Eight new stocks make our Safest Dividend Yield Model Portfolio this month, which was made available to members on May 25, 2017.

Recap from April’s Picks

Our Safest Dividend Yields Model Portfolio underperformed the S&P 500 last month. The Model Portfolio fell 3.5% on a price return basis and 3.4% on a total return basis while the S&P rose 1.8% on both a price and total return basis. The best performing stocks in the portfolio were large cap stock PPL Corporation (PPL), which was up 4%, and small cap stock, National Research Corp (NRCIB), which was up 6%. Overall, four out of the 20 Safest Dividend Yield stocks outperformed the S&P in April and six had positive returns.

Since inception, this Model Portfolio is up 10% on a price return basis (S&P +12%) and 13% on a total return basis (S&P +13%).

The success of this Model Portfolio highlights the value of our Robo-Analyst technology, which scales our forensic accounting expertise (featured in Barron’s) across thousands of stocks.

This Model Portfolio only includes stocks that earn an Attractive or Very Attractive rating, have positive free cash flow and economic earnings, and offer a dividend yield greater than 3%. Companies with strong free cash flow provide higher quality and safer dividend yields because we know they have the cash to support the dividend. We think this portfolio provides a uniquely well-screened group of stocks that can help clients outperform.

New Stock Feature for May: LaSalle Hotel Properties (LHO: $29/share)

LaSalle Hotel Properties (LHO), a REIT which owns and develops upscale and luxury full-service hotels, is one of the additions to our Safest Dividend Yield Model Portfolio in May.

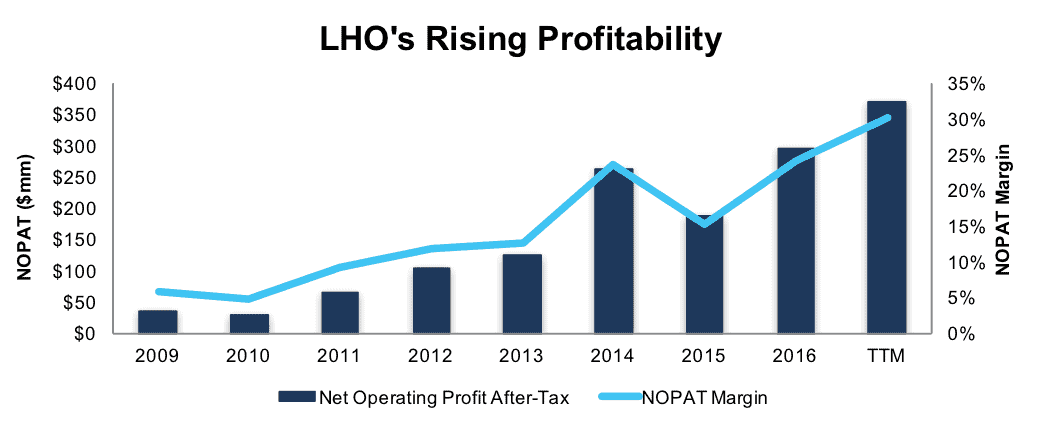

Since 2009, LHO has grown revenue 11% compounded annually. After-tax profit (NOPAT) has grown much faster (35% compounded annually) over the same period with the help of improving margins. Per Figure 1, the company’s NOPAT margin has improved from 6% in 2009 to 30% over the last twelve months (TTM), while return on invested capital (ROIC) has improved from 2% in 2009 to 10% TTM.

LHO’s revenue and NOPAT growth since 2009 are not just a recent trend or simply a recovery from recession levels. Since 1998, LHO has grown revenue and NOPAT by compounded annual rates of 20% and 15%, respectively. Add in the company’s positive free cash flow (FCF) and 6% current dividend yield, and it’s easy to see why LHO earned a spot in this month’s Safest Dividend Yields Model Portfolio.

Figure 1: LaSalle’s Profit Growth Since 2009

Sources: New Constructs, LLC and company filings

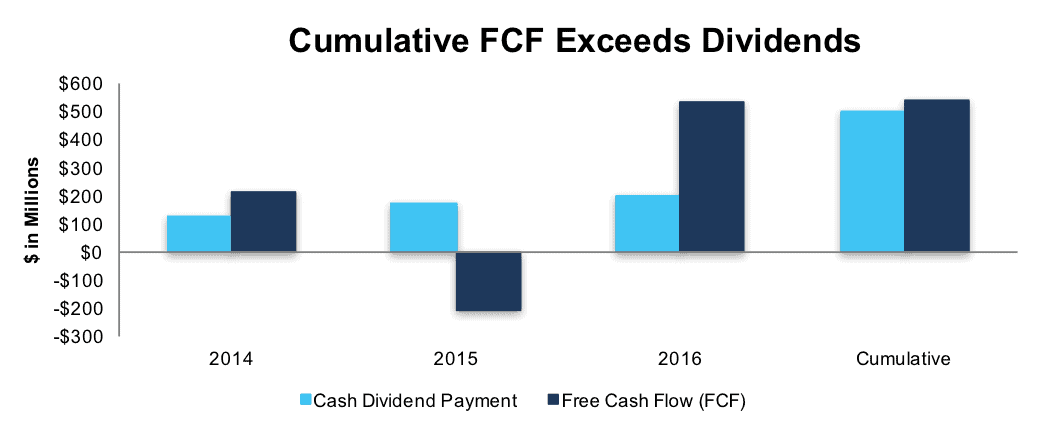

Business Operations Support Dividend Growth

LHO has increased its quarterly dividend from $0.11 in 1Q12 to $0.45 in 1Q17. Dividend increases have been made possible by LHO’s growing NOPAT and free cash flow (FCF). LHO generated $534 million in FCF in 2016 and has generated $767 million in FCF over the trailing twelve months (TTM) as hotel acquisitions have slowed. LHO’s TTM FCF equates to a 19% FCF yield. Per Figure 2, LHO has generated a cumulative $538 million (16% of market cap) in FCF over the past three years which exceeds cumulative dividends of just over $500 million.

Companies with strong free cash flow provide higher quality dividend yields because we know the firm has the cash to support its dividend. On the flip side, dividends from companies with low or negative free cash flow cannot be trusted as much because the company may not be able to sustain paying dividends.

Figure 2: LHO’s FCF vs. Dividends Over Last Three Years

Sources: New Constructs, LLC and company filings

LHO Remains Undervalued Despite Impressive Fundamentals

At its current price of $29/share, LHO has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects LHO’s NOPAT to permanently decline by 30% from current levels. Such expectations seem too pessimistic given LHO’s track record of growing NOPAT 15% compounded annually since 1998.

Even if LHO were to never again grow profits from current levels, the company’s economic book value, or no growth value of the firm is $42/share – a 45% upside from the current valuation.

However, if LHO can maintain 2016 NOPAT margins of 24% (below 30% TTM NOPAT margin) and grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $51/share today – a 76% upside. Large upside potential coupled with LHO’s 6% dividend yield provides investors a low risk/high reward opportunity.

Impacts of Footnotes Adjustments and Forensic Accounting

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to LaSalle Hotel Properties’ 2016 10-K:

Income Statement: we made $68 million of adjustments with a net effect of removing $62 million in non-operating expense (5% of revenue). We removed $66 million related to non-operating expenses and $4 million related to non-operating income. See all adjustments made to LHO’s income statement here.

Balance Sheet: we made $234 million of adjustments to calculate invested capital with a net increase of $6 million. The most notable adjustment was $110 million (3% of reported net assets) related to excess cash. See all adjustments to LHO’s balance sheet here.

Valuation: we made $1.5 billion of adjustments with a net effect of decreasing shareholder value by $786 million. Apart from total debt, the largest adjustment to shareholder value was $3 million related to minority interests. This adjustment represents <1% of LHO’s market value. Despite the net decrease in shareholder value, LHO remains undervalued.

This article originally published on June 7, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.