FireEye (FEYE) – Closing Short Position – down 25% vs. S&P up 27%

We put FireEye (FEYE: $11/share) in the Danger Zone on June 27, 2016. At the time, FEYE received an Unattractive rating. Our short thesis noted the firm’s profitless revenue growth, industry-worst profitability, and overvalued stock price.

This Danger Zone report, along with all of our research, utilizes our “novel dataset”[1] of footnotes disclosures to get the truth about earnings, as shown in the Harvard Business School and MIT Sloan paper, “Core Earnings: New Data and Evidence.”

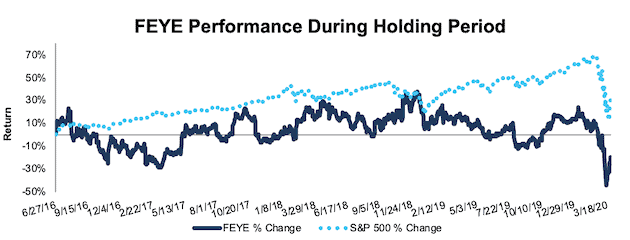

During the nearly four-year holding period, FEYE outperformed as a short position, falling 25% compared to a 27% gain for the S&P 500.

FEYE’s fundamentals, while still weak, have improved since our original report. Its return on invested capital (ROIC) improved from -24% to -9% in 2019 and after-tax operating profit (NOPAT) margin increased from -62% to -22% over the same time. However, despite falling 33% year-to-date, FEYE is still overvalued. This performance, coupled with rumors that Cisco could be interested in acquiring the firm, lead us to take the gains and close this short position.

Figure 1: FEYE vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on March 30, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors at Harvard Business School (HBS) & MIT Sloan empirically show that data is superior to IBES “Street Earnings”, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).