For the week of 10/19/20-10/23/20, we focus on the Earnings Distortion Scores for 121 companies.

Our Earnings Distortion Scores[1] empower investors to make smarter investments with superior data as well as defend against management efforts to obfuscate financial performance.

Our proprietary measure of earnings distortion (as featured on CNBC Squawk Box) leverages proprietary data featured in Core Earnings: New Data & Evidence. This paper shows that our adjusted core earnings are more accurate than “Operating Income After Depreciation” and “Income Before Special Items” from S&P Global (SPGI).

Weekly Earnings Distortion Insights

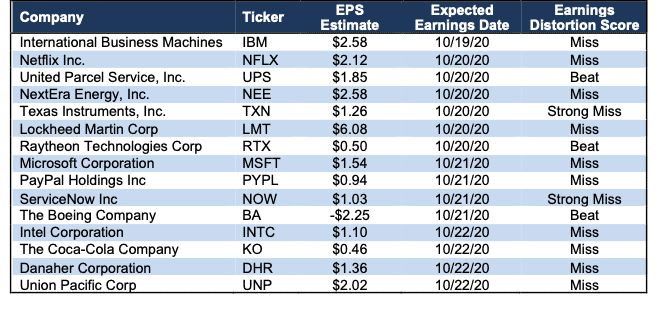

Figure 1 contains the 15 largest (by market cap) companies that earn a “Beat”, “Miss”, or “Strong Miss” Earnings Distortion Score and are expected to report the week of October 19, 2020.

Figure 1: Earnings Distortion Scorecard Highlights: Week of 10/19/20-10/23/20

Sources: New Constructs, LLC and company filings

The appendix shows the Earnings Distortion Scores for all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of October 19, 2020.

Details: Raytheon Technologies (RTX): Earnings Distortion Score: Beat

Over the trailing-twelve months (TTM), Raytheon Technologies has -$5.2 billion in net earnings distortion that cause earnings to be understated by $5.12/share or 322% of EPS. Notable unusual expenses hidden and reported in Raytheon’s filings include:

- $3.2 billion goodwill impairment – 2Q20 10-Q

- $317 million restructuring charges – 2019 10-K

- $271 million related to separation transactions recorded in selling, general, and administrative costs – 1Q20 10-Q

- $231 million restructuring charges recorded in cost of sales – 2019 10-K

- $190 million restructuring charges recorded in selling, general and administrative – 2019 10-K

- $40 million acquisition-related costs – 2019 10-K

In addition, we made a $768 million adjustment for income tax distortion. This adjustment normalizes reported income taxes by removing the impact of unusual items.

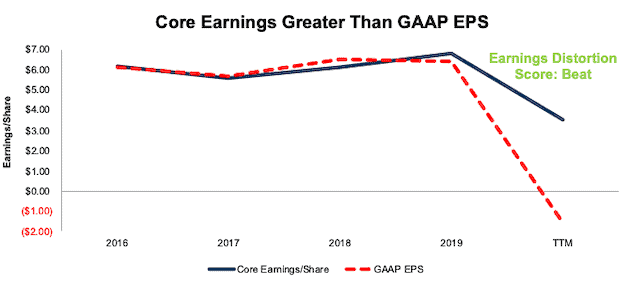

In total, we identified $5.12/share (322% of GAAP EPS) in net unusual expense that cause Raytheon Technologies’ TTM GAAP results to be understated. After removing this earnings distortion, Raytheon Technologies’ TTM core earnings of $3.53/share are much greater than GAAP EPS of -$1.59, per Figure 2.

With understated earnings, RTX gets our “Beat” Earnings Distortion Score and is likely to beat consensus expectations. While we expect RTX to beat expectations in the short term, its bottom-quintile return on invested capital (ROIC) and negative free cash flow yield earn it an Unattractive Risk/Reward rating, which focuses on the long term.

Figure 2: Raytheon Technologies Core Earnings Vs. GAAP: 2016 - TTM

Sources: New Constructs, LLC and company filings

Figure 1 shows that Raytheon Technologies is one of three companies that earn our “Beat” score for this week.

How to Make Money with Earnings Distortion Data

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 8% per year.” – Page 1 in Core Earnings: New Data & Evidence

In Section 5.2, professors from HBS & MIT Sloan present a long/short strategy that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings.

This strategy produced abnormal returns of 8% a year. Click here for more details on our data offerings.

We Provide 100% Audit-ability & Transparency

Clients can audit all of the unusual items used in our calculations in the Marked-Up Filings section of each of our Company Valuation models. We are 100% transparent about what goes into our research because we want investors to trust our work and see how much goes into building the best earnings quality and valuation models.

This article originally published on October 12, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

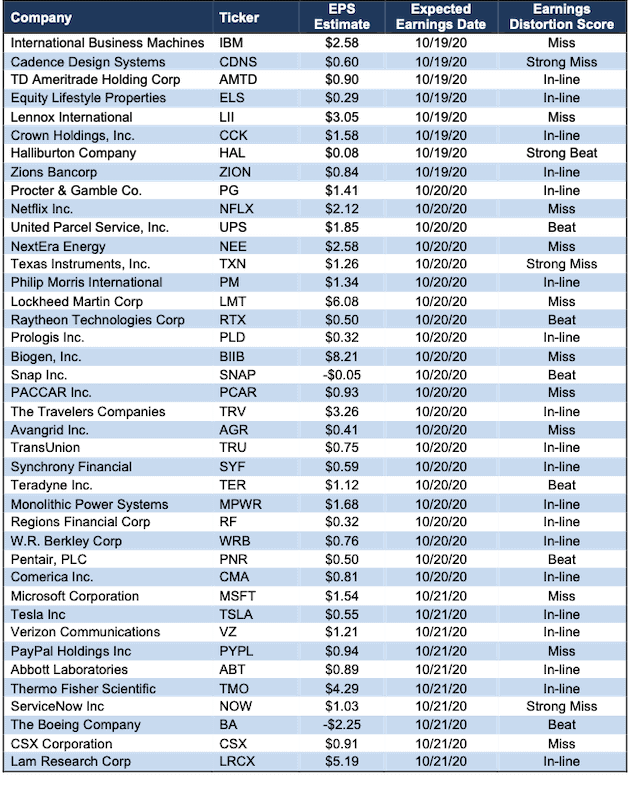

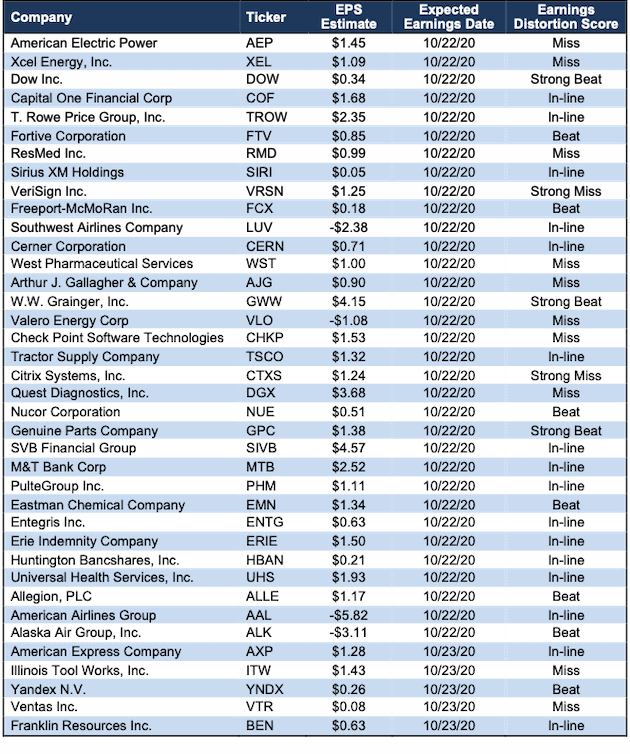

Appendix: All Major Companies Expected to Report October 19 – 23

Figure 3 shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of October 19, 2020.

Figure 3: Earnings Distortion Scorecard: Week of 10/19/20-10/23/20

Sources: New Constructs, LLC and company filings

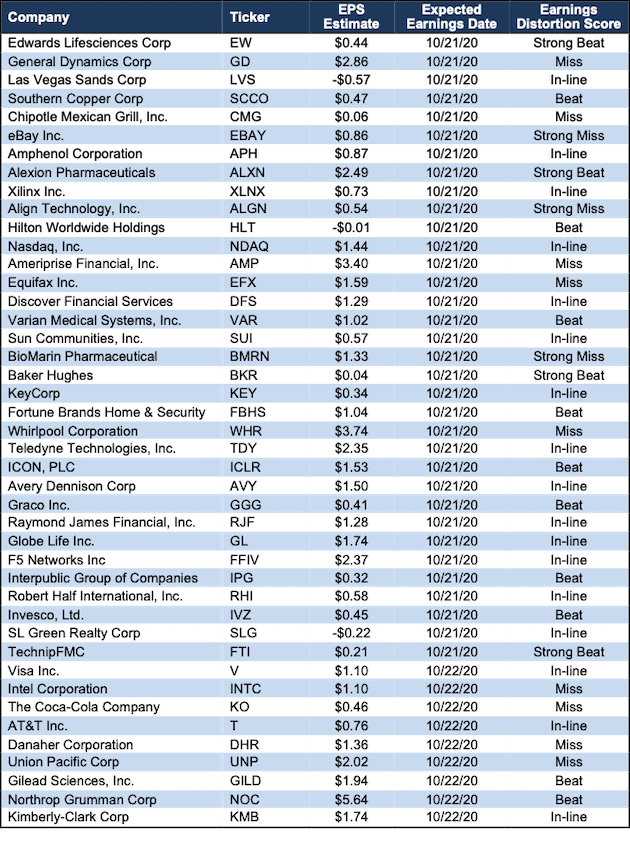

Figure 3: Earnings Distortion Scorecard: Week of 10/19/20-10/23/20 (continued)

Sources: New Constructs, LLC and company filings

Figure 3: Earnings Distortion Scorecard: Week of 10/19/20-10/23/20 (continued)

Sources: New Constructs, LLC and company filings

[1] Earnings Distortion scores on ~3,000 stocks are also available to clients of our website.