CEO David Trainer recently joined Jeremy Schwartz, EVP and Global Head of Research at WisdomTree, on the Behind the Markets podcast on July 10, 2020.

Topics covered included:

- Why the expected fall in 2Q20 earnings understates the true, core earnings of U.S. companies

- The market is cheaper than Wall Street would have you believe

- The level of earnings distortion in earnings reports

A New View on Earnings…and Valuation

The precipitous fall expected in 2Q20 earnings significantly understates the true, Core Earnings of U.S. companies because these earnings metrics are not adjusted for unusual gains/losses.

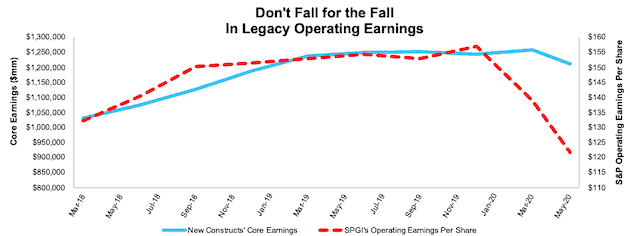

Figure 1 compares the steep fall expected in consensus estimates for S&P Global’s Operating Earnings[1] to Core Earnings[2]. Specifically, the trailing-twelve-month (TTM) Core Earnings[3] for the S&P 500 show a 2% fall since 2019 while consensus predicts a 22% fall. Investors would be well-served to see through the dip in SPGI’s operating earnings metrics, especially when it comes to valuation.

Figure 1: Core Earnings vs. SPGI’s Operating Earnings for the S&P 500: 2018-Present

Sources: New Constructs, LLC, company filings, and S&P Global (SPGI). Note: the most recent periods’ data for SPGI’s Operating Earnings is based on consensus.

The Core Earnings analysis is based on aggregated quarterly data for the S&P 500 constituents in each measurement period.

Better Earnings for Valuing the S&P 500

Not only is the market more profitable than Wall Street would have you believe, but it is also cheaper.

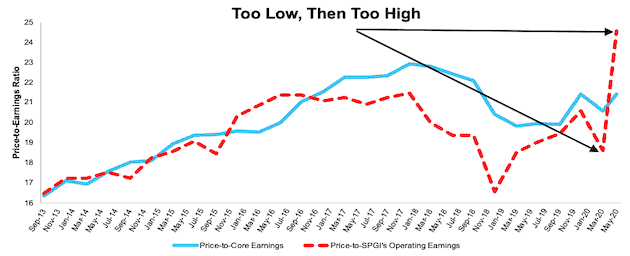

Per Figure 2, analyzing the price-to-earnings (P/E)[4] of the S&P 500 based on our Core Earnings shows how much investors oversold in March and that, despite the recent rebound, the S&P 500 remains very reasonably valued compared to the past few years.

Figure 2: Price-to-Core vs. Price-to-SPGI’s Operating Earnings for the S&P 500: 2013 – present

Sources: New Constructs, LLC, company filings, and S&P Global.

P/E ratios are based on four quarters of aggregated S&P 500 constituent results in each period. More details in Appendix.

In contrast, valuing the S&P based on SPGI’s Operating Earnings suggests the market is more highly valued than any time since the Financial Crisis (see Figure III in the Appendix).

We believe there’s upside left in this market.

Most investors know that GAAP earnings are prone to distortion because they include unknown amounts of unusual gains/losses. However, most investors are not aware that legacy metrics like Street Earnings (from Refinitiv) and Operating Earnings (from S&P Global (SPGI)) still miss about $0.45 out of every $1.00 of unusual gains/losses (hidden and reported) – as detailed in section 5.1 of the new paper from HBS & MIT Sloan: Core Earnings: New Data & Evidence. This paper also uses our new, advanced measure of Core Earnings to prove the market is inefficient at reflecting unusual gains/losses buried in footnotes.

Our recent report shows how investors armed with a cleaner measure of Core Earnings have a differentiated and more informed view of fundamentals and, therefore, the valuation of markets and stocks.

This article originally published on July 14, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] We think SPGI’s Operating Earnings provide the best available comparison to our calculation of Core Earnings. We can compare with any other metrics.

[2] For 3rd-party reviews on the benefits of adjusted Core Earnings, historically and prospectively, across all stocks, click here and here.

[3] The Core Earnings data in this analysis is based on all 10-Q and 10-K filings for S&P 500 constituents as of 5/26/2020. Since then, an immaterial number of companies (~18) companies have filed a new 10-K or 10-Q with the SEC.

[4] The methodology for calculating an apples-to-apples price-to-Core Earnings and price-to-SPGI’s Operating Earnings is in Appendix I.