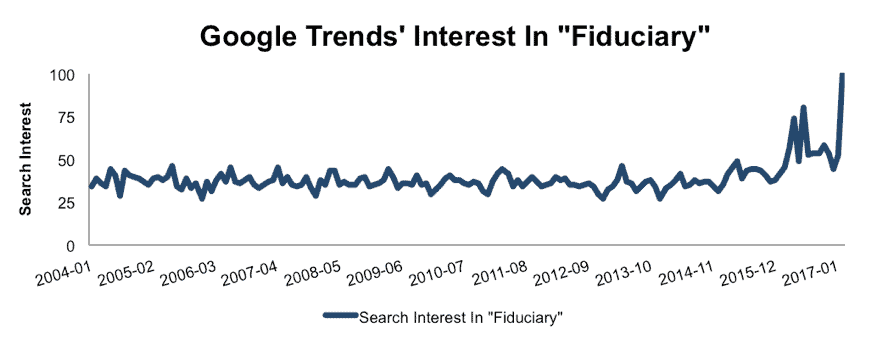

The Fiduciary Movement cannot be erased from the history books. Given heightened investor awareness (per Figure 1) of the fiduciary rule and its meaning, we think few advisors will fund much success if they do not embrace fiduciary levels of service. However, we think few in the business are prepared to fulfill the Duty of Care.

Figure 1: Interest In “Fiduciary” Reaches All Time High

Sources: New Constructs, LLC and company filings.

Fiduciary duty can be broken down into two pieces: duty of loyalty & duty of care. Duty of loyalty means that the fiduciary must put their clients’ interests first and avoid conflicts. We’ve already seen lots of wealth management firms work to comply with this duty, such as Bank of America Merrill Lynch (BAC) ending commission-based accounts for retirement savers.

Duty of care, by law, means that a fiduciary must act with “care, skill, prudence, and diligence.” In contrast to the constant discussion of the duty of loyalty, we’ve seen much less attention paid to the duty of care.

As Michael Kitces writes, failure to live up to the duty of care could leave wealth managers open to painful class action lawsuits. Even if they don’t run into legal trouble, it’s hard to imagine human advisors holding on to assets against robos without a clearly articulated message for how they provide a higher level of care.

So, how does one define “care, skill, prudence, and diligence?” For starters, any investment recommendations should be based on research that is:

- Comprehensive. Analyze all relevant publicly available data (e.g. 10-Ks and 10-Qs), including the footnotes.

- Objective. Clients deserve unbiased research.

- Transparent. Client should be able to see how the analysis was performed and the data behind it.

- Relevant. There must be a tangible, quantifiable connection to stock, ETF or mutual-fund performance.

The importance of meeting these criteria is self-evident. In reality, however, very little research meets any of these criteria, which is a big surprise to most average investors.

How To Get Research That Is Diligent?

10-K and 10-Q reports can be hundreds of pages long, with important information often buried deep in the footnotes. Emerging Robo-Analyst technology allows for fundamental diligence at a previously impossible scale.

This article originally published on June 1, 2016.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Jake Bouma (Flickr)