This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

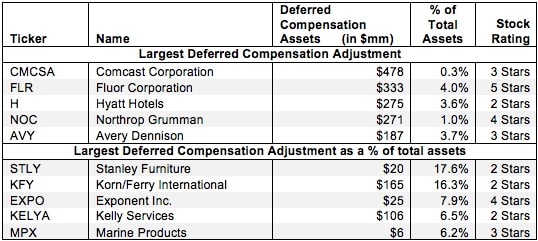

Deferred compensation plans delay employee compensation until a later date. The assets held for these plans are used to compensate employees in the future, not to generate profits for the company. As such, they should not be factored into the calculation of a company’s return on invested capital (ROIC).

Sometimes, companies declare their deferred compensation assets directly on the balance sheet. Korn/Ferry International (KFY) lists the assets to fund its deferred compensation plan under “Marketable securities, non-current” and “Cash surrender value of company owned life insurance policies, net of loans” on its consolidated balance sheet.

2 replies to "Deferred Compensation Assets – Invested Capital Adjustment"

First, sorry for my English since I’m a French Canadian.

I want to know if you also classify the deferred compensation liability as a financial liability rather than an operating liability (effectively offsetting the asset with the liability)? The same logic seems to apply to over-funded pensions : pension assets don’t produce sales nor operating income and pensions liabilities can only be invested in operating assets up to a limite, which is the pensions assets (the under-funded pensions cases). In the case of over-funded pensions, you are only adjusting the surplus pension assets and not the totality of those assets. On the other hand, deferred compensation liabilities can only be reinvested in operating assets up to a limite since some of it, or the totality, needs to be put aside and invested in financial assets.

If I put the deferred compensation asset on the financial side of the balance sheet, the deferred compensation liability decrease the net operating assets and increase the return on capital. I’m inclined to put the liability on the financial side too, but I want to know how you do it.

I don’t have an access to your plateforme hence my question. As a young investor and accountant, I really like the work you guys are doing 🙂

Hi William,

Thanks for your question. We treat deferred compensation as a non-operating liability. The best place to ask modeling questions is on our online community, the Society of Intelligent Investors. We can get you feedback from analysts at new Constructs, as well as other community members. Please sign up here: https://www.newconstructs.com/society. We’d love to have you join the online conversations!

Best,

Tam