“Advertising is the price you pay for having an unremarkable product or service” (Jeff Bezos, 2009)

Source: TD Ameritrade

In 2018, TD Ameritrade launched its 24/5 marketing campaign, which featured Lionel Richie ringing a ‘24/5’ bell to promote the company’s overnight trading of ETFs on weekdays.

The company spent over $290 million in advertising that year promoting noise-trading tactics and that ‘trading options is just like playing pool’. The result: TD Ameritrade gained just over 500,000 new accounts – which equated to $586 spent to acquire a new account.

Meanwhile, sleepy Charles Schwab (SCHW), with its do-it-with-you platform and low-cost index funds, added over 1.5 million new accounts at $199 per account in the same year. That customer acquisition cost (CAC) dropped to $104 in 2022, and (gasp) $18 in 2020, when everyone became an eager investor while locked up at home.

Why did TD Ameritrade (coincidentally acquired by Schwab post-2018) need to spend so much more to acquire a customer than Schwab?

Was it something about their technology?

Their user interface?

Is it because they’re Canadian? (I know you were asking it).

Though all plausible, none of these answers are correct.

Schwab had been vying for its place in the sun for a long time, branding itself as a trusted provider of passive funds and investment services at a time when passive management became the norm for most investors. By providing a commoditized service at commodity prices, Schwab positioned itself in the right place, at the right time.

TD Ameritrade didn’t need a better website. It didn’t need a better interface. Heck, it didn’t even need Lionel Richie. What TD lacked…was a moat.

Let’s dive in.

What is a Moat?

When assessing a company’s competitive advantages, the concept of an economic moat guards a company from the relentless siege of competition. Originating from the investment philosophy of Warren Buffett, the term has been analyzed and expanded by Pat Dorsey, former Director at Morningstar. An economic moat is more than a corporate shield; it’s the strategic advantage that allows a company to weather storms and outperform competitors in the long term. What makes the idea compelling is its multifaceted nature. Not all moats are created equal, and their effectiveness can be classified into different categories such as structural and regulatory advantages.

Many Kinds of Moats

Companies like Wal-Mart (WMT) boast structural advantages through an unbeatable supply chain, whereas Moody’s enjoys regulatory advantages that give it a near-monopolistic position in credit ratings. But that’s just scratching the surface. Economic moats come in varied flavors, each requiring a unique strategy for maintenance and expansion. For instance, brand moats, as seen in luxury brands like LVMH, are not just built but meticulously maintained – even if that maintenance includes destroying unsold merchandise to uphold an air of scarcity and exclusivity. On the flip side, low-cost provider moats depend on a business being the most cost-efficient player in its space, as demonstrated by Wal-Mart’s prices. Then, there is the network effect, a moat that becomes more valuable as more people use a service, which is often seen in payment platforms like Visa (V), as well as social networks.

The landscape of moats also includes specialized but incredibly fortified companies such as CoStar (CSGP), which owns a large portion of the market on commercial real estate data. Its edge comes not just through organic growth but also through strategic acquisitions of regional databases. Similarly, MSCI (MSCI) has leveraged specialized financial services to create a multi-pronged moat, from index licensing to risk management software.

The Best Moats Can Be Expanded

An interesting aspect of analyzing economic moats is the concept of the ‘reinvestment runway’, also coined by Dorsey. It’s not enough to merely identify a company’s moat; it is equally important to assess how long that moat will enable the company to reinvest capital at high rates of return. Take Visa, for example. The company doesn’t just have a wide moat; it has the ‘runway’ to keep reinvesting capital at a high rate, which significantly enhances its long-term value. In other words, Visa is part of a rapidly-changing and growing market (payments), where the company is able to invest heavily in technology to continue to widen its moat or to acquire and incorporate startups.

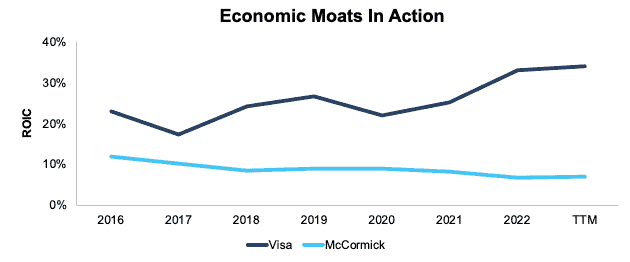

In contrast, companies like McCormick (MKC), for example, despite having substantial moats, find their growth constrained by mature markets, where not a lot is changing. For investors, this dynamic adds an extra layer to valuation metrics: the need to go beyond assessing present advantages to incorporating the capacity for future growth and capital efficiency. See how the concept of ‘reinvestment runway’ plays out in the historical ROIC for both Visa and McCormick, displayed in Figure 1.

Figure 1: ROIC for Visa and McCormick: 2016 – TTM

Sources: New Constructs, LLC and company filings

Customer trust also plays a pivotal role in building unassailable moats. Amazon’s (AMZN) domination in the online shopping world is a testament. The company’s relentless focus on customer satisfaction has built a level of trust that turns first-time buyers into lifelong customers. Even though Amazon doesn’t necessarily offer the lowest prices, the majority of consumers don’t bother checking elsewhere, which solidifies its moat and leaves competitors scratching their heads.

By recognizing the various types of moats and the significance of the ‘reinvestment runway,’ one gains a more nuanced perspective for assessing business strategy and investment opportunities. These insights, grounded in real-world examples, metrics, and cautionary tales, map out what it takes for businesses to not just survive but thrive in an increasingly competitive landscape.

Introducing ESG-C

“Although we are all interested in margin, it must never be done at the expense of our philosophy. Margin must be obtained by better buying, emphasis on selling the kind of goods we want to sell, operating efficiencies, lower markdowns, greater turnover, etc. Increasing the retail prices and justifying it on the basis that we are still “competitive” could lead to a rude awakening as it has with so many. Let us concentrate on how cheap we can bring things to the people, rather than how much the traffic will bear, and when the race is over Fed-Mart will be there”.

Sol Price, founder of Fed-Mart (predecessor to Costco), 1967

Nick Sleep, the elusive manager behind Nomad Investment Partners, has garnered a cult following among discerning investors, who are intrigued by his unconventional investment philosophy and impressive returns. Operating largely under the radar, he has quietly built a reputation for his long-term, concentrated investment strategy, which often involves holding just a handful of stocks. His investment fund was a highflyer as it generated nearly 21% annual returns from 2001 to 2014, versus a benchmark of 7% annually (MSCI World Index). Here are a few interesting insights from Sleep and Nomad’s investment process.

In the intricate context of competitive advantages, the term ‘scale economics shared’ encapsulates a unique philosophy. Conventional wisdom in investment circles often obsesses over the moment a company scales sufficiently to ‘own’ its consumer base and ramp up prices and expand margins. However, this model is starkly in contrast to the operational ideologies of market leaders like Costco (COST) and Amazon, which have dominated their respective sectors through a radically different approach. Call it “ESG-C”, where companies not only care about the environment and social equity, but adopt the long-term strategy of sharing value with its customers and stakeholders as a tactic for lasting success and customer loyalty.

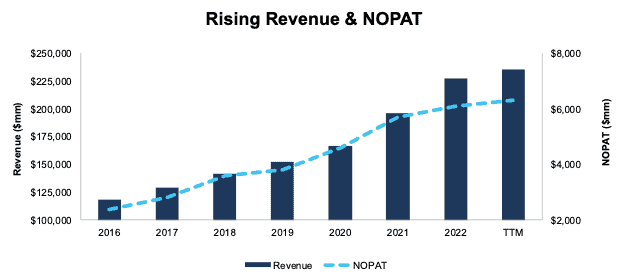

Rather than holding customers hostage, these firms share the benefits of their competitive advantage (e.g. scale, product expertise, etc) with their consumers. This framework is simple yet revolutionary: as the company grows, the cost advantages and superior product sourcing are passed down to the customers in the form of lower prices and superior products. This value proposition, in turn, encourages greater customer loyalty and spending, which generates profits for the company that it can reinvest in extending its competitive advantages. And, the company sets into motion a self-reinforcing virtuous cycle of business success. Companies adopting a ‘scale economics shared’ model consider value-sharing not as an afterthought but as a primary business goal. See Figure 2.

Figure 2: Costco’s Revenue and NOPAT 2016 – TTM

Sources: New Constructs and company filings

With an enormous employee base scattered across hundreds of warehouses, every Costco employee is an active participant in diligently managing an annual cost structure that hovers around the tens of billions of dollars. The collective pursuit is not to figure out a single masterstroke for cost reduction; it’s about thousands of nuanced decisions that cumulatively contribute to keeping the cost base extremely competitive. This shared value is shared with customers in the form of lower prices, completing one loop of an ongoing, virtuous circle of shared economics.

The sustainability of this business model is not merely theoretical; it’s empirically demonstrable. Firms utilizing this approach have consistently expanded their revenue streams even through economically turbulent times. Costco’s revenue, for example, has grown year-over year every single year but 2009 (when it retracted 1%) since 1998. What fortifies this model is that it is exceedingly difficult to imitate, especially if not planted into the company’s culture from inception. Jeff Bezos of Amazon echoes this sentiment, emphasizing that such cultures are nearly impossible to create unless embedded from the very beginning.

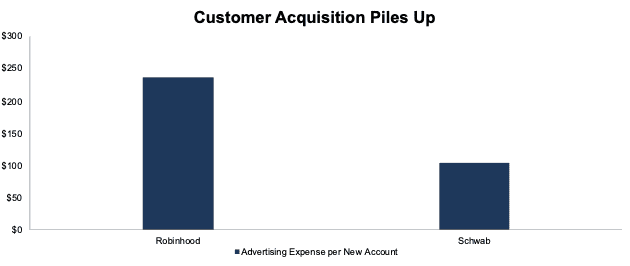

Advertising strategies further underscore the quiet confidence of these companies. The absence of blaring promotional activities among firms like Amazon and Costco is a testimony to the robustness of their business models. They don’t need to shout; their prices and products speak for themselves. This understatement in operations extends itself to a long-term vision that is keenly focused on enduring value rather than ephemeral market sentiments. Similarly, the advertising budgets of Charles Schwab, a recent Long Idea, and Robinhood (HOOD), a Zombie Stock, when compared to their customer acquisition numbers, denote the true size of Schwab’s moat when compared to Robinhood. See Figure 3.

Figure 3: Charles Schwab and Robinhood’s Customer Acquisition Costs: 2022

Sources: New Constructs and company filings

The businesses built on ‘scale economics shared’ are a testament to a more symbiotic relationship between companies and consumers, one where the moats are not walls that lock consumers in but bridges that invite them back, time and again.

GAP and Moats

The Growth Appreciation Period (GAP) has long been a part of the New Constructs lexicon and serves as a critical metric for evaluating a company’s value. Essentially, GAP quantifies the duration over which a firm is projected to secure a return on invested capital (ROIC) exceeding its weighted average cost of capital (WACC) for incremental capital deployments. Beyond this time horizon, it is presumed that any fresh investments made by the company will only yield an ROIC equal to the WACC, which means the net present value of such investments is zero. Put more simply, GAP measures the number of years a company will grow its profits. There must be some limit on the number of years a company grows profits; otherwise, if it can grow profits forever, its value is infinite. Moreover, the law of competition implies that no business will remain immune to competition forever and have the ability to grow profits forever.

GAP is the same concept as CAP, competitive advantage period, which Michael Mauboussin links to the stock valuation process in this excellent paper: CAP: The Neglected Value Driver.

Our proprietary reverse discounted cash flow (DCF) model is designed to measure the GAP implied by the stock price. In the absence of such a comprehensive model, investors find themselves inadequately equipped to decode the entire set expectations baked into market valuations. Furthermore, our reverse DCF model transcends the limited time frames of 5 or 10 years often seen in traditional models. It navigates through a lattice of different GAPs, grounded on a Terminal Value formula that rules out any profit growth after the GAP. In other words, no sneaky use of terminal values to juice the numbers.

Essentially, market-implied GAP provide a more complete view of the current market price of an asset by quantifying the duration of profit growth required to justify the price. If the market price implies 30 or more years of profit growth, then the stock is more likely to be considered expensive. On the other hand, if the market price implies a GAP of <2 years, then the stock is more likely to be considered cheap. Either way, investors with this insight into market-implied GAP have a more holistic understanding of the expected lifecycle of a business’ cash flows.

Connecting this concept back to the earlier discussions on both Nick Sleep’s and Pat Dorsey’s insights, it becomes evident that an integration of qualitative and quantitative evaluations of moats aligns with measuring GAP. While quantitative metrics like GAP are indispensable for valuation, they must be grounded in a qualitative understanding of the underlying business model and competitive landscape. At the same time, the market-implied GAP provides a helpful measure of how wide the market believes a company’s moat is.

For example, companies such as Costco and Amazon, which have meticulously built robust moats through the ‘scale economics shared’ approach, can justify far more ambitious GAP assumptions than a company like McCormick, whose moat affords predictability but has limited duration. Ignoring the quality and durability of a moat can lead investors to illusions of cheapness or value that don’t stand up to rigorous scrutiny. Though no single names are given in this report, we want investors to know we’re doing the diligence to understand not just how profitable a business will be or how fast it will grow, but we also take into consideration its competitive position and how long it will be able to stave off competition and grow its profits. In other words, we give you the whole picture, not just the pieces that support our thesis.

We are always looking for companies that verifiably make long ‘reinvestment runways’ as well as ‘scale economics shared’ as part of their strategy.

This article was originally published on September 7, 2023.

Disclosure: David Trainer, Kyle Guske II, Italo Mendonca, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.