Netflix’s Price Increase Signals Original Content Isn’t Enough

Netflix (NFLX: $184/share) announced a price increase that will affect new U.S. members immediately while existing members will see the changes “over the next several months.” We’ve recently seen the impact that price increases can have on Netflix’s membership growth, when the company blamed poor 2Q16 growth on cancelations due to a price increase. Will the latest price increase have the same effect? In the larger context, we believe the price increase signifies that Netflix’s competitive advantage has been wiped away. In order to justify its massive original content budget, it must raise prices if it is to ever meet the expectations implied by its stock price.

Competition Is Eroding Netflix’s Business Model

The streaming video market has grown dramatically and Netflix has lost much of its early-mover advantage as we detailed in July 2016. Today, the market is highly fragmented with competitors offering live TV bundles, original content, and exclusive access to content from certain movie studios to attract customers. Competitors are also eating away at Netflix’s business model by removing content from the service. Disney recently announced a standalone streaming platform with all Disney content, including Marvel and Star Wars. Fox has been pulling its content from Netflix over the past few months and making it available via Hulu. Meanwhile, Apple has plans to invest billions into original content that it is streaming via its Apple music service.

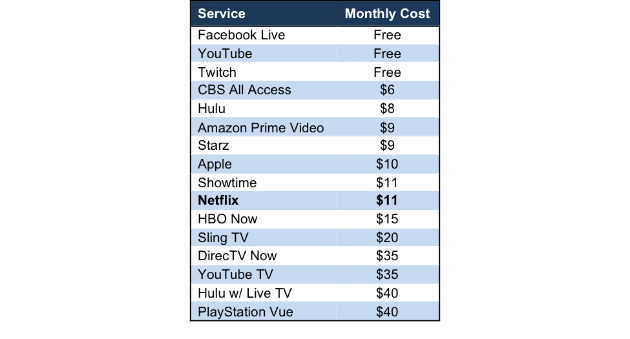

Worse yet, Netflix’s pending price increase limits its pricing power over the competition, per Figure 1. The competitors in Figure 1 also include live TV offerings, such as Sling TV and DirecTV Now.

Figure 1: Streaming Market Competition

Sources: New Constructs, LLC and company filings.

The increase in competition leaves limited pricing power, a lynchpin for the viability of Netflix. Without pricing power, Netflix can’t afford to continue to do all the things that have helped management hype the stock, such as invest in growing original content, attracting new members and maintaining its large content library. As we have written for some time, investors will not tolerate huge cash flow losses forever. Now, with ample competition, it’s clear Netflix’s only value is in its costly original content.

The recent revelations that competitors are willing to pull content from Netflix and start their own service indicate that Netflix’s business model is completing its shift to a traditional TV network, even if not by its own choosing. Accordingly, all investors, not just the bankers and insiders, should beware especially since the valuation of the stock is yet to recognize the cracks in the Netflix bull thesis.

Content Costs Continue to Outpace Revenue Growth

With plans to spend $6 billion on content in 2017, Netflix’s streaming content obligations continue to grow faster than revenue. We first warned about Netflix’s alarming streaming content obligation growth in 2014. Since then, the issue has only worsened as free cash flow has fallen further.

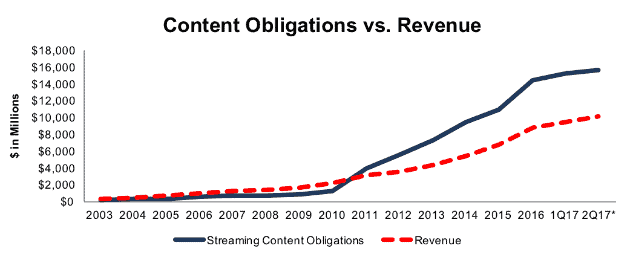

Since 2010, content obligations have grown 43% compounded annually while revenue has grown 25% compounded annually, per Figure 2. At the end of 2Q17, content obligations totaled $15.7 billion and have grown faster than revenue YoY in six of the past seven years. The realities of Netflix’s costly business model are finally catching up to the firm.

Figure 2: Content Obligation Growth Outpaces Revenue

*Revenue from the trailing twelve months

Sources: New Constructs, LLC and company filings

Cash Burn Compounds Obligation Growth Issues

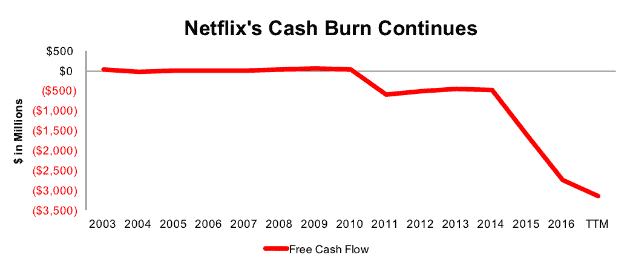

As Netflix’s content obligations increase, its free cash flow (FCF) only grows more negative. Since 2010, the last year Netflix generated positive FCF (and first year it began increasing its content library), Netflix has burned through a cumulative $6.4 billion in cash, per Figure 3. Netflix’s FCF over the trailing twelve months sits at -$3.1 billion, the largest cash burn reported in Netflix’s history.

Figure 3: Netflix’s TTM Free Cash Flow is -$3.1 Billion

Sources: New Constructs, LLC and company filings.

Price Increases Have Hurt Membership Growth

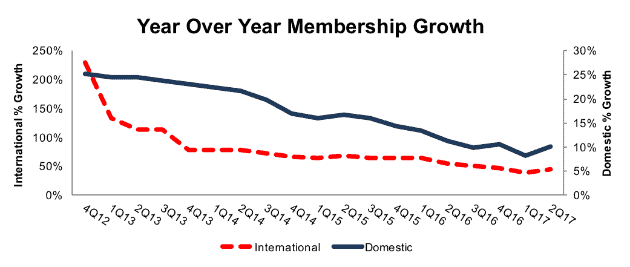

In 2Q16, Netflix missed membership growth expectations and blamed the slow growth on customers cancelling the service ahead of a planned price increase. Per Figure 4, Netflix stopped a long-term trend in slowing membership growth in 2Q17. The newly announced price increase could see as similar impact as 2Q16 and halt the membership growth trend reversal in its tracks.

Per Figure 4, international members grew 44% YoY in 2Q17, down from 55% in 2Q16 and 78% in 2Q14. Similarly, domestic members grew 10% YoY in 2Q17, down from 11% in 2Q16 and 22% in 2Q14.

Figure 4: Netflix’s Membership Growth Rates

Sources: New Constructs, LLC and company filings.

NFLX Valuation Remains Unrealistically Optimistic

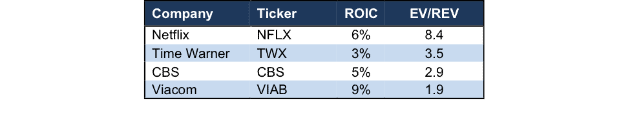

Figure 5 shows the striking valuation gap between Netflix and TV networks such as CBS, Viacom, and HBO parent Time Warner. Despite having a similar return on invested capital (ROIC), Netflix is valued with an Enterprise Value/Revenue ratio between 2-4 times higher.

Figure 5: Netflix Is Much More Expensive Than TV Networks

Sources: New Constructs, LLC and company filings.

Assuming a 2.7x multiple (average of TWX, CBS, and VIAB) to TTM revenue of $10.8 billion, NFLX is worth $51 share – a 72% downside.

One could argue that NFLX deserves a premium over these other stocks due to its international growth opportunities and popularity among younger viewers. Still, it’s hard to justify the massive premium at 8.4. Furthermore, TWX, CBS, and VIAB actually generate significant free cash flow and have sustainable competitive advantages. They also have a customer base that includes nearly every household with a TV – or 118.4 million homes to which networks can advertise. How does Netflix stand a chance or, much less, deserve a premium valuation?

This article originally published on October 5, 2017.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.