General Electric (GE) – Closing Long Position – flat vs. S&P down 2%

We made General Electric a Long Idea in December 2019 in our article “Two Stocks That Should Beat Earnings Expectations.”

In our article, we pointed out that, due to unusual non-operating expenses, GE’s GAAP net income significantly understated its core earnings[1]. As a result of this earnings distortion, GE earned our “Beat” Earnings Distortion Score (as featured on CNBC Squawk Box), which indicated the stock was more likely to beat consensus expectations. Sure enough, GE beat both revenue and earnings expectations when it reported 4Q19 results on January 29, 2020. The stock jumped 10% that day, but the boost was short lived.

We also noted in our article that we weren’t optimistic about the company’s longer-term prospects. Its low return on invested capital (ROIC) was well below the Industrials sector average and its valuation looked expensive. After parsing its 2019 10-K on February 25, 2020, we downgraded GE to Very Unattractive.

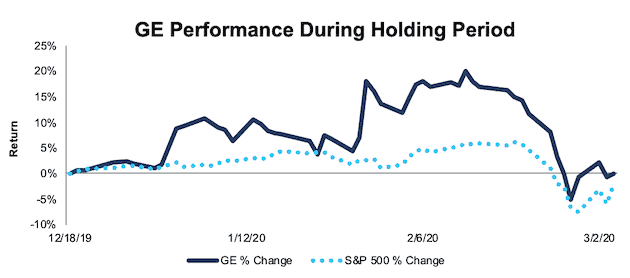

During the 77 day holding period, GE outperformed as a long position, as it was flat, compared to a 2% drop for the S&P 500. GE’s declining ROIC and expensive stock price lead us to close out this short-term call.

Figure 1: GE vs. S&P 500 – Price Return – Successful Long Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on March 5, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our Core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to IBES “Street Earnings”, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).