For March 5, 2018, our forensic accounting red flag comes from a specialty pharmacy company with rising supplier concentration.

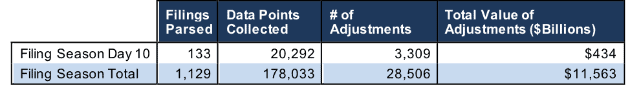

We pulled this highlight from yesterday’s research of 133 10-K filings, from which our Robo-Analyst technology collected 20,292 data points. Our analyst team used this data to make 3,309 forensic accounting adjustments with a dollar value of $434 billion. The adjustments were applied as follows:

- 1,415 income statement adjustments with a total value of $38 billion

- 1,370 balance sheet adjustments with a total value of $167 billion

- 524 valuation adjustments with a total value of $228 billion

Figure 1: Filing Season Diligence for Monday, March 5th

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Healthcare Investors

Analyst Lindsay Bohannon found an unusual item yesterday in Diplomat Pharmacy’s (DPLO) 10-K.

On page 70, DPLO disclosed that the percentage of its cost of goods sold attributable to its second and third largest suppliers, Celgene (CELG) and Pharmacyclics (ABBV) had risen from 21% in 2015 to 31% last year. Crucially, the company states that the drugs it purchases from these two companies “are not available from any other source.”

The increased concentration for CELG and ABBV comes at the expense of DPLO’s top supplier, AmerisourceBergen (ABC), which saw its share of cost of goods sold decline from 50% in 2015 to 41% last year. Unlike the other two suppliers, DPLO does have alternative vendors available for the drugs it purchases from ABC.

DPLO’s increased reliance on CELG and ABBV decreases its negotiating leverage and puts heightened pressure on already narrow margins. Since 2015, DPLO’s after-tax profit (NOPAT) margins have declined by more than half, from 1% to 0.4%. Its return on invested capital (ROIC), has fallen from 6% to 2%. This decline in profitability has multiple causes, but decreased leverage versus suppliers certainly seems to be a contributing factor.

This article originally published on March 6, 2018.

Disclosure: David Trainer, Lindsay Bohannon, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.