Host Hotels & Resorts (HST) – Closing Short Position – down 7% vs. S&P up 13%

Host Hotels & Resorts (HST: $17/share) was originally put in the Danger Zone on 2/5/19, alongside two other stocks that appeared cheap based on their P/E ratios, but were actually expensive based on price to economic book value (PEBV). This report, along with all of our research, utilizes our one of a kind database of footnotes disclosures to get the truth about earnings, as shown in the Harvard Business School and MIT Sloan paper, “Core Earnings: New Data and Evidence.”

The three stocks from the original report, Landec Corporation (LNDC), Brooks Automation (BRKS), and Host Hotels & Resorts are up by an average of 9% compared to 13% for the S&P 500.

At the time of the report, HST received a Very Unattractive rating. Our short thesis pointed out the firm’s misleading GAAP net income and high growth expectations implied by its stock price.

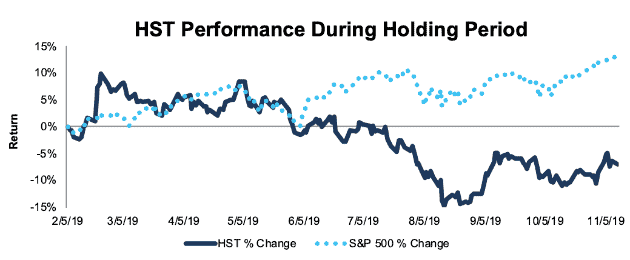

During the 180 day holding period, HST outperformed as a short position, falling 7% compared to a 13% gain for the S&P 500.

Since our article, HST’s after-tax operating profit (NOPAT) has grown significantly, and it now earns positive economic earnings. The company’s improved fundamentals, combined with its lower valuation, means the risk in this stock has decreased. We believe it is time to take the gains and close this short position.

Figure 1: HST vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 12, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.