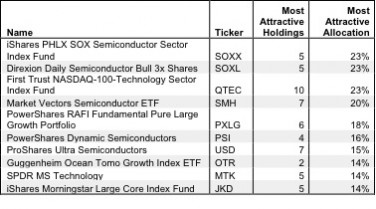

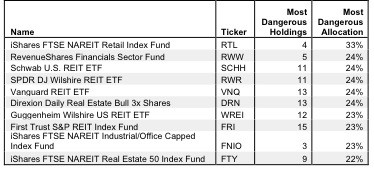

The Most Attractive ETFs for March

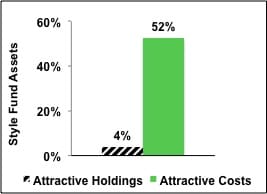

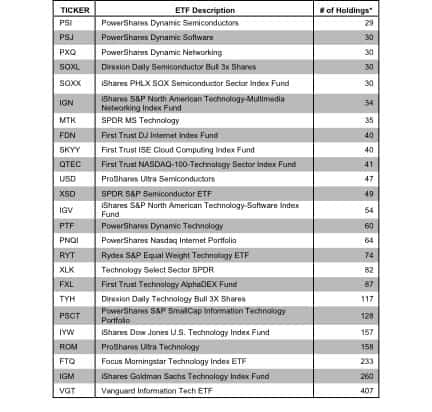

My ratings on ETFs are unique because they are based on my stock ratings for each of a fund’s holdings.

Analyzing and rating an ETF based on its holdings delivers many interesting insights:

David Trainer, Founder & CEO