Our latest featured stock is a micro-cap nuclear energy company with misleading pension accounting.

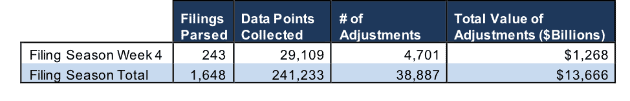

We pulled this highlight from last week’s research of 243 10-K filings, from which our Robo-Analyst technology collected 29,109 data points. Our analyst team used this data to make 4,701 forensic accounting adjustments with a dollar value of $1.3 trillion. The adjustments were applied as follows:

- 800 income statement adjustments with a total value of $630 billion

- 1,932 balance sheet adjustments with a total value of $514 billion

- 1,969 valuation adjustments with a total value of $124 billion

Figure 1: Filing Season Diligence for Week of March 12-17

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of service to their clients.

One Company to Watch in 2018

Analyst Jacob McDonough found a significant red flag in the footnotes of Centrus Energy’s (LEU) 2017 10-K.

Companies with significant pension assets and liabilities usually take steps to ensure that changes in these assets and liabilities don’t have an outsized impact on reported earnings. To achieve this goal, a firm uses long-term average assumptions for things like return on plan assets, changes in healthcare costs, and changes in compensation. The difference between these assumed values and the actual results are amortized over a longer period of time, which has the effect of “smoothing” these changes and minimizing the impact of yearly fluctuations.

However, on page 42, LEU discloses that it doesn’t follow this practice. Instead, it recognizes the actuarial gain or loss from the difference between projected and actual results in the fourth quarter of each year. This practice is allowed under accounting rules, but it has the effect of distorting reported earnings during years when the market significantly under or over performs.

On page 82, we see the impact of LEU’s accounting decision. A strong year for the market led to the company’s pension assets earning a return significantly above average expectations, which resulted in a $36 million (16% of revenue) actuarial gain.

LEU earned $5 million in GAAP net income in 2017 but removing the impact of pension gains and other non-operating items, we show that its after-tax operating loss was $49 million. Don’t be fooled by reported results, this company is still nowhere near profitability, and it earns our Very Unattractive rating.

In total, we made the following adjustments to Centrus Energy’s 2017 10-K:

Income Statement: we made $178 million of adjustments, with a net effect of removing $54 million in non-operating income. We removed $116 million in non-operating income and $62 million in non-operating expense. You can see all the adjustments made to LEU’s income statement here.

Balance Sheet: we made $352 million of adjustments to calculate invested capital with a net increase of $3 million. Our largest adjustment was to add back $140 million in accumulated asset write-downs. You can see all the adjustments made to LEU’s balance sheet here.

Valuation: we made $660 million of adjustments with a net effect of decreasing shareholder value by $351 million. The largest adjustment to shareholder value was $332 million in underfunded pensions. This adjustment represents 86% of LEU’s enterprise value.

This article originally published on March 20, 2018.

Disclosure: David Trainer, Jacob McDonough, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.