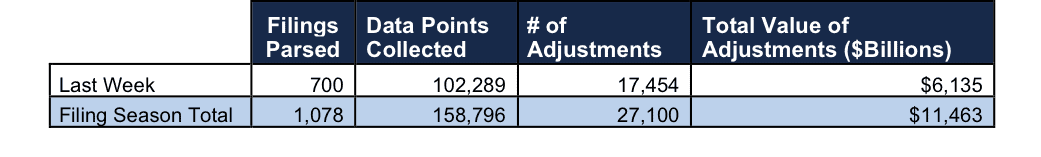

Last week, our analysts parsed 700 filings and collected 102,289 data points. In total, they made 17,454 adjustments with a dollar value of $6.1 trillion. That breaks down into:

- 7,361 income statement adjustments with a total value of $422 billion

- 7,221 balance sheet adjustments with a total value of $2.5 trillion

- 2,872 valuation adjustments with a total value of $3.2 trillion

These adjustments helped to show that a former industrial giant’s problems are even worse than they seem.

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

So far this filing season, we’ve found an unusual contradictory disclosure from Zoe’s Kitchen (ZOES), incredibly cheap stock options granted by VMware (VMW), a 99-year operating lease for Las Vegas Sands (LVS), and a corporate jet that constitutes 45% of homebuilder M/I Homes’ (MHO) PP&E. Follow us on Twitter and check out the hashtag #filingseasonfinds for regular updates on our research.

Every year in this six-week stretch from mid-February through the end of March we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” The Robo-Analyst uses machine learning and natural language processing to automate much of the parsing process.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe that in time investors will come to demand this level of diligence when it comes to their investment advice.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of diligence to their clients.

One Company To Watch In 2017

Based on our analysis of US Steel’s (X: $37/share) 10-K this week, we have downgraded the stock from Dangerous to Very Dangerous.

Analyst Allen L. Jackson found a $411 million decrease in LIFO reserves on page 22 of the financial footnotes, page 112 overall. The decline in reserves helped to significantly decrease US Steel’s reported cost of goods sold.

US Steel also recorded $22 million in non-operating pension income, attributable in part to its decision to raise its pension cost discount rate from 3.75% to 4.25% (found on page 127).

US Steel’s GAAP net loss was 75% smaller in 2016 compared to 2015, but our adjustments showed that its net operating loss after tax (NOPAT) actually increased by 12%. Don’t be fooled by the topline numbers, this former titan is only getting further from profitability.

Without reading the footnotes, investors would miss the large change in reserves in U.S. Steel’s 10-K. Reading the footnotes is an essential part of providing a fiduciary level of diligence, and it has enabled our stock picks to consistently outperform the market.

This article originally published here on March 6, 2017.

Disclosure: David Trainer, Allen L. Jackson, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.