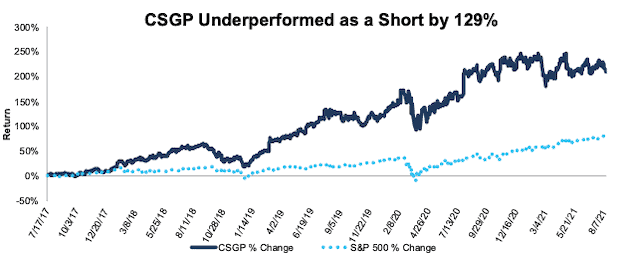

CoStar Group (CSGP) – Closing Short Position – up 210% vs. S&P up 81%

We made CoStar Group (CSGP: $85/share) a Danger Zone pick on July 17, 2017. At the time of the report, CSGP earned an Unattractive rating. We felt the firm’s roll-up acquisition strategy destroyed shareholder value, balance sheet inefficiency drove down profitability, and an expensive valuation created dangerous risk/reward.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the 4+ year holding period, CSGP underperformed as a short position, rising 210% compared to an 81% gain for the S&P 500.

CoStar Group effectively combined its numerous acquisitions, leveraged its proprietary database of commercial real estate information, and expanded its rental platform to build a consistently profitable business. The firm’s Core Earnings improved from $16 million in 2010 to $274 million in 2020 and ROIC is up from 1% in 2015 to 10% over the TTM. CoStar Group must still improve its current margins to all-time highs and grow at consensus estimates for a decade to justify the current stock price, so it’s not cheap.

However, since it’s more difficult to make a case to short the stock given the improving fundamentals, rising demand for rental properties, and the expected rebound in commercial real estate post COVID-19, we’re closing this short position.

Figure 1: CSGP vs. S&P 500 – Price Return – Unsuccessful Short Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on August 13, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.