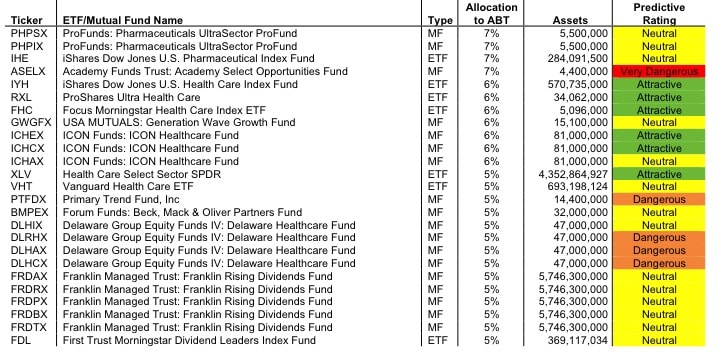

Best and Worst Funds: Materials Sector

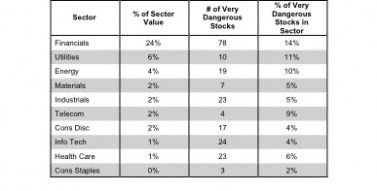

The Materials sector ranks fifth out of the ten major sectors as detailed in our sector roadmap. It gets my Neutral rating, which, like my fund ratings, is based on aggregation of stock ratings for each of about 150 companies in the sector.

David Trainer, Founder & CEO