Everyone has opinions on most everything. Ask 10 people a question, and you’ll likely get 10 different responses. However, there is one undeniable fact: we’re all getting older with each passing day.

Aging brings on new experiences, added stressors, and, unfortunately, health ailments. The aging process, and everything that comes along with it, creates long-term demand for healthcare services.

In a market filled with overvalued stocks, it may surprise you to hear that we found an industry leader poised to capitalize on this demand trading at a discount to its no-growth value.

We previously made Universal Health Services Inc. (UHS: $204/share) a Long Idea in July 2020 and closed the position in January 2024. At the time we closed the position, the company’s stock valuation looked too expensive.

However, Universal Health Services has significantly improved both its operational efficiency, and when coupled with lasting industry tailwinds, its stock looks cheap again.

UHS offers favorable Risk/Reward based on:

- an aging population driving healthcare services demand,

- worsening mental health driving behavioral services demand,

- rising admissions and revenue per patient,

- a strong track-record of revenue and profit growth, and

- a cheap stock valuation.

U.S. Population is Getting Older by the Day

The United States is getting older. The U.S. population age 65 and older increased 3.1% year-over-year (YoY) in 2024, while the population under the age of 18 decreased by 0.2% YoY. While children still outnumber adults in the U.S., the gap is narrowing. The share of the population age 65 and older has increased from 12% in 2004 to 18% in 2024, while the share of children declined from 25% to 22%.

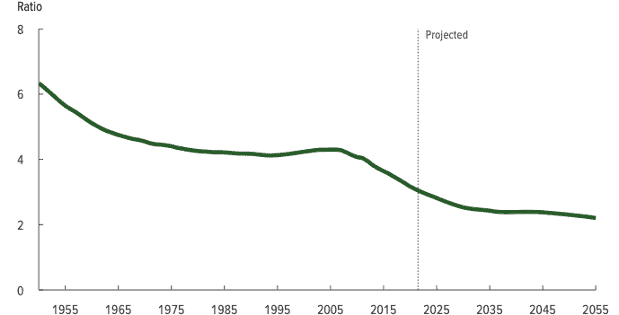

This trend is not going to change anytime soon. The Congressional Budget Office projects the ratio of people ages 25-64 to people ages 65+ to decline from 2.8 to 1 in 2025 to 2.2 to 1 by 2055. Figure 1 illustrates how this ratio has steadily declined since the 1950s.

Additionally, the Census Bureau expects the U.S. centenarian (ages 100 and older) population to quadruple from 2024 to 2054.

Figure 1: The Ratio of 25-64 Year Olds to 65+ Year Olds: 1950 Through 2055

Sources: Congressional Budget Office

Healthcare Spend Rises with Age

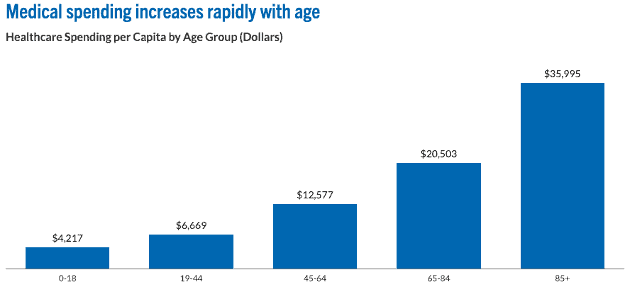

An aging population drives more healthcare spending. This fact makes logical sense given that, empirically, the older a patient, the more they spend on personal healthcare services.

The latest Centers for Medicare & Medicaid services (CMS.gov) data shows that the per capita spending of a person aged 85 or older is 8.5x higher than the spending of a child aged 18 or under. For those aged 65-84, healthcare spending is 4.9x higher than those aged <18. See Figure 2.

Figure 2: Healthcare Spending Per Person by Age Group in the U.S.

Sources: Peter G. Peterson Foundation and CMS.gov

Rising Acute Care Hospital Service Demand

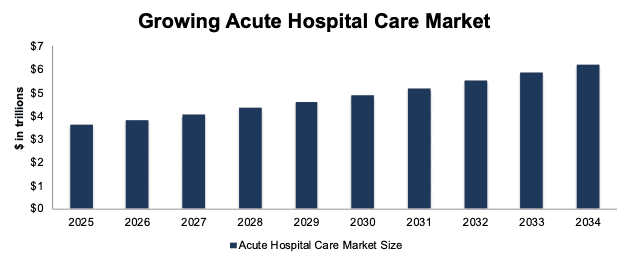

Given that healthcare spending rises with age, it follows that an aging population, combined with recovering demand for elective procedures since COVID-19, drives future acute care hospitals and service demand.

Specifically, Precedence Research forecasts the global acute hospital care market to grow from $3.6 trillion in 2025 to $6.2 trillion in 2034, or 6% compounded annually. See Figure 3.

Figure 3: Acute Hospital Care Market Forecast: 2025 Through 2034

Sources: Precedence Research

Behavioral Health Care Demand Rising, Too

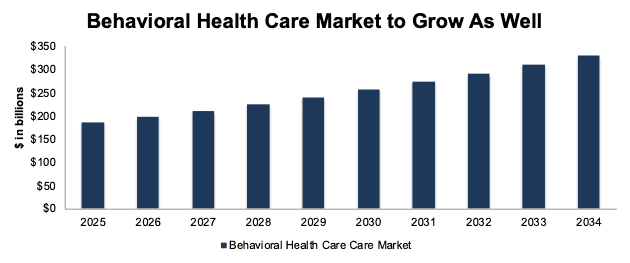

Mental health is an increasingly urgent concern in the U.S. The number of individuals experiencing mental illnesses is on the rise, while the availability of behavioral health treatment has not kept pace. As a result, a significant supply-demand imbalance exists for behavioral health care services.

In 2024, approximately 62 million (23% of total) U.S. adults experienced mental illness but only 52% of them received treatment.

A 2023 study found that the United States has just 28 inpatient psychiatric beds per 100,000 people. The study finds that expert consensus posits the optimal level should be 60 beds per 100,000 people.

The rise in mental illness ultimately drives higher demand for behavioral health services. Precedence Research forecasts the behavioral health market will grow $185 billion in 2025 to $330 billion in 2034, or 7% compounded annually. See Figure 4.

Figure 4: Behavioral Health Market Forecast: 2025 Through 2034

Sources: Precedence Research

Enter the Second-Largest Healthcare System in the U.S.

With more than 400 facilities and hospitals and over 30,000 licensed beds, Universal Health Services is well positioned to capitalize on the rising demand for acute and behavioral health services. The company is the second largest healthcare system in the U.S. by number of hospitals, ranking only behind fellow Long Idea HCA Healthcare (HCA).

The company maintains a balanced and diversified portfolio, with revenue split between acute care hospital services (57% of TTM revenue) and behavioral health care services (43% of TTM revenue).

Capitalizing on Demand – Rising Admissions and Occupancy Rates

Universal Health Services has effectively capitalized on rising demand and grown admissions while improving occupancy rates across its hospitals.

In the acute care hospitals segment, the company grew same facility admissions from over 305,000 in 2021 to nearly 335,000 in the TTM ended 2Q25. The company improved its occupancy rate from 67.2% in 2021 to 68.4% in the first half of 2025.

In the behavioral health care services segment, the company grew same facility admissions from around 450,000 in 2021 to over 472,000 in the TTM ended 2Q25. The company improved its occupancy rate from 70.6% in 2021 to 73.6% in the first half of 2025 as well.

Universal Health Services is not only growing admissions, but it’s also growing its revenue per adjusted admissions. Adjusted admissions include outpatient services, which is important as outpatient activity surges across the U.S.

Specifically, Universal Health Services’ net revenue per adjusted admission increased 3.2% and 7.9% YoY in 1H25 in its acute care services and behavioral health care services segments, respectively.

Adding Beds to Meet the Demand

Universal Health Services is expanding its capacity through the construction of new hospitals and adding more beds to existing locations. The company is currently expanding or recently expanded the following locations:

- Three Trails Behavioral Hospital in Montana, which will accommodate up to 120 beds. It is on track to open in late 2026.

- Construction of Hanover Hill Behavioral Health, a joint venture facility between Universal Health Services and Lehigh Valley Health Network in Pennsylvania, which will accommodate 144 beds. It is expected to complete by the end of the year.

- Southridge Behavioral Hospital, a joint venture between Universal Health Services and Trinity Health Michigan, opened recently in May 2025 and added a total of 96 beds to the company’s system.

- A new hospital in D.C. called Cedar Hill Regional Medical Center GW Health opened in April 2025, and it currently accommodates 136 beds, with the capacity to expand further to 184 beds, and a 54-bay emergency department.

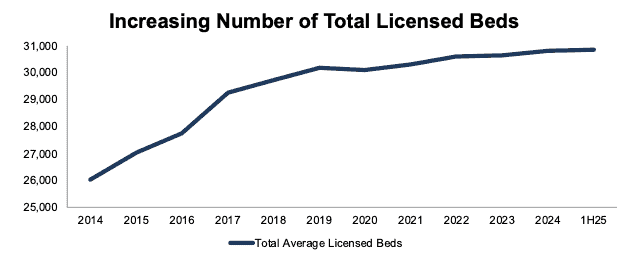

The company’s total average licensed bed count (acute care hospitals beds + behavioral health centers beds) increased from 26,000 in 2014 to nearly 31,000 in the first half of 2025. See Figure 5.

Figure 5: Universal Health Services’ Total Average Licensed Beds: 2014 – 1H25

Sources: New Constructs, LLC and company filings

Mental Health Patient Satisfaction Rates Bode Well for Growth

Compared to traditional medicine, mental health patients have much more choice as to whether they get treatment and where they get it. As a result, satisfaction of these patients is critical to getting them to return to or seek a provider’s services.

In its 2024 Impact by the Numbers report, Universal Health Services reported:

- 91% of patients feel better than when they were admitted,

- 89% said they were overall satisfied with their treatment,

- 89% said they were treated with dignity and respect, and

- 89% said their treatment goals and needs were met.

These great satisfaction scores bode well for growth in the company’s behavioral health segment, as they help drive referrals and repeat patients.

Operating Expenses Under Control

Over the last few years, high labor costs are one of the largest concerns in the healthcare industry. In fact, rising labor costs were one of the key reasons we closed UHS as a Long Idea in January 2024. After COVID-19, demand for services increased alongside a shortage in healthcare professionals, which caused the cost of employing healthcare workers to rise. As a result, Universal Health Services, and other hospital and healthcare facility operators, had their least profitable year in 2022.

Since then, Universal Health Services has effectively managed its costs, with particular attention to its salaries, wages, and benefits expense. From 2022 to the TTM, Universal Health Services’ salaries, wages and benefits expense fell from 50% to 47% of revenue. Across the board, the company’s total operating expenses fell from 93% to 89% of revenue over the same time. See Figure 6.

With a handle on labor costs, Universal Health Services is operating at its most profitable level, as measured by return on invested capital (ROIC), relative to all other fiscal years in our model (dates back to 1998).

Figure 6: Universal Health Services’ Expenses as a Percent of Revenue: 2022 – TTM

Sources: New Constructs, LLC and company filings

Labor Costs Will Remain a Challenge Across the Industry

The shortage of healthcare workers, while manageable, hasn’t disappeared and isn’t going to. McKinsey projects the global healthcare worker shortage to reach 10 million by 2030.

In the U.S., the American Hospital Association (AHA) projects a nurse assistant shortage of 73,000 and a critical health care worker shortage of 100,000 by 2028, despite projections for a slight registered nurse surplus over the same time.

With ongoing shortages, the labor costs remain a challenge for the broad healthcare industry.

However, with its large scale and market leadership position, Universal Health Services effectively managed its labor costs over the last year and a half, all while growing its business.

Even if the labor costs were to rise again and pressure margins like it did during the heat of the crisis in 2022 and 2023, any deterioration in the company’s margin is already more than priced into its current stock price.

Consistent Revenue and Profit Growth

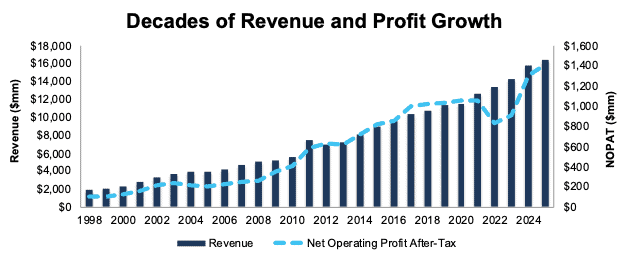

Universal Health Services has a proven track record of growing revenue and profits across decades. The company has grown revenue 9% and net operating profit after-tax (NOPAT) 10% compounded annually since 1998. See Figure 7.

Additionally, the company’s Core Earnings grew 11% compounded annually from $77 million in 1998 to $1.2 billion in the TTM ended 2Q25.

The company improved its NOPAT margin from 6% in 1998 to 9% in the TTM while invested capital turns fell from 1.5 to 1.3 over the same time. Rising NOPAT margins are enough to offset invested capital turns and drive the company’s ROIC from 8% in 1998 to 11% in the TTM.

More recently, the company has grown revenue and NOPAT 7% and 6% compounded annually since 2019, respectively. Rising admissions and revenue per admission, high occupancy rates, and decreasing costs relative to revenue drive a complete recovery in profits since the post-COVID dip.

Figure 7: Universal Health Services’ Revenue and NOPAT Since 1998

Sources: New Constructs, LLC and company filings

Industry Leading Profitability as Well

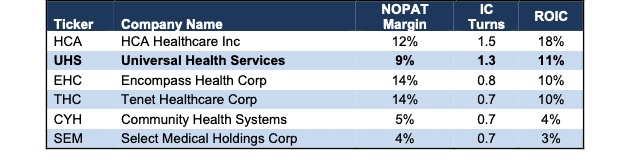

Universal Health Services is not only the second largest healthcare system in the U.S., but it is also the second most profitable amongst its peers. The company leverages its large scale, high customer satisfaction, and efficient operations to drive higher profitability.

Universal Health Services’ invested capital turns and ROIC rank second highest among publicly traded healthcare system operators. The only company more profitable than Universal Health Services is fellow Long Idea HCA Healthcare (HCA). Other competitors in the comparison include Encompass Health Corp (EHC), Tenet Healthcare (TNT), Community Health Systems (CYH), and Select Medical Holdings (SEM), per Figure 8.

Figure 8: Universal Health Services’ Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

Consistent Cash Flow Generation

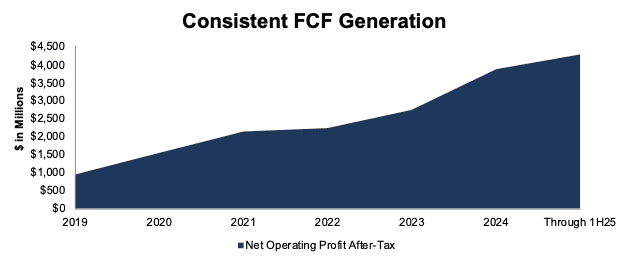

Universal Health Services steadily generates high free cash flows (FCF). Since 2019, the company generated $4.3 billion in FCF, which equals 24% of its enterprise value. See Figure 9.

In the first half of 2025, Universal Health Services generated $421 million in FCF, which is more than the $405 million returned to shareholders through dividends and repayments.

However, it’s worth noting that since 2021, Universal Health Services hasn’t generated enough cumulative free cash flow ($2.7 billion) to cover both dividends and repurchases ($3.7 billion). Should FCF fall below the level of dividend and purchases, management could choose to slow repurchases while maintaining its consistent dividend growth to prudently allocate capital.

The company generated $1.5 billion of that in the last year and a half alone.

Figure 9: Universal Health Services’ Cumulative Free Cash Flow Since 2019

Sources: New Constructs, LLC and company filings

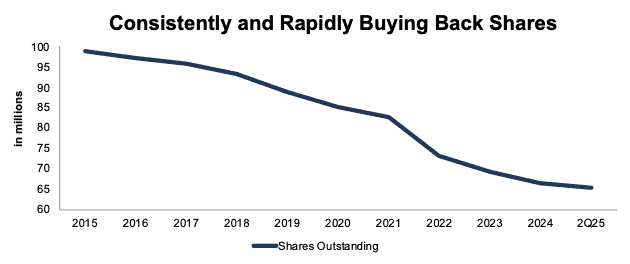

Shares Outstanding Falling Rapidly

Universal Health Services’ aggressive share buyback activity has meaningfully reduced its shares outstanding from 99 million in 2015 to 65 million in 2Q25. See Figure 10.

We like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation.

Figure 10: Universal Health Services’ Shares Outstanding: 2015 – 2Q25

Sources: New Constructs, LLC and company filings

Exec Comp Is Aligned with Shareholders’ Interests

We also like companies that pay their executives for performance that benefits shareholders. Universal Health Services’ executives receive annual incentives, which are tied to certain target levels for adjusted net income per share, and return on capital.

Including return on capital, a variation of ROIC, as a performance incentive ensures that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value.

With the incentive to focus on return on capital, Universal Health Services has earned an ROIC greater than its weighted-average cost of capital (WACC) in each of the last 24 years, as well as the TTM period. Universal Health Services’ management has grown economic earnings, the true cash flows of the business, 5% compounded annually over the last decade, from $353 million in 2014 to $561 Million in the TTM.

Potential for 4.3%+ Yield

Since the company restarted dividend payments in 2021 (stopped paying between 2Q20 and 1Q21), Universal Health Services has paid $260 million (2% of market cap) in cumulative dividends and has maintained a quarterly dividend $0.20/share over the same time. The company’s current dividend, when annualized, provides a 0.4% yield.

Although the company’s dividend yield is relatively low, it more than makes up for it with its heavy share repurchases. From 2021 through the first half of 2025, the company repurchased $3.7 billion (29% of market cap) of shares.

As of June 2025, the company is authorized to repurchase up to an additional ~$493 million of shares. Should the company repurchase shares at its TTM rate, it would use up the entirety of its remaining authorization and repurchase $493 million of shares over the next year, which equals 3.9% of the current market cap. When combined, the dividend and share repurchase yield could reach 4.3%.

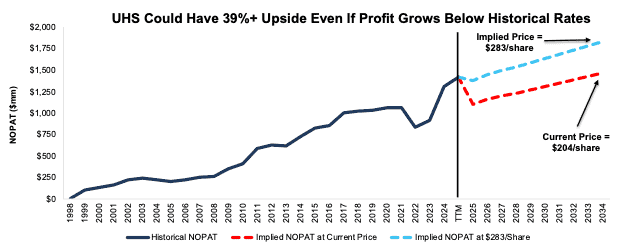

Current Price Implies Profits Will Fall

At its current price of $204/share, UHS’s price-to-economic book value (PEBV) ratio is 0.8. This ratio means the market expects the company’s NOPAT to permanently decline 20% from TTM levels. This expectation seems overly pessimistic considering Universal Health Services has grown NOPAT by 7% compounded annually over the last decade and 10% compounded annually since 1998. Furthermore, consensus estimates imply EPS will grow YoY in each of the next three years.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for UHS.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin falls to 6.4% (equal to the second lowest margin over the last decade compared to 8.6% in the TTM) from 2025 through 2034,

- revenue grows at consensus rates in 2025 (9%) and 2026 (5%), and

- revenue grows 3% (compared to 7% compounded annually over the last 5 and 10 years) each year thereafter through 2034, then

UHS would be worth $204/share today – equal to the current price. In this scenario, Universal Health Services’ NOPAT would grow just 1% compounded annually from 2025 through 2034. For reference, Universal Health Services has grown NOPAT by 6% and 7% compounded annually over the past 5 and 10 years, respectively. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 39%+ Higher Even If Profits Grow Less Than Historical Rates

If we instead assume:

- NOPAT margin immediately falls to 8% (below ten-year average of 8.5%) through 2034,

- revenue grows at consensus rates in 2025 (9%) and 2026 (5%), and

- revenue grows 3% each year thereafter through 2034, then

the stock is worth $283/share today – a 39% upside to the current price. In this scenario, Universal Health Services’ NOPAT would grow just 3% compounded annually from 2025 to 2034. Contact us for the math behind this reverse DCF scenario.

Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside. Furthermore, we think companies with long track records of strong profit growth deserve premium stock valuations, especially in a market filled with so many underperforming companies.

Figure 11: Universal Health Services’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Universal Health Services’ business will enable it to continue to generate higher NOPAT than the current market valuation implies:

- second-largest healthcare system in the growing healthcare industry,

- superior scale and profitability compared to peers, and

- strong long-term demand for healthcare services.

What Noise Traders Miss with Universal Health Services

These days, fewer investors focus on finding quality capital allocators with shareholder-aligned corporate governance. Due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- growing demand for both acute and behavioral health services,

- consistent revenue and Core Earnings growth across more than two decades,

- valuation implies profits will permanently decline by 20%.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have purchased 729,892 shares and have sold 1,343,716 shares for a net effect of 613,824 shares sold. These sales represent 1% of shares outstanding.

There are currently 2.5 million shares sold short, which equates to 4% of shares outstanding and just over four days to cover.

Attractive Funds That Hold UHS

The following funds receive an Attractive-or-better rating and allocate significantly to UHS:

- Leatherback Long/Short Alternative Yield ETF (LBAY) – 3.5% allocation and Very Attractive rating.

- First Trust Health Care AlphaDEX Fund (FXH) – 2.2% allocation and Very Attractive rating.

This article was originally published on October 15, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.