This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

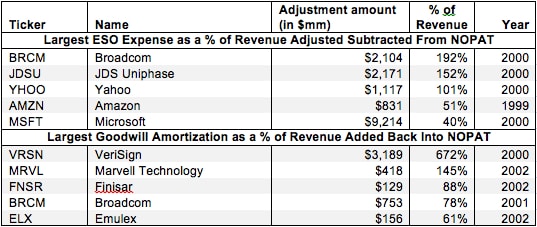

Employee stock option expense and goodwill amortization adjustments are two adjustments that impact past years in our model but no longer have an impact due to changes in accounting standards. The Financial Accounting Standards Board (FASB) ended the practice of goodwill amortization in 2002 and required businesses to record expenses related to employee stock options beginning in 2006.

Employee stock option (ESO) expense is the cost of the issuing (at-the-money) stock options. Prior to 2006, businesses were not required to record any cost for issuing ESOs. During that time, many companies exploited that loophole to overstate reported earnings by compensating employees with ESOs.

Using data provided only in footnotes, we determined the cost of all ESO issuances long before FASB required companies to report them in 2006. This adjustment is important not only for getting a true view a company’s profits versus other firms but also for comparability of profits before and after 2006.

Goodwill amortization is a gradual, formulaic reduction in asset value using any of the several GAAP amortization methods. In 2002, this system was done away with and replaced with the practice of goodwill impairment, which calculates any depreciation in the value of an asset based on performance tests. We account for the use of amortization expense prior to 2002 by adding the charge back to net income to determine NOPAT. Synergies should never depreciate, so goodwill amortization is not a true operating cost. In addition, this adjustment enables comparability between companies with different amortization methods or that have no goodwill amortization because they used the now defunct Pooling Method of accounting for an acquisition.

1 Response to "Employee Stock Option Costs and Goodwill Amortization – NOPAT Adjustment"

On July 5, 2000, Vignette Corp., an Austin, Texas-based provider of Internet applications, completed its $1.5 billion acquisition of OnDisplay Inc., which designs software for E-commerce. About $52.9 million was recorded as deferred stock compensation, and will be amortized over the remaining life of the options. Most of that–$33 million–was expensed in 2000. Meanwhile, goodwill is being written off over only two to four years. Last year, the amortization charge for goodwill and other purchased intangibles was $328.7 million, accounting for most of the company’s $532 million loss on its $367 million in revenues.