Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This report closes multiple successful and unsuccessful Danger Zone picks.

Our Danger Zone reports aim to identify firms that, despite the noise, have struggling businesses and highly overvalued stock prices. These reports, along with all of our research, leverage cutting-edge technology to provide clients with a cleaner and more comprehensive view of profits and enable them to pick better stocks and avoid excessive risk.

Danger Zone Picks to Close

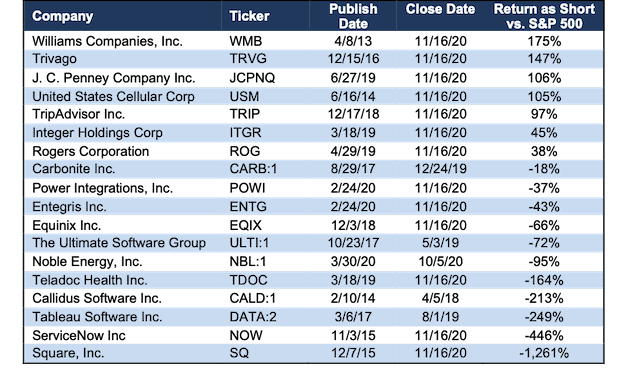

Figure 1 provides a list of Danger Zone picks we are closing along with the performance vs. the S&P 500 since each report was published.

When closing positions, we analyze key aspects of the firm and its stock, such as:

- Price movements

- Trend in fundamentals, particularly profits and margins

- Favorable/unfavorable industry trends

- Changes in corporate governance, such as executive compensation plans.

Figure 1: Closed Danger Zone Picks: Performance as of Closing Prices on 11/13/20

Sources: New Constructs, LLC and company filings

The close dates for CARB, ULTI, NBL, CALD, and DATA correspond to the dates each firm was acquired, and their stocks were no longer publicly traded.

Below, we provide details on why we’re closing each position.

Williams Companies (WMB)

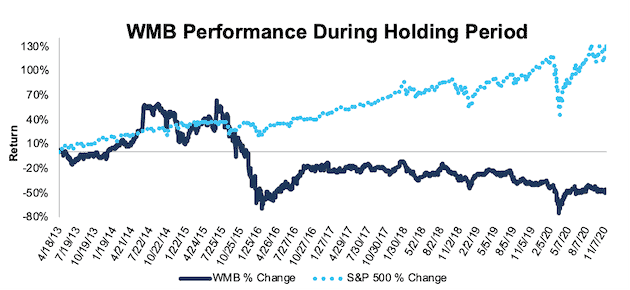

We put Williams Companies (WMB: $20/share) in the Danger Zone on April 8, 2013. At the time, WMB received a Very Unattractive rating. Our short thesis highlighted low potential for growth in its industry and a return on invested capital (ROIC) consistently below the firm’s weighted average cost of capital (WACC).

During the 7+ year holding period, WMB outperformed as a short position, falling 46% compared to a 129% gain for the S&P 500.

More recently, Williams Companies’ fundamentals have been trending higher. Economic earnings, while still negative, have improved year-over-year (YoY) each year since 2018. ROIC, while still below WACC, has improved from 3% in 2016 to 4% TTM and net operating profit after-tax (NOPAT) margin improved from 16% in 2013 to 26% TTM. Given improvement in the firm’s fundamentals, and the large outperformance as a short, we believe it is time to take the gains and close this short position.

Figure 2: WMB vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Trivago (TRVG)

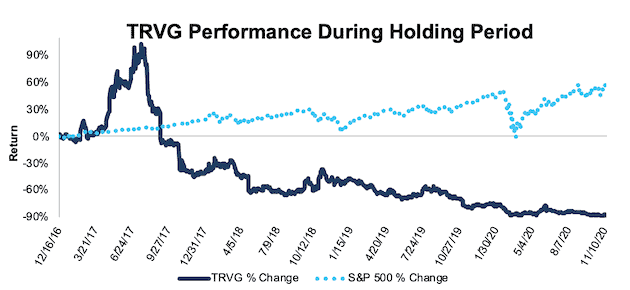

We put Trivago (TRVG: $1.40/share) in the Danger Zone on December 15, 2016, just before its IPO. At the time, TRVG received an Unattractive rating. Our short thesis highlighted the firm’s profitless revenue growth, weak competitive position, negative ROIC, and overvalued IPO price.

During the nearly four-year holding period, TRVG outperformed as a short position, falling 88% compared to a 58% gain for the S&P 500.

The stock still earns an Unattractive rating, but the firm’s ROIC, NOPAT, and economic earnings were all trending higher prior to the COVID-19 pandemic. Specifically, ROIC improved from -4% in 2015 to 3% in 2019 while NOPAT margin increased from -7% to 4% over the same time.

Now, any additional positive news regarding COVID-19 and the economy, such as additional vaccine results, or signs of increased travel, could send shares higher given Trivago’s heavy reliance on consumer travel. With the stock down over 47% year-to-date, and trading near its 52-week low, we believe it’s a great time to take the gains in this short position.

Figure 3: TRVG vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

J.C. Penney Company (JCPNQ)

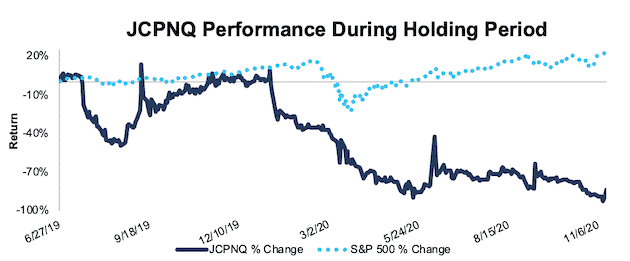

We put J.C. Penney Company (JCPNQ: $0.18/share) in the Danger Zone on June 27, 2019. At the time, JCPNQ received an Unattractive rating. Our short thesis highlighted J.C. Penney’s unusually high operating lease discount rate that understated its reported operating lease burden. In the report, we noted specifically that J.C. Penney’s “lease commitments increase bankruptcy risk.”

During the 508-day holding period, JCPNQ outperformed as a short position, falling 84% compared to a 23% gain for the S&P 500.

J.C. Penney’s profitability continued its long-term decline, and in May 2020, the firm filed for bankruptcy. With shares trading at $0.18/share, we believe now is the time take gains and close this short position.

Figure 4: JCPNQ vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

United States Cellular (USM)

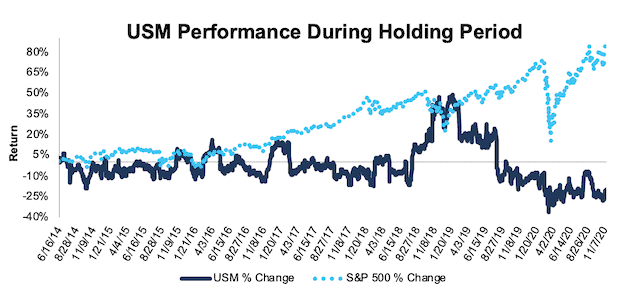

We put United States Cellular (USM: $32/share) in the Danger Zone on June 16, 2014. At the time, USM received a Very Unattractive rating. Our short thesis highlighted that the firm’s profitability had fallen nearly every year since 2000, its NOPAT was declining even as reported GAAP profits were rising, and it occupied a weak competitive position relative to peers.

During the nearly six-and- a-half-year holding period, USM outperformed as a short position, falling 20% compared to an 85% gain for the S&P 500.

United States Cellular now earns a Neutral rating, and its ROIC has improved from 2% in 2016 to 4% TTM while NOPAT margin improved from 3% to 8% over the same time. The firm’s economic earnings, while still negative, have improved YoY in each year since 2017 as well.

Given the improving fundamentals, the firm’s stock price no longer presents the same risk/reward. We’re taking the gains and closing this position.

Figure 5: USM vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

TripAdvisor (TRIP)

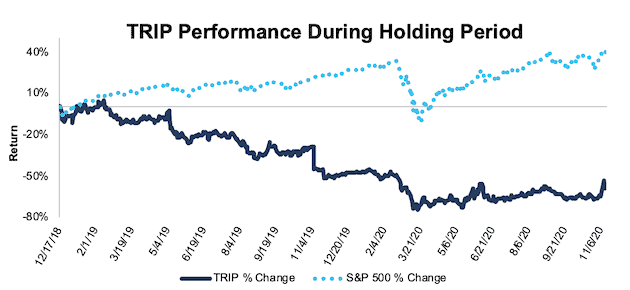

We put TripAdvisor (TRIP: $25/share) in the Danger Zone on December 17, 2018. At the time, TRIP received an Unattractive rating. Our short thesis noted TRIP was a stock to sell before a bear market given its low ROIC relative to its competition, namely Booking Holdings (BKNG), and its expensive valuation.

During the nearly two-year holding period, TRIP outperformed as a short position, falling 56% compared to a 41% gain for the S&P 500.

The stock still earns an Unattractive rating, but its profitability was trending higher prior to the COVID-19 pandemic. Similar to TRVG, any additional positive news regarding a return to normalcy in the global travel market could send shares higher.

Given that TRIP is down over 16% year-to-date, we believe it’s time to take the gains in this short position.

Figure 6: TRIP vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

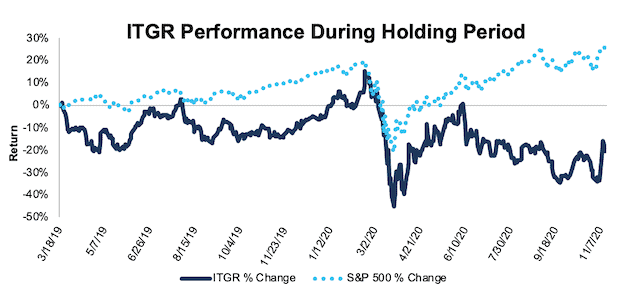

Integer Holdings Corp (ITGR)

We put Integer Holdings Corp (ITGR: $70/share) in the Danger Zone on March 18, 2019. At the time, ITGR received a Very Unattractive rating. Our short thesis highlighted Integer Holdings’ poor corporate governance, falling economic earnings, and expensive valuation. Specifically, we noted the firm’s use of adjusted EBITDA in its executive compensation plan failed to hold executives accountable to creating shareholder value.

During the 609-day holding period, ITGR outperformed as a short position, falling 19% compared to a 27% gain for the S&P 500.

Integer Holdings now earns a Neutral rating, in large part due to its improving fundamentals. Prior to the COVID-19 pandemic, Integer Holdings’ ROIC improved from 4% in 2016 to 7% in 2019 while NOPAT margin increased from 9% to 12% over the same time. Additionally, the firm’s core earnings[1] increased from $43 million to $110 million over the same time. Integer Holdings also removed adjusted EBITDA as a performance goal in its executive compensation plan. While we would still recommend tying executive compensation to ROIC improvement, the removal of adjusted EBITDA is a move in the right direction.

With improved fundamentals, and lower stock price, the stock no longer looks as expensive as it did when we put it in the Danger Zone. We’re taking the gains and closing this short position.

Figure 7: ITGR vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

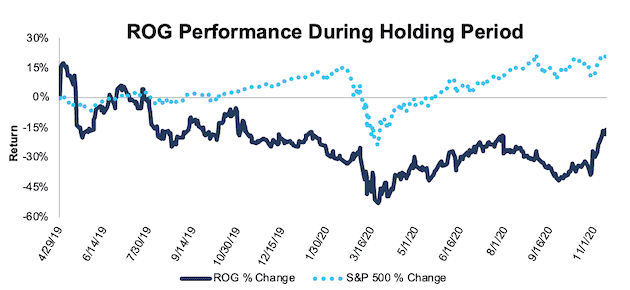

Rogers Corporation (ROG)

We put Rogers Corporation (ROG: $139/share) in the Danger Zone on April 29, 2019. At the time, ROG received a Very Unattractive rating. Our short thesis highlighted that ROG’s huge price movement that year (the stock was up 72% in 2019 at the time of writing) could come crashing down, given the firm’s falling economic earnings and expensive valuation.

During the one-and-a-half-year holding period, ROG outperformed as a short position, falling 19% compared to a 22% gain for the S&P 500.

The firm still earns an Unattractive rating, and ROIC fell from 8% in 2019 to 5% TTM as the COVID-19 pandemic disrupted operations. Core earnings fell from $86 million to $53 million over the same time.

However, Rogers Corporation supplies circuit materials for 5G wireless infrastructure and advanced driver assist systems (among other products), two markets that are projected for significant industry growth in coming years. With strong industry tailwinds, ROG could benefit from a “rising tide lifts all boats” sentiment. We’re taking the gains and closing this short position.

Figure 8: ROG vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

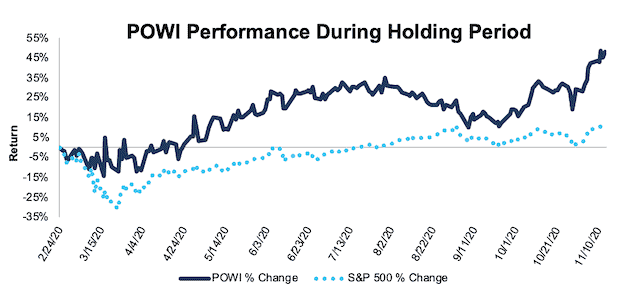

Power Integrations (POWI)

We put Power Integrations (POWI: $69/share) in the Danger Zone on February 24, 2020. At the time, POWI received an Unattractive rating. Our short thesis highlighted Power Integrations’ misleading GAAP net income, which was rising while core earnings declined, and its expensive valuation.

During the 266-day holding period, POWI underperformed as a short position, rising 48% compared to a 11% gain for the S&P 500.

Power Integrations’ misleading GAAP net income is no more, and the firm now earns a Neutral rating. The firm’s core earnings of $54 million in the TTM period are higher than the $45 million earned in 2019 and trending in the same direction as GAAP net income. Additionally, the firm’s ROIC improved from 11% in 2019 to 13% TTM while NOPAT margin increased from 11% to 12% over the same time.

Given expected growth in the Power Management Integrated Circuit market and Power Integrations’ improving fundamentals, we are closing this short position.

Figure 9: POWI vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

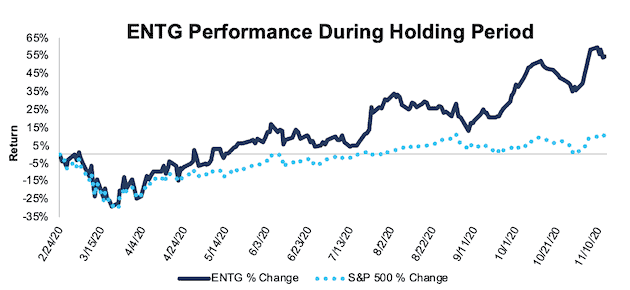

Entegris (ENTG)

We put Entegris (ENTG: $85/share) in the Danger Zone on February 24, 2020, in the same report with Power Integrations. At the time, ENTG received a Very Unattractive rating. Our short thesis highlighted Entegris’ misleading GAAP net income, which was rising while core earnings declined, and its expensive valuation.

During the 266-day holding period, ENTG underperformed as a short position, rising 55% compared to a 11% gain for the S&P 500.

Entegris now earns a Neutral rating due to improvements in profitability. The firm’s ROIC increased from 10% in 2019 to 12% TTM, which continues an upward trend since 2015. The firm’s NOPAT margin follows a similar trend, rising from 8% in 2015 to 18% TTM. Entegris’ core earnings returned to growth over the TTM as well, rising from $195 million in 2019 to $276 million TTM.

Given long-term tailwinds in the semiconductor equipment market, we’re closing this losing position.

Figure 10: ENTG vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

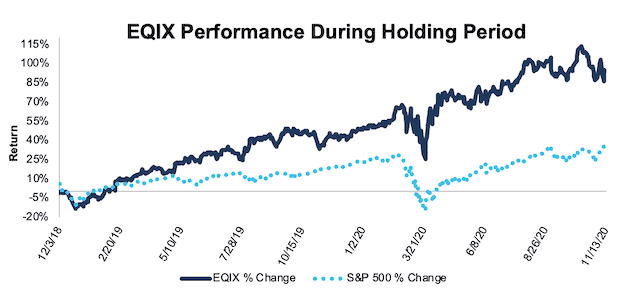

Equinix (EQIX)

We put Equinix (EQIX: $761/share) in the Danger Zone on December 3, 2018. At the time, EQIX received a Very Unattractive rating. Our short thesis highlighted that Equinix was particularly risky in the Real Estate sector, which was our worst-rated sector at the time. The gap between the firm’s ROIC and WACC was widening, and its costly acquisition strategy was destroying shareholder value.

During the nearly two-year holding period, EQIX underperformed as a short position, rising 95% compared to a 28% gain for the S&P 500.

While Equinix still earns an Unattractive rating, its fundamentals are showing signs of improvement. The firm’s ROIC improved from 3.7% in 2016 to 4.0% TTM, which is just below its WACC of 4.1%. NOPAT margins improved from 13% in 2016 to 16% TTM. Economic earnings, which fell YoY from 2015-2018 have improved from -$308 million in 2018 to -$37 million TTM.

Going forward, increased data usage, cloud access, and internet of things devices will drive growth in colocation data centers and companies are increasingly looking to outsource their data center needs to save on energy and infrastructure costs. Gartner projects worldwide data center infrastructure spending will grow 6% in 2021 and data center REITs, such as Equinix or Digital Realty (DLR), stand poised to benefit. Given the improvement in fundamentals and positive industry tailwinds, EQIX no longer presents quality risk/reward. We’re closing this position.

Figure 11: EQIX vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

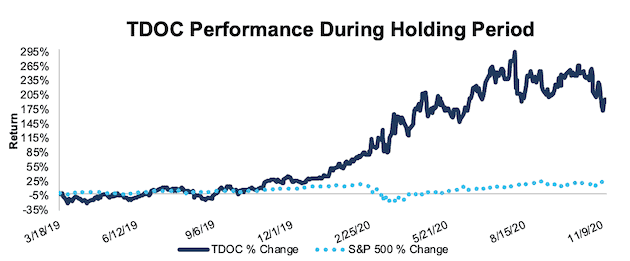

Teladoc (TDOC)

We put Teladoc (TDOC: $183/share) in the Danger Zone on March 18, 2019. At the time, TDOC received an Unattractive rating. Our short thesis highlighted Teladoc’s poor corporate governance, falling economic earnings, and expensive valuation.

During the 609-day holding period, TDOC underperformed as a short position, rising 190% compared to a 27% gain for the S&P 500.

Teladoc’s profitability, while still negative, has improved significantly in recent years. The firm’s ROIC increased from -24% in 2015 to -1% TTM while NOPAT margin increased from -67% to -3% over the same time.

Going forward, Teladoc benefits from the same industry tailwinds that we pointed out in our Long Idea on HCA Healthcare (HCA), namely the increased demand for telehealth services. With partnerships with CVS Health Corp (CVS) and insurance providers, Teladoc appears positioned to benefit from this trend and no longer presents the same risk/reward, despite its lingering unprofitability. We are closing this short position.

Figure 12: TDOC vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

ServiceNow (NOW)

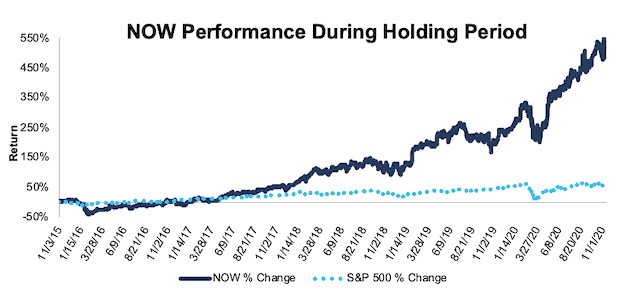

We put ServiceNow (NOW: $508/share) in the Danger Zone on November 3, 2015. At the time, NOW received an Unattractive rating. Our short thesis highlighted ServiceNow’s growing losses due to rising expenses, ROIC significantly below competitors, and a valuation that was priced for perfection. Our short thesis underestimated the firm’s first-mover advantage in the software as a service IT market, as well as competitors’ ability and/or desire to compete in the space. The firm has grown revenue 38%, 39%, 35%, and 33% YoY in each of the past four years, all while improving profitability.

During the five-year holding period, NOW underperformed as a short position, rising 516% compared to a 70% gain for the S&P 500.

ServiceNow earns a Neutral rating and has significantly improved its fundamentals. ROIC improved from -43% in 2016 to 85% TTM while NOPAT margin improved from -10% to 4% over the same time. Furthermore, the firm improved its core earnings from -$177 million in 2016 to $187 million TTM.

Morningstar estimates ServiceNow holds nearly 40% market share in the narrowly defined Information Technology Service Management market, which is growing upwards of 20% annually. Going forward, Research and Markets projects the broader workflow automation market will grow nearly 6% compounded annually from 2020-2025. Given the improvement in fundamentals, particularly ROIC and margins, and positive industry tailwinds, NOW no longer presents quality risk/reward. We’re closing this position.

Figure 13: NOW vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Square Inc. (SQ)

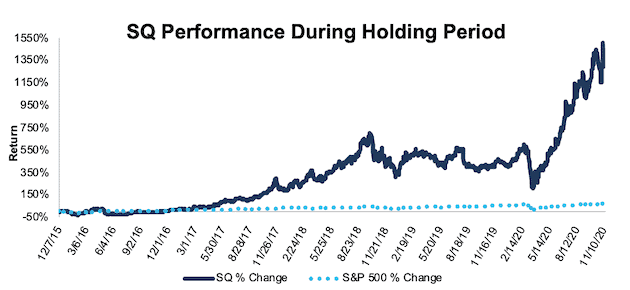

We put Square (SQ: $177/share) in the Danger Zone on December 7, 2015. At the time, SQ received an Unattractive rating. Our short thesis highlighted Square’s soaring expenses, low profitability vs. well entrenched competition, and a significantly overvalued share price. Ultimately, our short thesis underestimated the stickiness of Square’s payment system as well as the firm’s ability to expand into additional services. The firm’s peer-to-peer payments application CashApp, along with a debit card offering, move the firm closer to operating more like a traditional bank, spurred along by the FDIC approval of Square’s banking license in March 2020.

During the nearly five-year holding period, SQ vastly underperformed as a short position, rising 1334% compared to a 73% gain for the S&P 500.

Square now earns a Neutral rating and the firm’s profitability has significantly improved. Square’s ROIC improved from -35% in 2015 to 19% TTM while its NOPAT margin improved from -13% to 3% over the same time. Square’s core earnings also improved from -$175 million in 2015 to $192 million TTM. While its valuation still looks expensive (the firm has a negative economic book value, or no growth value, over the TTM period), Square has more than proven its ability to compete against incumbent payment providers and banks.

Given the shift to online/digital banking, Square could have a long runway for future growth. We’re closing this position.

Figure 14: SQ vs. S&P 500 – Price Return – Unsuccessful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Acquired Danger Zone Picks

The following Danger Zone Picks were acquired and provide great examples of stupid money risk, which is often the largest risk for any short thesis.

- Callidus Software (CALD): Published 2/10/14 and acquired 4/5/18

- Tableau Software (DATA): Published 3/6/17 and acquired 8/1/19

- Carbonite (CARB): Published 8/29/17 and acquired 12/24/19

- The Ultimate Software Group (ULTI): Published 10/23/17 and acquired 5/3/19

- Noble Energy (NBL): Published 3/30/20 and acquired 10/5/20

This article originally published on November 16, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).