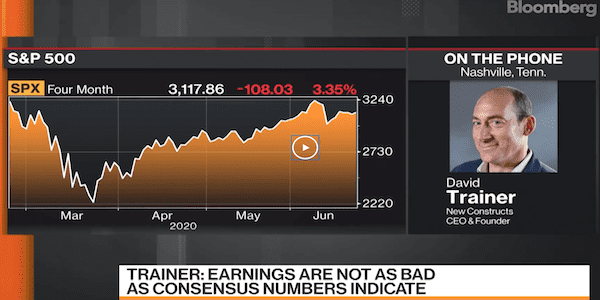

Don’t Fret 2Q20 Earnings – Bloomberg TV

We joined Bloomberg TV’s Bloomberg Markets China Open on Monday, June 22 to discuss earnings across the S&P 500 and more.

Kyle Guske II, Senior Investment Analyst, MBA