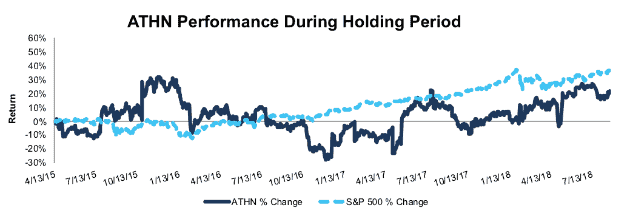

athenahealth Inc. (ATHN: $153/share) – Closing Short Position – up 18% vs. S&P up 37%

athenahealth was originally selected as a Danger Zone pick on 4/13/15. At the time of the report, the stock earned an Unattractive rating. Our short thesis highlighted declining economic earnings (falling faster than GAAP net income), competitive disadvantages relative to peers, and overly optimistic expectations baked into the stock price.

The largest risk to any short thesis is what we call “stupid money risk.“ We noted in our original report that an acquisition was unlikely, but with the efforts of activist investor Paul Singer of Elliott Management Corp, this risk has risen. On 5/7/18, Elliott Management outlined a proposal to acquire athenahealth for $160/share, which represented a 27% premium to the stock price at the time. Since then, UnitedHealth Group (UNH), along with TPG and Bain Capital have expressive interest in purchasing ATHN, according to Dealreporter.

During the 1,227-day holding period, ATHN outperformed as a short position, rising 18% compared to a 37% gain for the S&P 500. Due to the likelihood of an acquisition, whether by Elliott Management or another party, we are closing this position.

Figure 1: ATHN vs. S&P 500 – Price Return

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on August 23, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.