This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

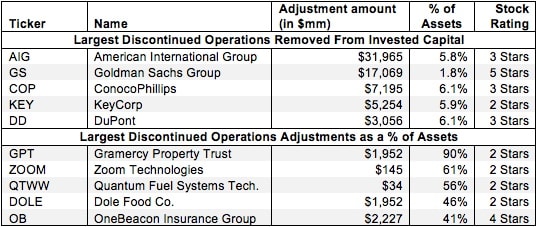

Assets from discontinued operations are assets that are held for sale by a company. These discontinued operations assets are disclosed as a separate line item on the balance sheet. While invested capital usually includes all capital invested in a business over its lifetime, we remove these discontinued operations assets from invested capital for a more accurate picture of how much operating capital a business has on hand to generate NOPAT. We also remove the income or loss from discontinued operations, which we detail in a separate report.

Most investors would never know that these discontinued operations distort GAAP numbers by over-stating assets on balance sheets and distorting the picture of a company’s ability to generate a return on that capital.

2 replies to "Discontinued Operations Removed from Invested Capital – Invested Capital Adjustment"

Hi Sam,

I’m a new subscriber.

I only know this in theory, but are you able to expand on this article by talking about how companies could possibly shift losses to discontinued operations i.e., management may increase its allocation of costs to the discontinued business. The potential impact is continuing operations would appear more profitable for the reporting period. Subsequently, operating expenses would revert to normal levels.

Thank you.

Jonathan

Hi Jonathan,

Thanks for reading and subscribing. This is a great question, and it’s absolutely true that companies sometimes engage in “earnings management” by classifying recurring expenses in discontinued operations. Researchers from Florida International University examined this hypothesis several years ago and found significant correlation between companies reporting large losses from discontinued operations and beating analyst expectations for recurring earnings:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1245863

Unfortunately, there’s no real way to examine or correct for this behavior on an individual basis. There’s typically not enough disclosure to determine whether or not expenses have been correctly classified as part of discontinued operations for any particular company. The best way to avoid being burned by this sort of earnings management is to look at the longer-term trend in profitability and be suspicious of any company that routinely beats earnings expectations by 1 or 2 cents a share.

-Sam