President Trump extended the deadline for countries to reach trade agreements with the U.S., which postpones the implementation of substantial tariff increases until early August. The announcement provided a temporary boost to investor sentiment, but also keeps global trade on uncertain terms. Volatility remains elevated, as trade tensions and geopolitical risks continue to dominate headlines and weigh on market stability.

During periods of heightened volatility, disciplined fundamental research becomes even more critical.

A deep understanding of a company’s underlying cash flows and valuation offers a significant advantage over simply following momentum or sentiment-driven strategies. While riding hype and short-term trends may offer temporary gains, only rigorous, fundamentals-based analysis drives sustainable, long-term investment success.

Our latest Long Idea is a great example of the edge that our superior fundamental research provides. This company benefits from long-term industry tailwinds, has industry leading profitability, provides high capital return backed by ample cash flows, and its stock is cheap.

We first made MPLX LP (MPLX: $51/share) a Long Idea in July 2023 and reiterated our bullish opinion on the stock in August 2024. Since our original report, the stock has outperformed the S&P 500 by 9%, rising 46% while the S&P 500 is up 37%. The stock has slightly outperformed the market year-to-date as well, and we’re here to remind investors that more upside potential remains in this stock.

MPLX still offers favorable Risk/Reward based on the company’s:

- position to benefit from rising global energy demand,

- “toll taker” business model that insulates it against energy price volatility,

- industry leading profitability,

- high capital return backed by ample cash flows, and

- cheap stock price.

What’s Working

Fossil Fuel Consumption Steadily Rising

Despite the massive attention and capital allocated to renewables over the last few years, fossil fuel (oil, natural gas, and, even, coal) consumption reached new heights in 2024. There’s no denying that fossil fuels remain a critical supplier of the world’s growing energy consumption.

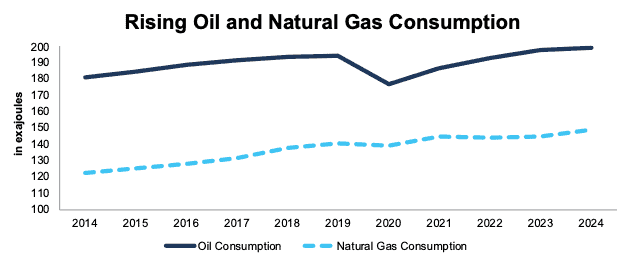

According to The Energy Institute’s 2025 Statistical Review of the of World Energy, global oil consumption and natural gas consumption increased 1% and 2% compounded annually over the last decade. More recently, global oil and natural gas consumption increased 0.7% and 2.5% YoY in 2024, respectively. See Figure 1.

Figure 1: Global Oil and Natural Gas Consumption in Exajoules: 2014 – 2024

Sources: New Constructs and The Energy Institute

The President of the Energy Institute specifically noted “the pace of renewable deployment continues to be outstripped by overall demand growth, 60% of which was met by fossil fuels”. More specifically, oil and natural gas made up 34% and 25% of the global energy consumption in 2024, respectively, which ranked as the first and third most-consumed energy types in the world.

OPEC projects oil and gas to supply the majority of energy consumption, with the share of oil and gas in the energy mix expected to remain above 53% (oil at 29% and gas at 24%) through 2050.

Energy Demand Also Rising

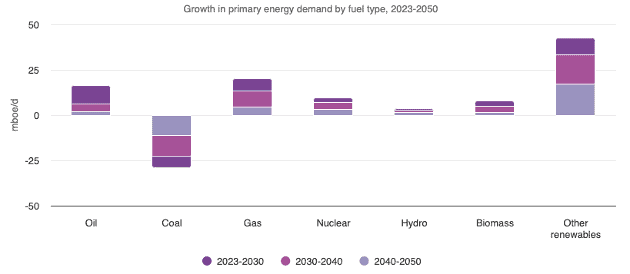

OPEC’s latest World Oil Outlook forecasts global primary energy demand to increase from 301 barrels of oil equivalent a day (mboe/d) in 2023 to 374 mboe/d in 2050, which represents an increase of 24%. Per Figure 2, the three fuel types that are expected to see the largest increase in demand from 2023 through 2050 are renewables (43 mboe/d), gas (21 mboe/d), and oil (17 mboe/d). In other words, fossil fuels will continue to play a critical role in supplying the world’s energy demands for decades to come.

As a pipeline operator, MPLX is positioned to benefit from the continued and rising usage of oil and natural gas.

Figure 2: Growth in Global Energy Demand by Fuel Type: 2023 – 2050

Sources: OPEC

Expanding to Meet Future Demand

MPLX continues to invest to meet the growing demand for oil and natural gas. The company announced new initiatives in 1Q25 on top of existing expansion projects.

First, MPLX announced its acquisition of the remaining 55% of the BANGL natural gas liquids pipeline that it did not already own. The company is expanding the BANGL pipeline’s transportation capacity from 250 thousand barrels per day (bpd) to 300 thousand bpd, which is expected to come online in the second half of 2026.

Next, MPLX and its partners announced a final investment decision on the Traverse pipeline, which is designed to transport 1.8 billion cubic feet per day (bfcd) of natural gas between the Agua Dulce and Katy areas along the Gulf Coast. The pipeline will go live in 2027, and MPLX will own 13% via indirect ownership through joint ventures.

The company also entered an agreement to increase its stake by 5% in the joint venture of the Matterhorn Express pipeline, bringing MPLX’s total interest to 10%. The joint venture is expanding the pipeline to transport up to 2.5 bcfd (up from 2.0 bcfd) of natural gas from the Permian basin to the Katy area near Houston.

Apart from expanding existing ventures, MPLX also acquired gathering businesses from Whiptail Midstream. These assets, located in the San Juan basin, consist primarily of crude and natural gas gathering systems and will complement the relationship between MPLX and Marathon Petroleum (MPC).

Volumes Increasing Across the Board

MPLX’s “toll-taking” business model insulates the company from big swings in energy prices, because it collects fees as long as it moves volumes.

Increased demand drives increased volumes across MPLX’s business.

In 1Q25, MPLX grew volumes YoY as follows:

- Crude oil pipelines 13%

- Product pipelines 10%

- Terminals 6%

- Gathering 5%

- Processing 4%

- Fractionation 4%

Improving Fundamentals

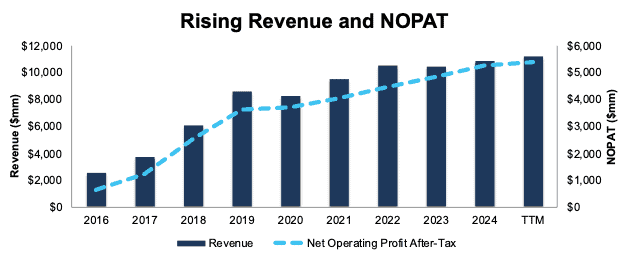

Amid rising energy demand and higher throughput volumes, MPLX is growing both its top and bottom line. The company has grown revenue and net operating profit after-tax (NOPAT) by 20% and 29% compounded annually since 2016 (earliest data available). See Figure 3.

Additionally, the company’s Core Earnings, a superior and cleaner earnings measure, grew 35% compounded annually from 2016 through the TTM.

More recently, the company improved its NOPAT margin from 42% in 2019 to 48% in the TTM while invested capital turns remained the same at 0.3 over the same time. Rising NOPAT margins drive the company’s return on invested capital (ROIC) from 12% in 2019 to 14% in the TTM ended 1Q25.

Figure 3: MPLX’s Revenue and NOPAT: 2016 – TTM

Sources: New Constructs, LLC and company filings

Leading in Profitability

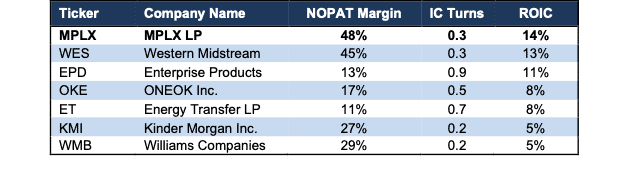

MPLX is not only growing volume throughput and expanding capacity, but it is doing so while maintaining the best profitability in the industry.

Over the TTM, MPLX has the highest ROIC and NOPAT margin among competitors, which include fellow Long Idea pick Enterprise Products (EPD), as well as Western Midstream (WES), ONEOK (OKE), Energy Transfer (ET) and other large midstream companies. See Figure 4.

Figure 4: MPLX’s Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

Potential for 8%+ Yield

Since 2020, MPLX has paid $17.7 billion (34% of market cap) in total distributions. The company has increased its quarterly distribution to LP unitholders from $0.69/share in 1Q20 to $0.96/share in 2Q25. The company’s current distribution, when annualized, provides a 7.5% yield.

MPLX also returns capital to shareholders through unit repurchases. Since 2020, MPLX repurchased $1.6 billion (3% of market cap) of units. During the first three months of 2025, the company repurchased $100 million of units.

The company has $420 million of units remaining under its current repurchase authorization. Should the company repurchase units at the TTM pace through the next year, it would repurchase $351 million of shares, which equals 0.7% of the company’s current market cap. When combined, the distribution and unit repurchase yield could reach 8.2%.

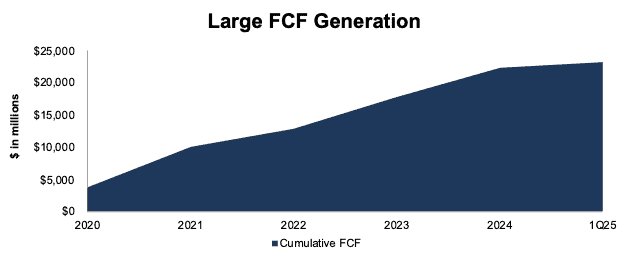

Strong Cash Flows Support Shareholder Return

Investors should take comfort in knowing MPLX can afford to pay its distributions and repurchase units due to its large free cash flow (FCF). From 2020 through 1Q25, MPLX generated $23.2 billion in FCF, which equals 32% of the company’s enterprise value.

MPLX’s $23.2 billion in FCF since 2020 is more than enough to cover its $19.3 billion in combined distribution payments ($17.7 billion) and unit repurchases ($1.6 billion).

Figure 5: MPLX’s Cumulative Free Cash Flow: 2020 – 1Q25

Sources: New Constructs, LLC and company filings

What’s Not Working

Oil Price Volatility

Despite oil consumption rising YoY for the last few years, oil prices have been steadily declining since their recent peak in 2022. At the beginning of July, OPEC+ agreed to raise production by 548,000 barrels per day in August. Rising inventories and supply across the world are expected to put additional downward pressure on oil prices through 2026.

The U.S. Energy Information Administration (EIA) forecasts the Brent crude oil prices will remain near current levels at an average of $69 per barrel in 2025 but fall significantly to an average of $58/barrel in 2026.

While fluctuating and falling prices may directly impact upstream (exploration and production) and downstream (refining, retailing) operators, MPLX’s toll-taking business model better insulates it from swings in energy prices. As long as consumption is rising, MPLX has opportunities to grow profits, as it has been doing for years.

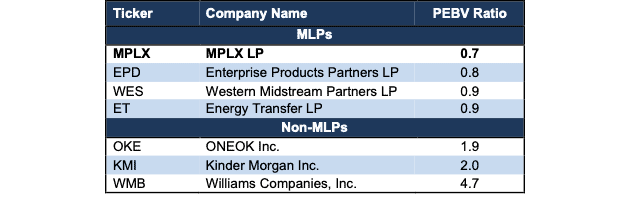

Master Limited Partnership Risks

As we’ve mentioned in previous reports, the biggest risk with master limited partnerships (MLPs) is that the general partner interests could conflict with those of unitholders. Despite MPLX’s proven success so far, investors should be aware that it is an MLP.

As a result of this structural concern, we give all MLPs a suspended Stock Rating as the nature of MLP agreements creates risk of significant unitholder dilution. However, we think the low valuation of MPLX’s common units easily offsets the risk of owning this MLP.

Per Figure 6, MPLX’s price-to-economic book value (PEBV) ratio is 0.7, while the PEBV of its non-MLP peers range from 1.9 to 4.7. This valuation gap may never close, but the low stock valuations for MLPs, below the economic book values, more than compensates investors for the MLP risk.

Figure 6: MPLX’s PEBV Vs. Non-MLP Peers: TTM

Sources: New Constructs, LLC and company filings

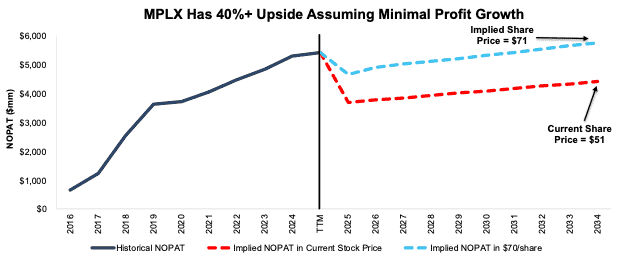

Current Price Implies Profits Will Permanently Fall by 30%

At its current price of $51/share, MPLX has a PEBV ratio of 0.7. This ratio means the market expects the company’s NOPAT to permanently decline 30% from TTM levels. This expectation seems overly pessimistic considering MPLX has grown NOPAT by 8% and 29% compounded annually since 2019 and 2016, respectively.

Below, we use our reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for MPLX.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin falls to 33% (equal to second lowest margin in company history, below five-year average of 45%, and TTM margin of 48%) from 2025 to 2034, and

- revenue grows 2% compounded annually (below past 5-year CAGR of 5%, consensus estimates of 7.1% and 5.2% for 2025 and 2026, and just above OPEC’s global oil demand estimate of 1.6% CAGR between 2023 and 2029) from 2025 through 2034,

then the stock would be worth $51/share today – or equal to the current stock price. In this scenario, MPLX’s NOPAT would fall 2% compounded annually through 2034, which is well below historical growth rates. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 40%+ Higher at Consensus Growth

If we instead assume MPLX’s:

- NOPAT margin falls to 40% (below five-year average of 45% and TTM margin of 48%) from 2025 to 2034,

- revenue grows at consensus estimates in 2025 (7.1%) and 2026 (5.2%), and

- revenue grows 2% compounded annually (below 5-year CAGR of 5% and just above OPEC’s global oil demand estimate of 1.6% CAGR between 2023 and 2029) from 2028 through 2034,

MPLX would be worth at least $71/share today – a 40% upside to the current price. In this scenario, MPLX’s NOPAT would grow 1% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario.

Should MPLX grow profits more in line with historical levels, the stock has even more upside. Figure 7 compares MPLX’s historical NOPAT to the NOPAT implied in each of the above DCF scenarios.

Figure 7: MPLX’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

This article was originally published on July 9, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.