Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

DreamWorks Animation (DWA: $25/share) is in the Danger Zone this week. Few companies can consistently produce high-quality original content, and DWA has learned the hard way that past hits are no guarantee of future success. Since its spinoff in 2004, the company’s revenues, profits, and stock price have been in decline. The stock is down nearly 30% this year, and 10% since we first warned investors about its risks. Those risks remain, and we think the stock has much farther to fall.

Long-Term Decline

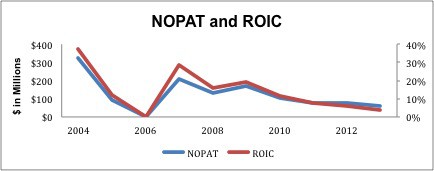

In 2004, DWA was riding high. Shrek 2 was one of the top grossing animated films of all time, and the company earned a fantastic return on invested capital (ROIC) of 37%. Figure 1 shows how quickly and steadily that picture has soured for DWA’s bottom line.

Figure 1: Declining Profitability

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

After tax profit (NOPAT) and ROIC for DWA have been in a steady decline for the past decade except for 2007. Over this same time, NOPAT has declined by 17% compounded annually and ROIC has fallen to 4%, which puts DWA in the bottom quintile of all 3000 companies we cover.

Another concern is DWA’s high level of write-downs. After not taking any write-downs for several years, DWA has taken big write-downs on its films in 2012, 2013, and 2014. These reflect the weaker than expected performances at the box office as well as, in one case, higher than expected production costs.

Most recently, DWA took a $57 million write-down in the first quarter of 2014 on its film, Mr. Peabody and Sherman after a disappointing box office take. High write-downs reflect not just poor performance from the films, but also an inability of management to adeptly allocate capital.

DWA is struggling to produce successful new movies, which is a big issue as some of its most popular franchises, like Shrek and Madagascar, have grown stale.

No, DreamWorks is not Disney

The primary bullish argument for DWA is that the company can become “the next Disney (DIS)”, a full-fledged media empire where box office revenue is supplemented by merchandise, TV shows, and a variety of events featuring characters from the movies.

It’s true that DWA has emphasized these segments more in recent years, and they’ve had some success in that area. Total non-feature film revenue increased by 24% last year. However, non-film revenue still accounted for just 29% of total revenues and wasn’t able to offset the declining film revenue last year, as total revenues for the year dropped 6%.

The company is making the right moves by trying to find new ways to monetize its films, but bulls that compare it to Disney are significantly overstating the growth potential of these new businesses. Disney has resources, history, and brand power that dwarfs DWA. Disney’s advertising budget alone in 2013 was 30% larger than DWA’s current market cap.

Moreover, Disney’s 90-year history means that it has substantially more in the way of iconic characters to market than DWA. Disney is still producing hits as well. Frozen just became the top grossing animated movie of all time.

For all the focus put on corporate strategy at Disney and DWA, everything still comes back to the films. Without high quality original content, there is no merchandising or other strategy. People don’t typically buy a lot of merchandise for box office busts or watch TV shows based on movies they haven’t seen.

For DWA to succeed long-term, it needs to revitalize its slumping feature films. Unfortunately, competition for audience dollars in the animated film industry is growing more intense. In addition to Disney, Warner Bros. (TWX) and Universal Pictures (CMCSA) have recently created solid franchises with The Lego Movie and the Despicable Me movies.

Without compelling evidence that DWA can get back to consistently producing hits as it did in the mid-2000’s, it’s hard to see how DWA can reverse the downtrend in profitability and achieve significant growth.

Valuation Implies a Dream Scenario

Even though the stock is down 30% this year, DWA remains significantly overvalued. Specifically, its valuation of ~$25/share implies that the company will grow NOPAT by 19% compounded annually for 11 years. After what this company has done for the past decade, it seems overly optimistic to predict such high profit growth going forward.

Even a solid growth scenario of 10% NOPAT growth compounded annually for 10 years yields a present value of just $9.50/share, a 60% downside to the current valuation. I have trouble believing DWA could exceed 10% profit growth for 10 years, but I could definitely see it doing worse than that.

Currently, everything is going against this stock. Momentum is negative, the valuation is still high, and profits are on a long-term downward trend. The stock needs a positive catalyst in order to stop its free fall, and I don’t expect one to materialize.

Funds that hold DWA

Investors should also avoid AmericaFirst Quantitative Funds: AmericaFirst Seasonal Trends Fund (STQAX) due to its 3.8% allocation to DWA and Dangerous rating.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.