“Liberation day” arrived and the announced tariffs were big. Markets reacted negatively, and the major indices recorded their worst single day declines in years.

The impacts of tariffs are yet to be fully seen, even if the immediate reaction of the market was a resounding “No” on tariffs.

The uncertainty of exactly when and how tariffs will be felt creates opportunity. Some of the best investors make hay in uncertainty, and the current market is giving us the best buying opportunities we’ve seen in years.

Don’t get scared off by Wall Street fanning the flames of panic, know that your diligence allows you to outperform.

Diligence never goes out of style. We work hard to make the truth about earnings and valuation available to any kind of investor. Our proven-superior fundamental research gives you an edge that you can trust in this market.

Where else can you get anything like that?

To put our money where our mouth is, we’re going to give you a free stock pick.

We scoured our proprietary database to identify a company that is growing its dividend and generates enough cash flows to cover its dividend payments. Stocks with growing dividends are a great way to protect a portfolio in uncertain times. Finding companies with the ability to grow their dividends can lead to a gold mine. That’s exactly what our Dividend Growth Stocks Model Portfolio finds.

The report below features one stock from this Model Portfolio. It is not an in depth Long Idea report, but it will give you a good understanding of how our research combines fundamental research with expectations investing.

We hope you enjoy this free stock pick. Feel free to share this report with friends and colleagues.

We update this Model Portfolio monthly. March’s Dividend Growth Model Portfolio was updated and published for clients on March 28, 2025.

Free Stock Feature March: Allison Transmission Holdings Inc (ALSN: $99/share)

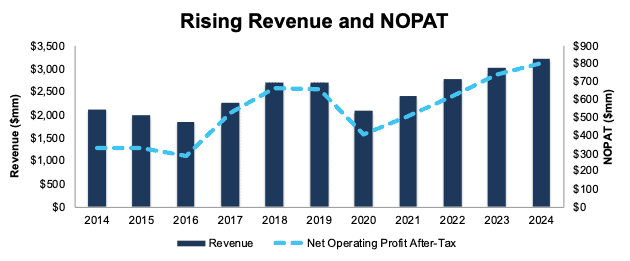

Allison Transmission has grown revenue and net operating profit after-tax (NOPAT) by 4% and 9% compounded annually, respectively, over the last decade. The company’s NOPAT margin increased from 15% in 2014 to 25% in 2024, while invested capital turns rose from 0.5 to 0.8 over the same time. Rising NOPAT margins and invested capital turns drive return on invested capital (ROIC) from 8% in 2014 to 19% in 2024.

Figure 1: Allison Transmission’s Revenue & NOPAT Since 2014

Sources: New Constructs, LLC and company filings

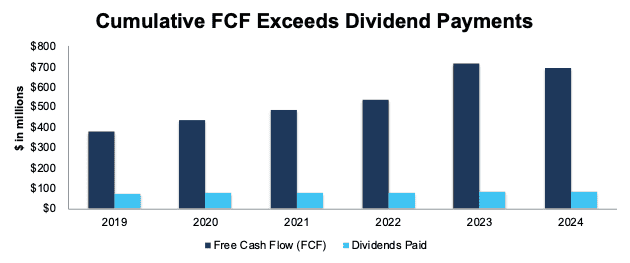

Free Cash Flow Supports Dividend Payments

Allison Transmission has increased its regular, quarterly dividend from $0.15/share in 1Q19 to $0.27/share in 1Q25. The quarterly dividend, when annualized, equals $1.08/share and provides a 1.1% dividend yield.

More importantly, Allison Transmission’s cumulative free cash flow (FCF) easily exceeds its dividend payments. From 2019 through 2024, Allison Transmission generated $3.2 billion (31% of current enterprise value) in FCF while paying $482 million in dividends. See Figure 2.

Figure 2: Allison Transmission’s FCF vs. Dividends Since 2019

Sources: New Constructs, LLC and company filings

Companies with FCF well above dividend payments provide higher-quality dividend growth opportunities. On the other hand, dividends that exceed FCF cannot be trusted to grow or even be maintained.

ALSN Is Undervalued

At its current price of $99/share, Allison Transmission has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects Allison Transmission’s NOPAT to permanently fall 10% from current levels. This expectation seems overly pessimistic given that Allison Transmission has grown NOPAT by 4% and 9% compounded annually over the past five and ten years, respectively.

Even if Allison Transmission’s:

- NOPAT margin falls to 21% (below five-year average of 22% and 2024 margin of 24%) and

- revenue grows 3% compounded annually (compared to 4% compounded annually over the last ten years) for the next decade,

the stock would be worth $118/share today – a 19% upside. In this scenario, Allison Transmission’s NOPAT would grow just 1% compounded annually through 2034. Contact us for the math behind this reverse DCF scenario.

Add in Allison Transmission’s 1.1% dividend yield and a history of dividend growth, and it’s clear why this stock is in March’s Dividend Growth Stocks Model Portfolio.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we make based on Robo-Analyst findings in Allison Transmission’s 10-K:

Income Statement: we made just under $150 million in adjustments with a net effect of removing over $50 million in non-operating expense. Clients can see all adjustments made to Allison Transmission’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made just over $2 billion in adjustments to calculate invested capital with a net decrease of over $600 million. The most notable adjustment was for deferred tax assets. See all adjustments made to Allison Transmission’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made just under $4 billion in adjustments, with a net effect of decreasing shareholder value by over $2 billion. Apart from total debt, the most notable adjustment to shareholder value was for excess cash. See all adjustments to Allison Transmission’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on April 4, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.