When markets get expensive, investors should focus at least a portion of their portfolios on companies with stable business operations and a history of creating shareholder value. The insurance business fits this description and provides many good places for investors to put their money. This week’s stock pick of the week is Allstate Corporation (ALL).

Stock Action Doesn’t Always Reflect the Business’ Performance

We’ve previously highlighted how consistent Allstate is at “beating expectations” and despite the downward stock movement; this past quarter was another great sign for Allstate’s business. In its 1Q15 earnings, Allstate reported that property-liability premiums grew 5% over 1Q14. If not for stricter underwriting thresholds, Allstate management noted that its Esurance business, which grew revenues by 9%, could have grown even faster. In good times, stricter underwriting standards slow short-term growth, but in bad times, they protect firms from large losses. That decision means management is focused more on long-term profit growth, which is good for shareholders. We wish more companies shared this approach.

A Well Managed Company Creates Profits

Allstate is off the radar screen for many investors because its revenue growth is not very high at 3% compounded annually over the past six years. We don’t care because this business model is built for profit growth.

Over the past six years, Allstate has grown after-tax profit (NOPAT) by 25% compounded annually. On a trailing twelve-month basis, Allstate has grown NOPAT by another 7%. Consistent profit growth is in large part due to its ability to intelligently assess risk and underwrite quality policies. In 1Q15, Allstate’s property-liability combined ratio, which represents how well the company performs excluding investments, was 93.7. A ratio below 100 means that Allstate receives more in premiums than it pays out in losses, the goal of any insurance company. Best yet, in 2011, Allstate’s combined ratio was 103.4, much higher than this past quarter. This improvement showcases management’s ability to improve the company in a short amount of time. The trend also suggests that profits are more likely to grow than decline in the future.

Allstate currently earns a return on invested capital (ROIC) of 14%, up from only 5% in 2011. Allstate also generated $1.2 billion in free cash flow on a TTM basis. With a large amount of free cash flow, we see no reason why Allstate could not continue its dividend and buyback program while shares are undervalued.

Consistent Demand In All Business Climates

Investors might fear that insurance companies are always at risk due to unexpected natural disasters and the inherent danger in automobiles. However, this fear ignores the constant demand for Allstate’s products, regardless of disasters or accidents. Obtaining insurance is necessary when purchasing a home or car. This necessity creates a lasting demand that Allstate can capitalize upon.

Allstate’s business, with around 20% of revenue from home insurance, 70% from auto insurance, and the remainder from commercial and other business lines, has a hand in all aspects of purchases that require insurance. Allstate, with its strong brand presence has positioned itself to meet all types of customer needs through its local agent’s, online only Esurance, and Encompass packaged policies.

Overlooked Avenue of Growth

Allstate has large amounts of data on driving habits that is used to analyze risk and set prices, and it could also be useful to advertisers who want to know where and when large amounts of people are driving. In late May, Allstate CEO Tom Wilson noted that the company is exploring possibilities of monetizing customer data, much like Google, who has built their entire business model around this idea. This data could provide new growth avenues for Allstate and present an evolution of the traditional insurance business. It’s clear that Allstate is thinking outside the box for new ways to expand profits and create shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

We make several key adjustments to the earnings and balance sheets of companies to uncover the recurring cash flows of each company’s core business. In 2014, we removed $92 million in non-operating expenses, revealing that NOPAT was even higher than Allstate’s reported net income.

The Buying Opportunity Has Arrived

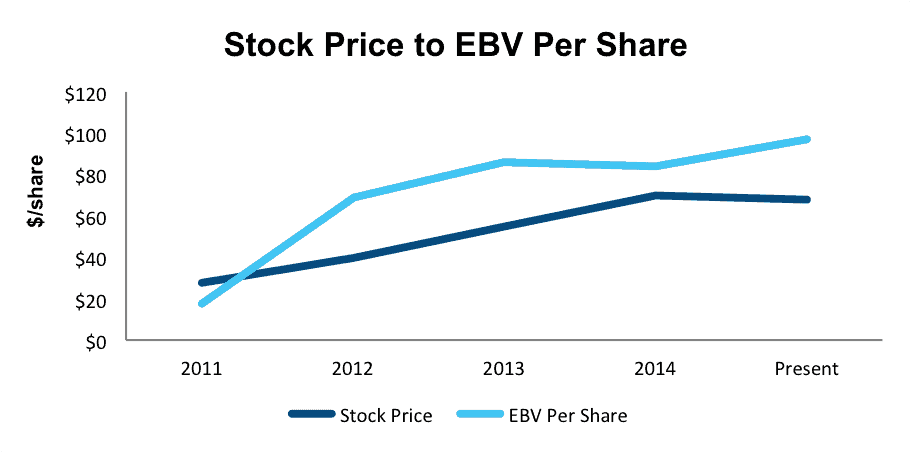

Despite all the positives noted above, ALL is down nearly 5% on the year, with the large drop due to the earnings release mentioned earlier. This price decline means that the market is greatly undervaluing Allstate and giving savvy investors an excellent entry point. As can be seen in Figure 1, Allstate’s share price has begun to disconnect from its economic book value per share.

Figure 1: Stock Price Is Below Economic Book Value

Sources: New Constructs, LLC and company filings

At its current price of ~$67/share, Allstate has a price to economic book value (PEBV) ratio of 0.7. This ratio implies the market expects Allstate’s NOPAT to permanently decline by 30%. Expecting Allstate’s NOPAT to never grow, let alone permanently decline by 30%, ignores the history of Allstate as well as its excellent turnaround since 2009.

Even if Allstate failed to grow NOPAT, its current economic book value, or no growth value sits at $96/share. This represents a 43% upside from the current stock price. However, if Allstate can continue growing profits, much like it has over the past five years, the stock is worth even more.

Disclosure: David Trainer owns ALL. David Trainer, Kyle Guske II, and Max Lee receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo credit: David Hilowitz (Flickr)

2 replies to "An Insurance Company Built for Profit Growth"

Ok….I am trying the “free” approach in order to determine whether to go GOLD. After signing up, how do I access things to see if I like it?

Guy

Guy,

Great question. Take a look at some of our recent Danger Zone reports to get an idea of how our reports are structured and the diligence that goes into our reports. In addition, if you’re interested in ETFs and Mutual Funds, take a look at our Sector Ratings section and Style Ratings section. These sections include many reports that are free of charge. Also, a great way to see our systems and tools in action is to watch some of our Webinars. CEO David Trainer goes over a wide variety of topics and highlights the abilities of our screeners, models, stock reports, and ETF and mutual fund reports as well.

Lastly, if you have any questions, don’t hesitate to contact us at support@newconstructs.com

-Kyle Guske II