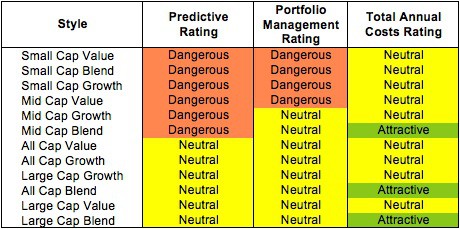

Investment Style Rankings For ETFs & Mutual Funds

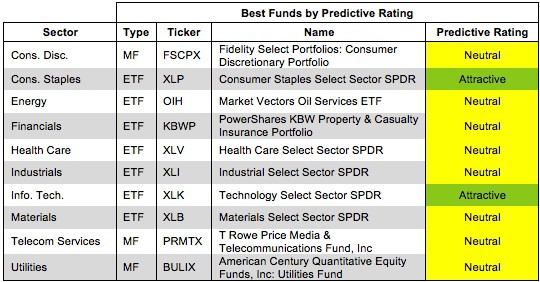

No fund style earns better than a Neutral rating going into 3Q13. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

David Trainer, Founder & CEO