This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

The net funded status of a company’s pension and post-retirement plans is included on the balance sheet. When a company has underfunded plans, we do not make any adjustment. The company is making a choice to fund other projects rather than use its money to fund its pension plan. Effectively, the company is borrowing from its own employees.

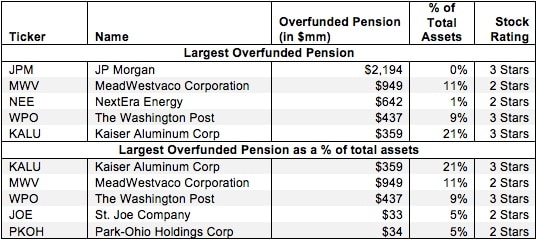

When a company’s pension plans are overfunded, on the other hand, the excess assets are not being actively used to create revenue. Overfunded pension assets are similar to excess cash, and should not be included in the calculation of return on invested capital (ROIC).