What do toy company Hasbro (HAS), retail giant Wal-Mart (WMT), tax preparer H&R Block (HRB), auto parts store AutoZone (AZO), and biotech companies Gilead (GILD), Amgen (AMGN), and Celgene (CELG) all have in common?

They are the only surviving S&P 500 stocks to rise 10% or more in 2008. In the midst of a collapsing market and the subsequent damage, these seven stocks made good money for investors.

What other trait do they share? They all earn a consistently high return on invested capital (ROIC). Six out of these seven companies have earned a double digit ROIC in every year for the past decade, and the one exception, CELG, has managed it in nine out of ten.

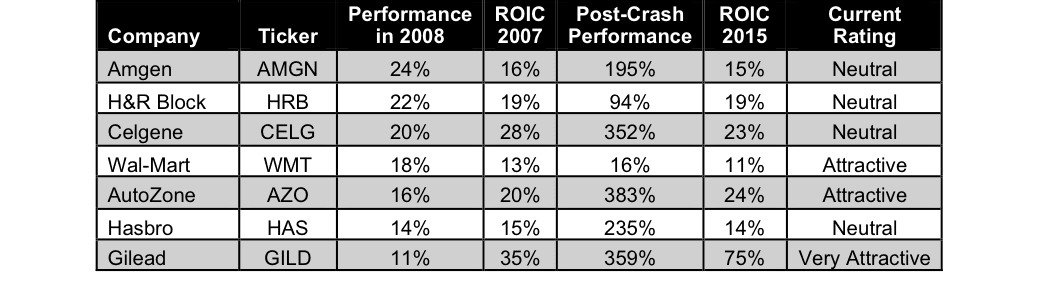

Figure 1: S&P 500 Stocks That Made Big Money In 2008

Sources: New Constructs, LLC and company filings.

Figure 1 shows that all seven companies earned a high ROIC going into the disastrous year of 2008. CELG struggled to a 5% ROIC in 2008 before quickly rebounding, while all of the other companies continued their strong profitability even in a poor economy.

The success of these stocks can’t be credited solely to their industries either. HAS competitor Mattel (MAT) dropped 16% on the year. AZO competitor Pep Boys (PBY) actually did worse than the broader market and fell over 60% in 2008.

Strong In A Bull Market Too

Not only did these stocks thrive during the market crash, they’ve done incredibly well in the recovery too. All except HRB and WMT have outperformed the S&P 500, and an equal weight bundle of these seven stocks would have returned 233% since the recovery began, 35% better than the S&P 500.

For those who wonder why we put so much work into adjusting the income statement and balance sheet to get ROIC, here is your answer. Empirical research shows that ROIC, not P/E is the most important driver of valuation. Long-term, companies that can earn superior returns on capital are the ones that outperform, regardless of the market climate.

The Common Thread Among the Best Businesses

The common thread connecting Fortune’s top 50 businesspeople of the year is businesses with high returns on invested capital (ROIC). Full article here. Below is a summary.

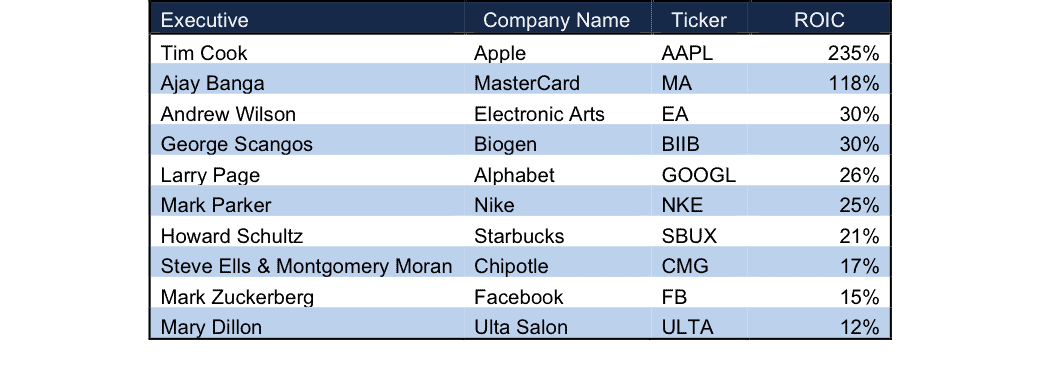

The top 10 CEOs from companies in our database all earn double-digit ROICs. Whether it’s apparel, biotech, restaurants, or online services, these companies aren’t just growing, they’re also creating real value for investors.

Figure 2: Only High ROIC Companies Make The List

Sources: New Constructs, LLC and company filings.

In fact, you have to go all the way down to Matthew Missad at #45 to find a CEO of an American company with an ROIC below 10%. And even then, Missad’s Universal Forest Products (UFPI) has a 9% ROIC that has been steadily increasing for several years in an industry with significant headwinds.

The recognition these CEO’s are receiving shows that the market cares about ROIC, even if many investors aren’t explicitly talking about it. We’ve shown that ROIC is the primary driver of valuation. This idea is hardly new.

What’s changed today is that we now have the tools and technology to create accurate models of ROIC for thousands of companies. Calculating ROIC is difficult and requires numerous adjustmentsto reverse accounting loopholes.

In the past, individuals had no way to create good ROIC-based models for a large number of companies. Today, with the technology to help our analysts quickly parse filings, we can reverse accounting distortions and don’t have to rely on less reliable metrics or models.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: captiveinternational.com