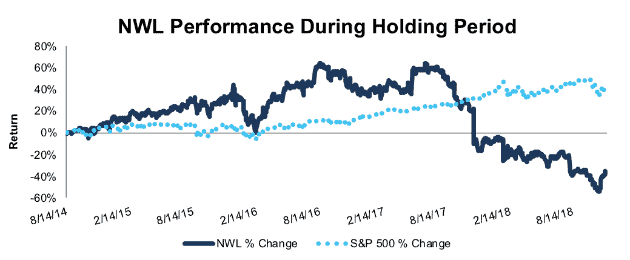

Newell Brands, Inc. (NWL: $21/share) – Closing Short Position – down 36% vs. S&P up 38%

Newell Brands was originally selected as a Danger Zone idea on 8/14/14. At the time of the initial report, the stock received a Very Unattractive rating. Our short thesis highlighted poor capital efficiency and misleading accounting. We reiterated our Danger Zone call on 12/21/15 when Newell acquired fellow Danger Zone pick Jarden Corporation.

During the 1,558-day holding period, NWL outperformed as a short position, declining 36% compared to a 38% gain for the S&P 500.

NWL was upgraded to Neutral on 11/12/18 after the company sold off a number of its underperforming assets.

NWL reached agreements earlier this month to sell Pure Fishing and Jostens, two brands it acquired during the Jarden acquisition. We don’t know what Pure Fishing was valued at prior to the Jarden acquisition, but NWL is selling Jostens at a loss – getting $1.3 billion for the class ring maker, which was valued at $1.5 billion in 2015.

These sales cap a string of divestitures over the course of the year that have freed up capital to help the company pay down its debt and maintain its 4.2% dividend yield.

We pointed out earlier this year that the Jarden acquisition ended up costing NWL investors ~100x more than Jarden short sellers lost. This year’s fire sale shows that management (under pressure from activists) recognizes its mistakes and is hitting the reset button.

This shift to a more disciplined capital allocation, combined with a cheaper stock price, decreases the risk for NWL. As a result, we are closing this position

Figure 1: NWL vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 20, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.