Our latest forensic accounting red flag is from a struggling small-cap stock that only looks more dangerous the deeper you dig.

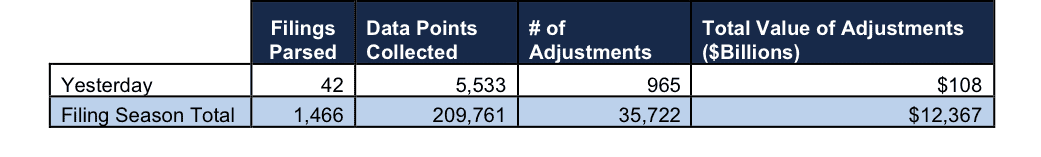

We pulled this highlight from yesterday’s research of 42 10-K filings, from which our robo-analyst technology collected 5,533 data points. Our analyst team used this data to make 965 forensic accounting adjustments with a dollar value of $108 billion. The adjustments were applied as follows:

- 400 income statement adjustments with a total value of $7 billion

- 412 balance sheet adjustments with a total value of $42 billion

- 152 valuation adjustments with a total value of $60 billion

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to close the gap between the suitability and fiduciary standard of investment advice services.

Today’s Forensic Accounting Needle In A Haystack Is For Consumer Discretionary Investors

Analyst Alec Estrada found an unusual item yesterday in Ascent Capital Group’s (ASCMA) 10-K.

On page 32, ASCMA revealed that the revaluation of a dealer liability in 4Q16 earned the company $7.2 million in hidden non-operating income (13% of reported operating income). Sure enough, eliminating this unusual item shows that ASCMA’s 13% increase in reported operating income was entirely artificial. Net operating profit after tax (NOPAT) was essentially flat at ~$55 million in 2016.

With $1.8 billion in total debt, ASCMA needs to grow its cash flows significantly to keep up with interest payments. Our research in the footnotes sheds a light on ASCMA’s stagnant cash flows and suggests that liquidation may be in its future.

This article originally published here on March 10, 2017.

Disclosure: David Trainer, Alec Estrada, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.