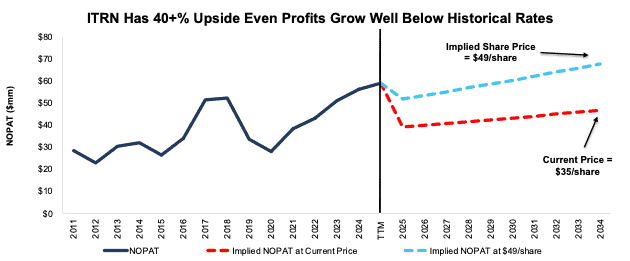

Current Stock Price Implies Profits Will Permanently Fall

At its current price of $35/share, ITRN has a price-to-economic book value (PEBV) ratio of 0.8, which means the market expects the company’s profits to permanently fall 20% from current levels. This expectation seems overly pessimistic considering Ituran has grown NOPAT by 11% and 6% compounded annually over the last five and ten years, respectively.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock valuation scenarios for ITRN.

In the first scenario, we quantify the expectations baked in the current price. If we assume:

- NOPAT margin falls to 11% (equal to the company’s lowest ever margin in 2020 and below its TTM margin of 17% and ten-year average margin of 16%) from 2025 through 2034 and

- revenue grows 2% compounded annually through 2034 (below consensus of 6% in 2026, the company’s 10-year CAGR of 6% and the forecasted telematics market CAGR of 15%), then

ITRN would be worth $35/share today – equal to the current stock price. In this scenario, Ituran’s NOPAT would fall 1% compounded annually from 2025 through 2034. For reference, ITRN has grown NOPAT by 11% and 6% compounded annually over the past five and ten years, respectively. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 40%+ Higher Even If Profits Grow Well Below Historical Rates

If we instead assume:

- NOPAT margin falls to 15% from 2025 to 2034 (below its TTM margin of 17% and equal to five-year average margin),

- revenue grows at consensus rates in 2025 (2%) and 2026 (6%), and

- revenue grows 3% each year thereafter through 2034 (below the company’s 10-year CAGR of 6% and the forecasted telematics market CAGR of 15%), then

ITRN would be worth at least $49/share today – a 40% upside to the current price. In this scenario, ITRN’s NOPAT would grow just 2% compounded annually from 2025 through 2034. Contact us for the math behind this reverse DCF scenario.

Should Ituran grow profits near historical rates, the stock has even more upside. Figure 9 compares ITRN’s historical NOPAT to the NOPAT implied in each of the above DCF scenarios.

Figure 9: Ituran’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Ituran’s business will enable it to continue to generate higher NOPAT than the current market valuation implies:

- leading market share,

- long-term demand drivers,

- progress in new motorcycle markets, and

- strong balance sheet.

What Noise Traders Miss with Ituran

These days, fewer investors focus on finding quality capital allocators with shareholder-aligned corporate governance. Due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- fast-growing telematics industry,

- consistent Core Earnings growth for more than a decade, and

- valuation implies profits will permanently decline by 20%.

Earnings Beats Could Send Shares Higher

Ituran has beaten earnings estimates in 8 of the past 10 quarters. Ituran missed earnings estimates this past quarter and has performed in line with Nasdaq (QQQ) so far this year. Year-to-date, both ITRN and QQQ are up 15% Should Ituran beat earnings again it could send shares even higher.

Additionally, any additional deals with OEMs and insurance providers could open up additional profit growth opportunities and send shares moving upward.

Exec Comp Could Be Improved

Ituran’s executives receive target-based cash incentives and excess return cash incentives. The former are based on “profit before tax” goals while the latter are based on the company’s stock performance relative to the Russell 2000.

We would prefer the company tie executive compensation to ROIC. Doing so ensures that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value. Improving ROIC requires attention to all areas of the business, so including it in an executive compensation plan would incentivize executives to improve the entire business, not just one sales goal or earnings number.

Despite using profit before tax and stock return metrics, Ituran’s management has grown economic earnings, the true cash flows of the business, 3% compounded annually over the last decade, from $29 million in 2014 to $41 million over the TTM.

Insider Trading and Short Interest Trends

As a foreign filer, there is no insider sales data available for ITRN.

There are currently 100 thousand shares sold short, which equates to <1% of shares outstanding and just under one day to cover.

Attractive Funds That Hold ITRN

The following fund receives an Attractive-or-better rating and allocate significantly to ITRN:

- MSS Series Trust Towpath Technology Fund (TOWTX) – 3.5% allocation and Very Attractive rating.

This article was originally published on September 17, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.