We joined Benzinga’s PreMarket Prep on April 22, 2020 to discuss the 1Q20 earnings season thus far.

1Q20 earnings season is projected be the worst since 3Q09. According to FactSet, S&P 500 companies are expected (as of April 9, 2020) to report an earnings decline of -10% in 1Q20. This expectation represents a drastic change from the 4.3% expected growth rate that was projected at the end of 2019.

With such a shifting landscape, how can investors protect themselves during these volatile times? Our Earnings Distortion Scores help investors during these volatile times. Investors can use these scores to get a short-term predictor of the likelihood of a company to miss or beat expectations in the next quarter.

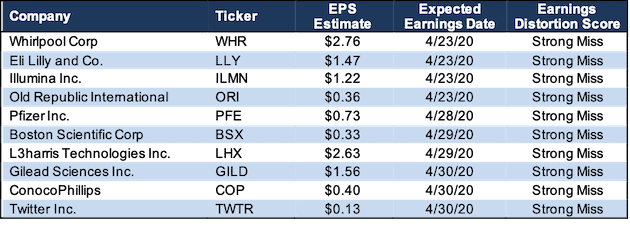

Already in 1Q20 earnings season, we successfully predicted that The Progressive Corp (PGR) would miss consensus expectations on 4/15/20. Figure 1 contains 10 more stocks expected to report the week of 4/20/20 and week of 4/27/20 that earn a “Strong Miss” Earnings Distortion Score.

These stocks, which include Whirlpool (WHR), Eli Lilly and Co. (LLY), Illumina Inc. (ILMN), Old Republic International (ORI), Pfizer Inc. (PFE), Boston Scientific (BSX), L3harris Technologies (LHX), Gilead Sciences (GILD), ConocoPhillips (COP), and Twitter (TWTR), are more likely to miss expectations when they report.

Figure 1: 10 Stocks More Likely to Miss Expectations

Sources: New Constructs, LLC and company filings

This article originally published on April 22, 2020.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.