We closed this position on November 16, 2020. A copy of the associated Position Update report is here.

U.S. Cellular Corp. (USM: $40/share), the fifth largest wireless carrier in the United States, has landed in the Danger Zone this week. The company’s profits, margins, and return on invested capital (ROIC) are all in decline, and its revenues have been stagnant for a number of years. In addition, reported earnings per share conceal the company’s growing profit losses. At around $40/share, USM is significantly overvalued — enough so to make our Most Dangerous Stocks list since April.

All Signs of a Business in Decline

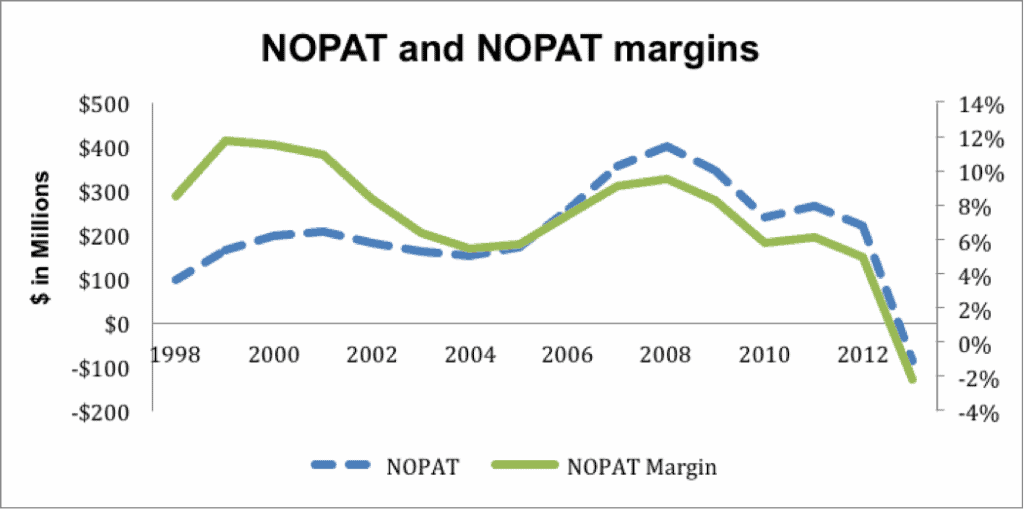

U.S Cellular’s profitability has been in decline for some time now, and its decline was quickly accelerated by the financial crisis in 2008. USM’s profits (NOPAT) peaked at $402 million in 2008, and have since declined to -$86 million in 2013.

NOPAT margins have shrunk almost every year, from 12% in 2000 to -2% last year.

Figure 1: Profit and Margins Plummeting Since 2008

Sources: New Constructs, LLC and company filings

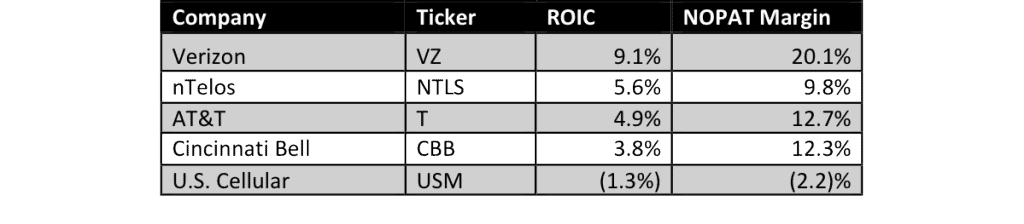

The company’s return on invested capital (ROIC) has fallen accordingly: USM’s ROIC is now -1.3% after a steady decline from 7% in 2008.

Revenue growth has also largely stalled since 2008, and USM’s most recent numbers show that its revenue is now in sharp decline. The company’s 2013 operating revenue was down 12% compared to 2012, and 1Q14 revenue was down 14% year over year.

USM’s primary problem is its demonstrated inability to grow its subscribers and retain these customers.

USM has two wireless customer segments: prepaid and postpaid plans. Some growth in the company’s number of prepaid plans has masked the decline in the company’s postpaid plans over the past few years. Postpaid customers have been abandoning USM at a growing rate. All told, this increasing decline coupled with the company’s divestiture from several markets in 2013 has caused USM to shed a total of 22% of its subscribers since 2009.

Non-Operating Items Mask Growing Losses

USM’s GAAP income does not reflect its startling decline in profitability. The company’s net income was up 26% to $140 million in 2013. However, as shown above, USM’s operating profit paints a much different picture — an $86 million loss in 2013.

The reason for this discrepancy between USM’s GAAP profit and its NOPAT lies in the non-operating items that the company recorded as operating income in 2013. Our patented research technology allows our analysts to quickly uncover these red flags in companies’ footnotes.

Most of this non-operating income is due to USM’s aforementioned divestiture from several east coast and Midwestern markets. USM was able to record $480 million from the sale of customers and spectrum licenses in these markets to Sprint (S). USM is boosting its earnings and masking a decline in profitability by essentially conceding a loss to its competition.

Weak Competitive Position

As the company’s exit from certain markets might indicate, USM has been lagging its competition. USM competes for customers with other United States mobile carriers, such as AT&T (T), Verizon (VZ), Sprint (S), and T-Mobile U.S. (TMUS).

Below is a breakdown of USM’s key profitability metrics vs. its competitors’. U.S. Cellular is behind only T, VZ, S, and TMUS in terms of number of subscribers. Despite this, it lags even the next-largest regional carriers, nTelos (NTLS) and Cincinnati Bell (CBB), in both ROIC and NOPAT margins (our model on S and TMUS requires more years of coverage to accurately assess NOPAT and ROIC):

Figure 2: Falling Short of the Competition

Customer service complaints (especially nickel-and-diming) have been a sore spot for USM in addition to its poor mobile coverage outside of its home markets near its headquarters in Chicago. The company simply cannot compete on coverage and pricing with national wireless carriers, which have room in their profit margins for lower prices.

Worrying Acquisitions and Spending

USM has recently resorted to growth through acquisitions, a method that generally dilutes shareholder value. USM recently paid $92 million to acquire spectrum, tower assets, and subscribers from Airadigm Communications, which is shutting down its wireless operations. USM will also pay a fee for each customer it acquires from Airadigm. USM is growing by acquisition (into markets that drove another company out of business) while losing customers in existing markets. This strategy bodes poorly for the business’ ROIC and cash flows.

USM is burning through its cash, with just $392 million on hand at the end of 2013. Accounting for the $92 million paid for Airadigm, this leaves the company with around $300 million, a 46% decline in cash since 2011. USM has been repurchasing shares, $3.8 million’s worth in 1Q14. Subscriber loss accelerated in the most recent quarter. USM lost 80,000 customers in 1Q14, up from net losses of 2,000 in 1Q13. At this rate, the company will have burned through its dwindling pile of cash in a little over 4 years.

Expensive Valuation

Despite these warning signs, USM is priced for high growth. The stock’s current price of $40/share implies that the company will instantly achieve pretax margins of 8% (from -4% currently) and that it will grow revenue at 14% compounded annually for 5 years. This is an awfully optimistic turnaround for a company that is shedding subscribers and exiting markets. USM’s poor competitive position relative to carriers like AT&T and Verizon make me even less confident that it can achieve this kind of growth.

If USM remains unprofitable, it should trade close to its tangible book value of $19.00/share, or a 52% downside.

Looking forward, if subscriber loss continues and financial losses widen, there is no reason for USM to continue trading this high after its buyback program ends. Expect the company to earn a loss in 2014, and with no gains from sale of assets to mask its unprofitability like in 2013. If the company does somehow manage to increase profits, it will be through slashing selling and promotional expenses as it has done in the past, further accelerating the decline of its subscriber base.

Insider Selling

In the past 12 months there have been 8 open market buys and 21 open market sells, with 44,496 shares bought and 259,716 shares sold. Shares sold are 2% of shares outstanding not owned by Telephone and Data Systems (TDS), which owns 84% of all shares.

While this level of selling might not raise any eyebrows, investors should be on the lookout for any pickup in insider activity.

Short Interest

Short interest stands at 1.1 million shares, or 1.3% of all shares outstanding and 8.2% of float.

Avoid These Funds that allocate to USM

Investors should avoid the following mutual funds, as they allocate over 3% of their assets to USM and hold many other poor stocks:

First Trust Utilities AlphaDEX Fund (FXU): 4.1% allocation to USM and Very Dangerous rating.

iShares U.S. Telecommunications ETF (IYZ): 3.2% allocation to USM and Very Dangerous rating.

ProShares Ultra Telecommunications (LTL): 3.2% allocation to USM and Very Dangerous rating.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Photo Credit: Fuchsia Foot (Flickr)