Danger Zone: El Pollo Loco (LOCO)

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

El Pollo Loco is a restaurant chain based in California that serves Mexican-style grilled chicken with an emphasis on a “healthy” image. The company was founded in 1975 in Mexico, and sold to private equity firm Trimaran Capital Partners in 2005. Trimaran took Loco public in July 2014 for $15/share and investor optimism took the shares to over $41/share in August.

Since then, Loco has dropped to below $20/share, but a strong fourth quarter to 2014 took the shares up to $26. We believe that shares still have much further to fall, and that investors who think this restaurant is going to become the next Chipotle (CMG) are willfully ignoring the company’s history and its current growth track.

How Good Was That Earnings Report?

Shares of El Pollo Loco had been something of a disappointment to investors since the company’s IPO, but the stock received an 8% pop a week ago after a positive annual earnings report. However, this pop seems to be a case of investors thinking that any news is good news.

We looked into Loco’s 2014 filing, and here’s what we found.

Total sales were up almost 10% and same store sales were up 7% in 2014 — not bad, but considering this company is billed as “the next Chipotle,” it has a lot of slack to pick up, as we’ll show later. Loco opened 15 new stores in 2014, representing 3% store growth.

Loco’s net operating profit after tax (NOPAT) fell 37% in 2014 year over year, and also sits below the company’s 2012 NOPAT. This fall in profits is in stark contrast to the company’s reported growth in net income, which shows an increase from -$8 million in 2012 to a profit of $42 million in 2014. We’ll go into details of why there is such a large discrepancy between thee amounts later in this report.

While Loco’s sales grew last year, its margins sank from 16% in 2013 to 9% in 2014. In line with its decline in profits, Loco’s return on invested capital (ROIC) fell to 6% in 2014, down from 11% in 2013. The company generated a free cash flow loss of -$13.5 million in 2014 due primarily to expenditures on new restaurants.

One Huge Issue

Aside from Loco’s lackluster growth in 2014, a large problem here is that 80% of revenue was derived from the greater Los Angeles area. Furthermore, 86% of Loco’s stores are in California, with the rest in Nevada, Arizona, Texas, and Utah.

Why is this concentration of revenue an issue, outside of the obvious reasons? First is the coming increase in labor costs in Southern California. The minimum wage in California is increasing from $9 to $10 beginning next year. Loco’s labor expense is 25% of current sales and wage hikes have already affected labor costs, raising them 7% in 2014 while the number of stores rose just over 3%. Expect labor costs to continue to rise as further wage-hike initiatives take effect in Los Angeles and San Diego, the latter of which just passed a resolution raising the minimum wage to $11.50 by 2017, and the former of which is considering boosting its minimum wage to over $15.

The second issue with this extreme localization is that Loco faces a 90-degree uphill battle in its expansion efforts. In the west, demographics and tastes are much different than other parts of the country and food and brands that work in one culturally distinct area of the country may not work in another. The Mexican-born Loco has tried to expand out of the western U.S. before: In 2009 it had 12 stores east of the Rockies in places like Atlanta, Georgia and Bergen, New Jersey. Both of these states are in the top 10 for total Hispanic population.

However, by 2012 all of those stores had closed. Expansion to the east may be even harder during Loco’s second attempt. We’ve learned that local tastes and incumbent restaurants can stop national expansion plans in their tracks, like in the case of Dunkin’ Brands (DNKN). What makes Loco think that its second expansion attempt will work any better than its first?

Another note from the earnings report is Loco’s chain-wide remodeling initiative. In an effort to boost its lackluster growth, Loco has remodeled 214 out of 415 total stores at end of 2014. Cost per store is estimated to be ~$270,000, and amounted to $8 million in 2014 (a lot of money when profits are $32 million). The goal with this initiative is a “strengthened brand,” but this is far from a guarantee, as we saw with Bob Evan’s similar remodeling initiative.

The Next Chipotle?

With headlines like “Investors Think El Pollo Loco Could Be The Next Chipotle” floating around, we’d be remiss not to compare the two companies on profitability and valuation to see if expectations like these are justified.

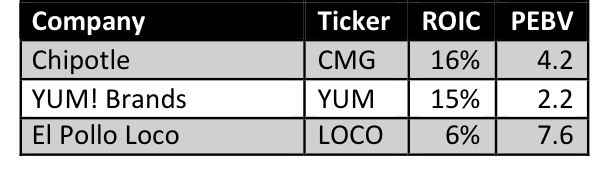

Figure 1 shows how Loco stacks up against its closest competitors in terms of ROIC and price to economic book value (PEBV). It compares Loco against Chipotle and YUM! Brands. YUM! owns Mexican-inspired chain Taco Bell and chicken restaurant KFC:

Figure 1: No True Competitor

Not only does El Pollo Loco have the lowest ROIC among its competition (a case that should be reversed for a growing restaurant), but it is also the most highly valued stock. Loco stands at a huge disadvantage to these two companies. Not only is its food competing very closely with the offerings of Chipotle, but both Chipotle and YUM! have enormous amounts of resources at their disposal. This allows them to expand and take market share from new Loco restaurants, but also to adapt more quickly to any change in consumer tastes.

These Adjustments and Red Flags Are Why El Pollo Loco Gets Our “Very Dangerous” Rating

There are a few items that most investors are probably missing that reinforce our call on Loco.

We removed $69 million (20% of revenues) in reported non-operating expenses from Loco’s reported earnings in 2014, mostly due to a tax receivable agreement with Trimaran. However, we had to subsequently increase Loco’s cash taxes by $89 million (to tax the higher income), which results in Loco’s 2014 NOPAT being $32 million, as opposed to its GAAP net income of $42 million. Investors thinking Loco is growing profits need to look closer at the details of the financial statements, as NOPAT has actually declined since 2011.

Loco also has $136 million in off-balance sheet debt due to operating leases (32% of net assets and 45% of total debt). This significantly raises Loco’s total debt over its reported debt of $166 million.

Asset write-downs have increased every year since 2012, from $2 million to over $14 million (3% of net assets) in 2014. If this pattern of value destruction continues, shareholders should be worried about management’s capital allocation skills.

Loco is Priced for Perfection

At its current price of $27/share, LOCO has a PEBV 7.6, the fifth highest out of the 34 restaurant stocks we cover. We think it’s clear that Loco doesn’t have the chops — in terms of profit or profit growth — to back up its valuation.

To justify its current valuation of $26/share, Loco must nearly track the growth of Chipotle and grow NOPAT by over 20% compounded annually for the next nine years. This takes into account the company’s rate of fixed assets growth to reflect Chipotle’s. This 20% growth rate still doesn’t quite match Chipotle’s 29% NOPAT growth rate since going public, but it gets close.

What about if Loco can’t match Chipotle’s track record? If Loco can grow NOPAT by a still-impressive 14% compounded annually for the next nine years, its shares are worth $17/share, a 37% downside. This is what we call “priced for perfection,” and anything less than perfection could mean disaster for shareholders.

Weak Bull Case

The bull case for Loco seems to rest mainly on the company becoming the next Chipotle. The two restaurants serve Mexican-inspired food that appeals to the “healthy” set. The valuation reflects this, but as we’ve discussed, the odds of this one becoming the next Chipotle are slim to none.

Loco is expecting to add 27 restaurants in 2015, for a growth rate of 7% and targets 8-10% annual growth in stores long term. The much more mature Chipotle expects to grow new stores by 11%-12% next year. Also, Chipotle’s revenue has grown at a 22% compounded annual growth rate (CAGR) since 2011. Loco’s revenue CAGR is only 8% since 2011.

In addition, Chipotle’s same store sales still rose in 2014, while El Pollo Loco’s are falling (7.0% in 2014 to guidance of 3-5% for 2015). Loco is not growing at anywhere near the pace of Chipotle, historically or going forward.

Several Likely Catalysts

The restaurant industry is fast moving and complex and there are a number of catalysts that could stop Loco’s stock in its tracks. We’ve already mentioned that increasing labor costs will impact Loco’s bottom line and panicky investors and institutions could dump the stock after any more minimum wage hikes.

Finally, if Loco attempts another expansion on the east coast, and this expansion fails once again, we think this will be the nail in the coffin for Loco’s stock, as there will be little hope after this that the company can make good on its (and its stock’s) growth promises. We’d like to ask: What makes investors think this time, Loco’s expansion will turn out any differently?

Little Stupid Money Risk

With its paltry cash balance and high valuation, we don’t think it’s likely El Pollo Loco will be acquired anytime soon.

At the moment, the company doesn’t pay a dividend or issue a buyback. We think this is an unlikely strategy given the company’s limited resources.

Insiders Selling Is Big

In the past 12 months, there have been no insider buys, but seven insider sells worth $184 million, which represents 19% of the company’s market value. Some of this is due to insiders jumping ship, but much of this is due to El Pollo Loco’s private equity firm Trimaran Capital Partners cashing in its gains after the company’s IPO.

Short Interest

Short interest stands at 3.8 million shares, or over 28% of float.

Dangerous Funds That Hold PF

No funds allocate heavily to LOCO and earn our Dangerous rating.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click Here to download a PDF of this report.

Photo credit: Paul Sableman