Finding the best mutual funds is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Don’t Trust Mutual Fund Labels

There are at least 189 different Real Estate mutual funds and at least 666 mutual funds across eleven sectors. Do investors need 61+ choices on average per sector? How different can the mutual funds be?

Those 189 Real Estate mutual funds are very different. With anywhere from 22 to 189 holdings, many of these Real Estate mutual funds have drastically different portfolios, creating drastically different investment implications.

The same is true for the mutual funds in any other sector, as each offers a very different mix of good and bad stocks. Consumer Non-cyclicals rank first for stock selection. Real Estate ranks last. Details on the Best & Worst ETFs in each sector are here.

How to Avoid Paralysis by Analysis

We think the large number of Real Estate (or any other) sector mutual funds hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many mutual funds. Analyzing mutual funds, done with the proper diligence[1], is far more difficult than analyzing stocks because it means analyzing all the stocks within each mutual fund. As stated above, that can be as many as 189 stocks, and sometimes even more, for one mutual fund.

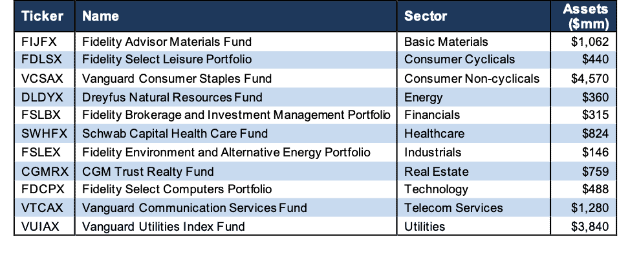

Anyone focused on fulfilling the fiduciary duty of care recognizes that analyzing the holdings[2] of a mutual fund is critical to finding the best mutual fund. Figure 1 shows our top rated mutual fund for each sector.

Figure 1: The Best Mutual Fund in Each Sector

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity

Sources: New Constructs, LLC and company filings

Amongst the mutual funds in Figure 1, Vanguard Consumer Staples Fund (VCSAX) ranks first overall, Fidelity Select Computers Portfolio (FDCPX) ranks second, and Fidelity Brokerage and Investment Management Portfolio (FSLBX) ranks third. Vanguard Communication Services Index Fund (VTCAX) ranks last.

How to Avoid “The Danger Within”

Why do you need to know the holdings of mutual funds before you buy?

You need to be sure you do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad. Don’t just take my word for it, see what Barron’s says on this matter.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

If Only Investors Could Find Funds Rated by Their Holdings

Our mutual fund ratings leverage our stock coverage. We rate mutual funds based on the aggregated ratings of the stocks each mutual fund holds.

Vanguard Consumer Staples Fund (VCSAX) is not only the top-rated Consumer Non-cyclicals mutual fund, but is also the overall top-ranked sector mutual fund out of the 666 sector mutual funds that we cover.

The worst mutual fund in Figure 1 is Vanguard Communication Services Index Fund (VTCAX), which gets a Neutral rating. One would think mutual fund providers could do better for this sector.

This article originally published on February 7, 2019.

Disclosure: David Trainer, Kyle Guske II and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.