This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

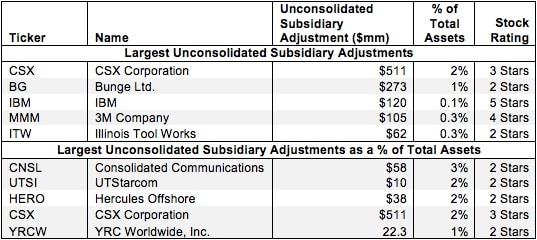

Unconsolidated subsidiaries are companies in which the parent company has significant control, usually owning between 20%-50% of the business. Unconsolidated subsidiaries are accounted for using the equity method. Investments in unconsolidated subsidiaries represent an investment of resources from the parent company, and investors therefore have the right to demand a return on that capital.

However, there are situations where poor disclosure forces us to treat unconsolidated subsidiary assets as non-operating and remove them from invested capital. Sometimes, companies bundle their unconsolidated subsidiary income into a non-operating line item. In those cases, we are forced to treat unconsolidated subsidiaries as non-operating to ensure consistent treatment of the asset and the income. If we did not make this adjustment, we would be holding companies accountable for unconsolidated subsidiary assets without measuring the income from those assets in our calculation of ROIC.