Maplebear Inc., which operates as the better-known Instacart (CART: $28-$30/share), is expected to start trading September 19, 2023 at a ~$8.1 billion valuation. At $29/share, the midpoint of its IPO price range, Instacart earns an Unattractive Stock Rating and is this week’s Danger Zone pick.

While the latest valuation is certainly lower than the COVID-19 mania-induced ~$39 billion valuation it garnered in 2021, the expectations baked into the midpoint IPO price range remain overly optimistic.

It’s true, Instacart has built a profitable business. However, growth is slowing, competition is rising, and future profits look less likely. However, the stock’s valuation implies the company will 9x profits and achieve revenue growth well above industry expectations. CART looks more than fully valued, and we think investors should pass on this IPO. Below, we’ll use our reverse discounted cash flow (DCF) model to show how expensive the IPO is.

Our IPO research aims to provide more investors with more reliable fundamental research.

Looking to Kickstart “Down-Round” IPO Appetite

Instacart soared in popularity during the COVID-19 pandemic as consumers increasingly turned to pickup and delivery of goods. During this time, Instacart was able to raise capital at a $39 billion valuation – a far cry from the expected midpoint IPO valuation of $7.5 billion.

The success (or lack thereof) of Instacart’s IPO could be a telling sign for other venture capital-backed companies that are considering an IPO. If demand for Instacart stock is high, we could see a flood of VC-backed IPOs, albeit at considerably lower valuations than prior funding rounds. However, if Instacart flops, it could freeze an already slow IPO market. While Instacart is profitable, the expectations for future profit growth baked into its midpoint IPO valuation could scare off prudent investors.

Turning Profitable Just Before IPO

Instacart’s topline benefited greatly from the COVID-19 pandemic, with year-over-year (YoY) growth rates reaching 935% in 2Q20. While such stratospheric growth rates have subsided, the company successfully leveraged the leading market share it obtained to achieve profitability in 2022.

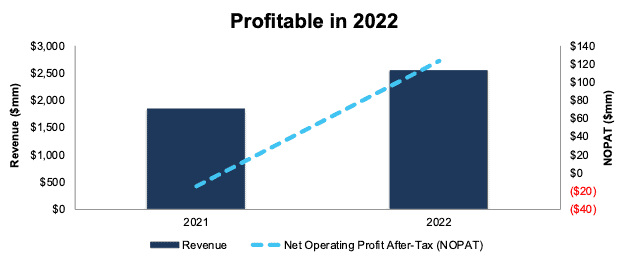

Instacart’s revenue grew 39% YoY in 2022 while its net operating profit after tax (NOPAT) improved from -$15 million in 2021 to positive $123 million in 2022. See Figure 1.

Figure 1: Instacart’s Revenue & NOPAT: 2021 – 2022

Sources: New Constructs, LLC and company filings

Instacart Took and Maintained Market Share

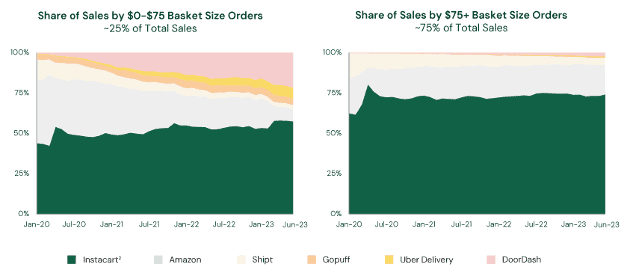

After Instacart exploded in popularity during the COVID-19 pandemic, it has since successfully defended the market share it gained during that period. At the end of June 2023, of third-party platforms, Instacart holds:

- 74% share of sales of orders greater than $75

- 56% share of sales of orders less than $75

Per Figure 2, Instacart’s share of larger orders, those greater than $75, has been remarkably consistent since 2020, while its share of smaller orders has slowly increased.

Figure 2: Instacart Market Share by Order Size: January 2020 – June 2023

Sources: Company filings

And the Company Scaled Efficiently

Perhaps most impressive – and something that the majority of the overvalued IPOs of 2021 lacked – Instacart efficiently scaled its business during and after the rapid growth of 2020.

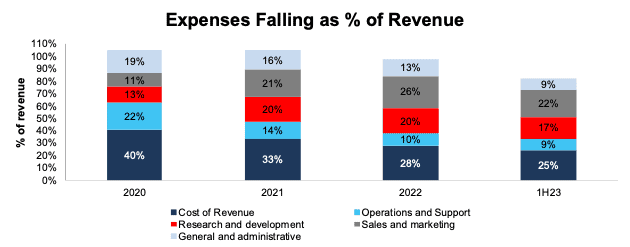

In 2020, total expenses, which include cost of revenue, operations and support, R&D, sales and marketing, and general and administrative, were 105% of revenue. In 2022, total expenses fell to 98% of revenue and just 82% of revenue in the first half of 2023. The biggest improvements come from:

- Cost of revenue: 40% to 25% of revenue from 2020 to 1H23

- Operations and support: 22% to 9% of revenue from 2020 to 1H23

- General and administrative: 19% to 9% of revenue from 2020 to 1H23

The ability to grow the business while keeping costs under control drives Instacart’s NOPAT margin from -1% in 2021 to 5% in 2022.

Figure 3: Instacart’s Falling Expenses: 2022 – 1H23

Sources: New Constructs, LLC and company filings

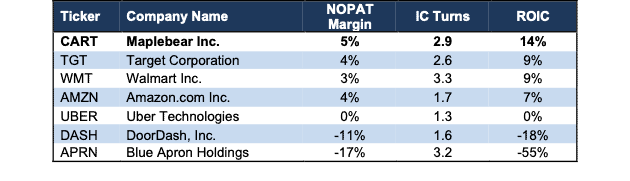

Currently More Profitable than Peers and Customers

Per Figure 4, Instacart has the highest NOPAT margin and return on invested capital (ROIC) amongst its competitors and partners. Not having the costly overhead of a traditional retailer and taking more of a middleman approach between the consumer and retailer has proven profitable, at least for now.

Nevertheless, we’re not confident in Instacart’s ability to maintain leading margins and ROIC moving forward for reasons detailed below.

Figure 4: Instacart’s Profitability Vs. Competition: TTM

Sources: New Constructs, LLC and company filings

Future Looks Less Certain

Despite the positives above, Instacart’s future is not all roses:

- the COVID-19 induced growth is in the past

- competition is consolidating and better-resourced,

- Instacart’s revenues remain highly concentrated, and

- its valuation already embeds very optimistic assumptions for future profit growth.

Growth Is Slowing

In the first half of 2023, GTV grew just 4% YoY while total orders grew less than 1% over the same time. Instacart expects much of the same moving forward, as it notes in its S-1:

“We also expect GTV growth to be tempered across our existing and new customer cohorts over the near term.”

Instacart laid out specific reasons why growth would be “tempered” moving forward, such as:

- The subsiding effects of the COVID-19 pandemic on demand for online grocery

- including a return to pre-COVID grocery shopping behaviors,

- continuing macroeconomic uncertainty,

- the cessation of government stimulus,

- the declining effectiveness of historical growth initiatives as Instacart continues to scale, and

- the effects of initiatives to drive profitable growth.

More specifically, these factors are expected to result in lower GTV and orders. They also lower average order value, which will further lower Instacart’s revenue and margins.

Instacart’s revenue, gross transaction value (GTV), and total orders were once growing at triple digit YoY rates, but those days are now, clearly, behind us.

Lastly, Instacart notes in its S-1 that the online grocery market is expected to grow at a compound annual growth rate of 10-18% from 2022 through 2025. Even the high end of that estimate would not be fast enough to justify Instacart’s IPO valuation, as we’ll show below.

Competition Is Plentiful

We think it is hard for Instacart bulls to buy into the company’s growth story continuing as it has in the past. As online grocery delivery rises in popularity, Instacart will find it tougher to maintain and take market share, as new competition floods into the industry. For instance, Instacart now faces competition from:

- Existing brick/mortar and online grocery/retailers

- Target (TGT)

- Walmart (WMT)

- Kroger (KR)

- Whole Foods/Amazon (AMZN)

- Third party delivery platforms

- DoorDash (DASH)

- Shipt (owned by Target)

- Ubers Eats (UBER)

- Fresh Direct

- GoPuff

- DashMart (owned by DoorDash)

- Drizly – specialized in alcohol delivery (owned by Uber)

- Direct to consumer food delivery

- Blue Apron (APRN)

- HelloFresh

- HomeChef (owned by Kroger)

Not only does the increased competition diminish pricing power, as competing services can choose to cut prices to take market share, but it creates low switching costs. Instacart warns in its S-1:

“… the cost to switch between providers of online grocery shopping is low for consumers, and consumers within various demographics have a propensity to shift to the lowest-cost or highest-quality provider and may use more than one delivery platform.”

In other words, its highly likely consumers will simply move to the lowest-cost provider, rather than stay loyal to any one service. Low switching costs also increases the cost to acquire and keep new customers, which would further lower Instacart’s margins moving forward.

Partners Are Becoming Competitors

As a third-party service, it’s no secret that Instacart is heavily reliant upon its partners. Without grocery stores, there is no Instacart. Unfortunately for Instacart, its partners are quickly becoming competitors as they build out their own delivery services.

For instance, Kroger and Walmart offer their own delivery service, along with a monthly subscription that provides free delivery as just one of many perks. Kroger uses temperature-controlled trucks and can even pack items directly at local fulfilment centers, thereby providing the highest quality food available. Target also offers same day delivery through Shipt, which it acquired in 2017. Whole Foods, owned by Amazon, provides very robust pickup and delivery services.

We previously highlighted the problem with grocery store partners as competitors when we first put Beyond Meat (BYND) in the Danger Zone, and the same problems apply to Instacart. Each grocery store that offers its own delivery service is going to be much more likely to direct shoppers to use it, rather than a third-party platform.

Additionally, grocery stores, such as Kroger, have data on all shoppers that use their loyalty program. This data can be leveraged to target consumers most likely to use delivery service or promote the service as an add-on to consumers’ existing shopping experience. Instacart has some data, but it is for a much smaller subset of shoppers as it only includes consumers that have used its service.

The bottom line here is that, while grocery stores have been good partners thus far, Instacart faces a growing brigade of formidable competitors, each with their own incentives that don’t align with Instacart’s. Many of the competitors have more than enough capital and expertise to further expand their own delivery options and box Instacart out of the market.

Partners Are Also Heavily Concentrated

Just three retailers accounted for 43% of Instacart’s GTV in 2021, 2022, and the first half of 2023. Such a large concentration in such few partners further highlights how reliant Instacart is on said partners/competitors. As these grocery stores build out their own delivery services, they could choose to suspend or cease relationships with Instacart, which would create a material reduction in Instacart’s revenue and profits.

As we all know from studying Michael Porter, large customers can also exert more influence over their suppliers, and in this case, partners. In other words, large customers have a lot of bargaining power when it comes to pricing. Should grocery stores decide that Instacart is taking too much in fees, they have significant leverage to negotiate better terms, reallocate funds to building their own service, or both. In any of those scenarios, Instacart’s revenue and profit growth could take a big dive.

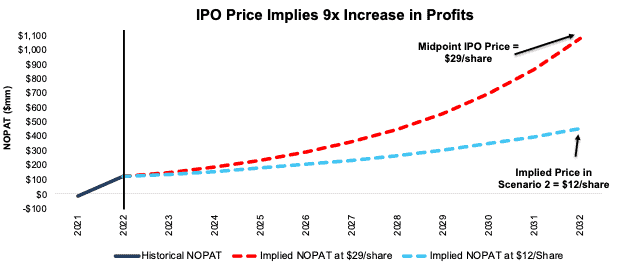

Valuation Implies Too Much Profit Growth

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into CART, we find that shares, even at the midpoint, embed very optimistic assumptions about margins and growth. We think the stock holds downside risk at its IPO valuation.

To justify the midpoint of its IPO valuation, our model shows Instacart would have to:

- maintain NOPAT margin at 4.8% (equal to 2022, despite expected margin pressures noted above) and

- grow revenue by 24% compounded annually (1.3x the high end of the projected online grocery market growth through 2025) for the next decade.

In this scenario, Instacart would generate $22.5 billion in revenue in 2032, which is nearly 9x its 2022 revenue and 2.9x DoorDash’s TTM revenue. We can use Instacart’s take rate[1] to estimate implied GTV in this scenario. For this analysis, we assume:

- Instacart’s transaction revenue is 72% of revenue in 2032 (equal to percent of revenue in 1H23)

- Instacart’s take rate is 7% (equal to Instacart’s transaction revenue as a % of GTV in 1H23)

In this scenario, Instacart’s implied GTV in 2032 would equal $227 billion, which is 7.9x higher than Instacart’s 2022 GTV and 1.8x Uber’s TTM gross bookings (similar metric to GTV).

This scenario also implies Instacart grows NOPAT 24% compounded annually through 2032, earns $1.1 billion in NOPAT in 2032, and generates an ROIC of 118%. The implied NOPAT is 8.7x Instacart’s 2022 NOPAT while the implied ROIC would be higher than all but 14 of the 2,977 companies we cover. For reference, Apple and Alphabet’s TTM ROIC are 70% and 40%, respectively.

It’s also important to note that companies that grow revenue by 20%+ compounded annually for such a long period are “unbelievably rare”. The cash flows expectations in Instacart’s midpoint IPO valuation are very high, which indicates there could be much more downside risk than upside potential.

59% Downside if Growth Matches Industry

Below we present an additional reverse DCF scenario to illustrate the downside risk even if we give the company credit for more reasonable growth assumptions than those outlined above.

If we assume Instacart’s:

- NOPAT margin remains at 4.8% and

- revenue grows 14% compounded annually (midpoint of projected industry growth through 2205) for the next decade, then

CART would be worth just $12/share today – a 59% downside to the midpoint IPO price range.

In this scenario, Instacart’s revenue would still grow to $9.5 billion in fiscal 2032, or 3.7x Instacart’s 2022 revenue. If we make the same assumptions as above regarding Instacart’s revenue breakdown and take rate, this scenario implies the company’s GTV grows to $95.8 billion which would be 3.3x Instacart’s 2022 GTV and 80% of Uber’s TTM gross bookings.

This scenario also implies the company grows NOPAT 14% compounded annually through 2032, earns $454 million in NOPAT in 2032, and generates a 50% ROIC in 2032.

Figure 5 compares Instacart’s implied future NOPAT in these scenarios to its historical NOPAT.

Figure 5: Midpoint IPO Price Looks Fully Valued

Sources: New Constructs, LLC and company filings

Each of the above scenarios assume Instacart grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the high level of expectations embedded in the current valuation.

Control Concentrated in Hands of Few

While not as bad as some recent IPOs, Instacart’s new investors will have limited control over corporate governance. Upon completion of the IPO, executives, directors, and other “cornerstone” investors who already own more than 5% of the company will own ~40% of Instacart’s outstanding shares.

The 40% is the floor for “cornerstone” ownership. Multiple “cornerstone investors” including some that already own more than 5% of the company, have expressed interest in buying additional shares upon IPO, which would further increase their ownership, and control over, the company.

No White Knight To Save Investors

The expectations baked into Instacart’s IPO valuation look highly optimistic. Often, the best hope investors might have in overvalued stocks is for an established company to acquire the firm. However, investors shouldn’t get their hopes up. As noted above, competitors are already building out their own delivery services. Acquiring Instacart wouldn’t necessarily create all that much value for a single retailer or grocer. Instacart’s primary value creation opportunity is in the scale it can achieve by connecting buyers with multiple retailers and grocers. We think Instacart either succeeds or fails on its own.

Additionally, Instacart’s economic book value, or no growth value, is less than $2/share – a 93% downside to the midpoint IPO price range. Potential acquirers will not likely have interest in paying anywhere close to the lofty IPO valuation for a business that looks likely to face significant challenges moving forward.

This article was originally published on September 14, 2023.

Disclosure: David Trainer, Kyle Guske II, Italo Mendonça, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] “Take rate” is the percentage the company receives as transaction revenue out of every dollar worth of product sold on the platform.

Click here to download a PDF of this report.

Editors Note: Valuation scenarios were updated on 9/15/23 when Instacart raised its IPO price range.