For February 28, 2018, our forensic accounting red flag is a marketing and private label credit card company with some unusual acquisition accounting.

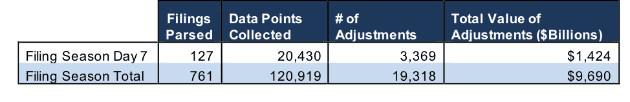

We pulled this highlight from yesterday’s research of 127 10-K filings, from which our Robo-Analyst technology collected 20,430 data points. Our analyst team used this data to make 3,369 forensic accounting adjustments with a dollar value of $1.4 trillion. The adjustments were applied as follows:

- 1,451 income statement adjustments with a total value of $106 billion

- 1,374 balance sheet adjustments with a total value of $582 billion

- 544 valuation adjustments with a total value of $736 billion

Figure 1: Filing Season Diligence for Wednesday, February 28th

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Business Support Services Investors

Analyst Peter Apockotos found an unusual item yesterday in Alliance Data Systems’ (ADS) 10-K.

On page 17 of the footnotes (page 76 overall), ADS disclosed a $7.9 million (1% of GAAP net income) bargain purchase gain on its $945 million acquisition of Signet Jeweler’s (SIG) credit card receivables and associated accounts. ADS believes that the assets it acquired in this deal are worth $7.9 million more than they paid for them.

Since most companies overpay for acquisitions, it seems surprising that ADS would have managed to acquire these receivables at a discount. There’s a chance that ADS is under-reserving for credit losses or overstating the value of the intangible assets (valued at $52 million) in this deal to boost short-term earnings. Investors should exclude that $7.9 million gain and be aware that ADS has a heightened probability of credit losses and write-downs in the future.

This article originally published on March 1, 2018.

Disclosure: David Trainer, Peter Apockotos, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.