New Constructs recently announced its partnership with Google Cloud, with whom we built FinSights (see press release). It is the first truly reliable AI for investing. Allow me to prove it to you.

Thought Leaders on AI – Long Before It Was Popular

Back in 2003, long before Wall Street discovered “AI”, New Constructs built proprietary Robo-Analyst technology to teach machines to perform complex tasks, like reading 10-Ks and 10-Qs. We’ve developed many cutting-edge systems to deliver superior data, financial models, and research to clients over the last 20+ years.

I’ve championed the importance of data to the success of AI for a long time. I wrote in April of 2018 and more recently that high-quality training data is the single most important ingredient in building AI that can perform expert-level work. In Thinking Small Drives Big Leaps in AI, I explain how we carefully curated a dataset and ontology with the specific goal of endowing machines with real subject matter expertise. In Forget Chips, AI Firms Need Higher Quality Data to Win, I explain how we endow machines with experience and expertise not found in books so they can perform tasks with comparable skill to human experts.

In short, we’ve been dedicated to delivering our clients the best that machines can offer for decades.

See FinSights AI in Action: Live Demo

Before we explain more about how we built FinSights, let us show you with this live demo.

FinSights Vs the Competition

We’re way ahead. Allow me to explain.

AI Agents for Investing are following this evolutionary path:

General LLM Search —> Curated Datasets (MCPs )—> Financial Models/Metrics —> Insights

That path is intuitive, and I think we see it playing out in broad daylight right now. Insights come from analyzing lots of data, we use models to analyze data, and the models only work when fed good data.

New Constructs delivers insights empirically-proven to give clients alpha, which, at the end of the day, is the most important thing in the investing business.

With FinSights, we “did the hard part first” by building an agent that delivers real insights. But, we could do that only by curating a pristine dataset to power an ontology that creates meaningful outputs.

Our competition still has a lot of work to do to get the data and the models/ontologies right before they can deliver insights that produce alpha like ours. Anyone familiar with financial analysis knows how difficult getting machines to analyze financial filings is. It’s a very hard problem to solve. We know because we solved it. Based on my experience and what I see our competition doing, I think it will take them a long time to catch up.

The Most Important Thing: Grounding In Alpha-Producing Data

Everything we do at New Constructs is centered around collecting and curating the best fundamental dataset in the world because we know that’s what’s required to beat the market. And, here’s the empirical evidence that our data produces real alpha: three live-traded indices that continue to out-perform the S&P 500.

First, I submit the Bloomberg New Constructs Core Earnings Leaders Index (BCORET:IND), which recently turned 1-year old, is beating the S&P 500 by more than 900 basis points so far in 2025. See Figure 1.

Over the last 5 years, the index (up 142%) outperforms the S&P 500 (up just 95%) even more strongly and beats it by 4,700 basis points.

Next, I want to introduce you to the Bloomberg New Constructs 500 Total Return Index (B500NCT:IND). Think of it as an enhanced version of the S&P 500 because it weights the top 500 stocks based on Core Earnings instead of market cap. As perhaps the purest demonstration of alpha in our data, it also beats the S&P 500 in the long and the short term.

Last but not least, the Very Attractive Stocks Index, officially known as the Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND), strongly outperforms as well.

Figure 1: The Core Earnings Leaders Index Strongly Outperforms the S&P 500

Sources: Bloomberg as of November 4, 2025

Note: Past performance is no guarantee of future results.

Vetted and Validated By Prestigious Institutions

Before we had live-traded indices to demonstrate the alpha in our research, Harvard Business School (HBS) published a case study “New Constructs: Disrupting Fundamental Analysis with Robo-Analysts that predicted how our proprietary machine-learning technology would supplant the need for manual fundamental research.

More papers from prestigious institutions followed:

- MIT Sloan and HBS proved our fundamental data is more comprehensive and superior.

- Ernst & Young proved our financial models are superior.

- HBS proved our Robo-Analyst Stock Ratings beat human-analyst stock ratings.

Not a Black Box: 100% Auditable Back to Source Data

Everything we do is 100% transparent. The Education section of our site shows the formulas behind every metric and the metrics behind every methodology, such as our Stock Ratings, Credit Ratings, ETF & Mutual Fund Ratings, Core Earnings, and Earnings Distortion Scores.

Best of all, clients can audit every data point in our models back to the original financial filings from which we collected the data. Do you think prestigious institutions would publish papers about our research if they could not 100% audit every single input?

See FinSights in Action

In addition to the demo video above, we want to share a few snippets of what FinSights can do.

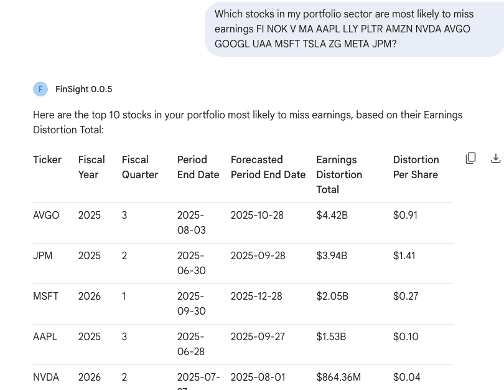

First, we show you how FinSights can scan your portfolio and tell which stocks are at the highest risk of missing consensus earnings. See Figure 2. The Core Earnings and Earnings Distortion research that powers FinSights is the same as that which drives the outperformance of our indices, as detailed above.

Figure 2: Prepare Your Portfolio for Earnings Season

Sources: FinSights as of November 4, 2025

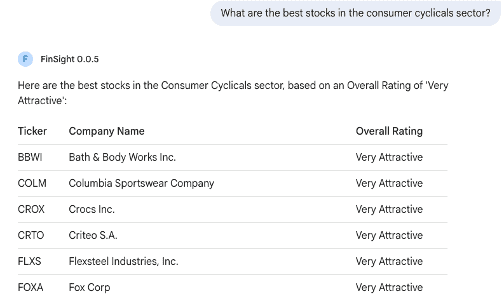

Figure 3 shows how FinSights delivers a very specific list of stocks when you ask it to find the best stocks in a particular sector. See Figure 3. The Stock Rating system that powers FinSights is the same as that which drives the outperformance of our indices, as detailed above.

Figure 3: Show the Best Stocks in the Consumer Cyclicals Sector

Sources: FinSights as of November 4, 2025

Build with Us and Google Cloud

Working with the Google Cloud team has been an honor and a privilege. They are some of the smartest and hardest working people that I’ve ever met. I cannot recommend them enough as a business partner. Together, we’ve garnered unrivaled experience in endowing machines with the subject matter expertise required to perform like human experts. If you want to do something similar, you will not find a more capable partner than Google Cloud.

While FinSights demonstrates the power of AI when using high quality data, the bigger vision has always been to include other datasets or Small Language Models (SLMs) like sentiment, insider buying/selling, and technical analysis. It’s awesome that our fundamental signals generate alpha on their own, but there’s no doubt that we can further enhance these signals by adding complimentary datasets and customizing FinSights to meet the goals of your organization.

Get Access

To learn more about New Constructs, our research and FinSights, be sure to join out mailing list here.

This article was originally published on November 6, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.