Forget all the “earnings season” analysis you read last month. The real earnings season – annual 10-K filing season – is happening right now.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. Our analysts work tirelessly to uncover red flags hidden in the footnotes and make our models the best in the business.

There’s no way we could analyze so many filings in such a short time without our engineering team’s help. Using machine learning and natural language processing, we automate much of the rote work of data gathering and modeling. Our technology frees our analysts up to spend more time on the complicated and unusual data points that other firms miss.

Investors understand that analyzing all financial statements and footnotes is an essential part of the diligence needed to fulfill the fiduciary duty of care. How else can one make the necessary adjustments to assess a company’s true earnings and return on invested capital (ROIC)? Our innovation is to scale this diligence and make it easily accessible to our subscribers.

What We Accomplished Yesterday

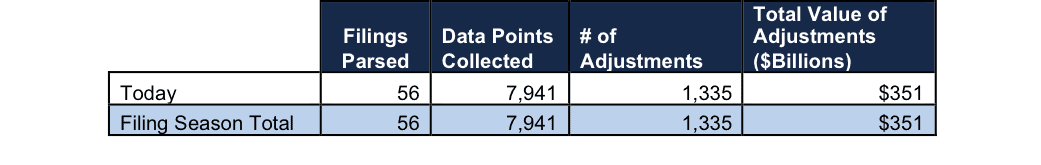

Tuesday was the first day of filing season. Figure 1 shows the work our analysts did yesterday. As filing season goes on, we’ll compile the total amount of work performed by our analysts over the whole period.

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

Yesterday, our analysts parsed 56 filings and collected 7,941 data points. In total, they made 1,335 adjustments with a dollar value of $351 billion. That breaks down into:

- 577 income statement adjustments with a total value of $24 billion

- 535 balance sheet adjustments with a total value of $159 billion

- 223 valuation adjustments with a total value of $168 billion

In particular, Senior Analyst Hunter Gray found an unusual item in Phillips 66’s (PSX) 10-K.

Like many big oil companies, PSX reports its inventories using the LIFO (Last In First Out) method rather than the FIFO (First In First Out) method preferred by most public companies. Utilizing LIFO increases cost of goods sold during times of rising oil prices, allowing PSX to report lower profits to the IRS and pay lower taxes.

Fortunately, GAAP rules require companies using LIFO to disclose what the inventory balance would have been if the company had used FIFO. This value, called the LIFO reserve, makes it possible for us to convert LIFO inventory and cost of goods sold to their FIFO equivalent.

In 2016, rising oil prices caused PSX’s LIFO reserve to increase by $2 billion (129% of reported GAAP net income!). PSX reported an earnings per share decline of over 60% in 2016. Our adjustments revealed that true after-tax profit (NOPAT) actually increased by 50%.

This article originally published here on February 22, 2017.

Disclosure: David Trainer, Hunter Gray, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.