Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

What happens when executives are compensated based on “adjusted EPS?” They will run the business for the sole purpose of increasing EPS regardless of the effect on shareholders. This week’s Danger Zone stock, Jarden Corporation (JAH: $47/share) is executing a roll-up scheme that lines the pockets of insiders and Wall Street banks while destroying shareholder value.

Misaligned Executive Compensation Hurts Shareholders

Jarden’s executives’ cash bonuses and equity awards are tied to meeting specific “adjusted EPS” criteria, which is the same as reported EPS except that it removes certain expenses, including stock compensation associated with restricted stock. It must be nice to have your own pay removed from the metric that determines your cash bonuses. As long as executives are rewarded for growing EPS, look for Jarden to keep making acquisitions that boost this flawed metric. Whenever the word adjusted appears in a metric used to measure performance, investors must remain skeptical.

Why Is EPS A Flawed Metric For Executive Compensation?

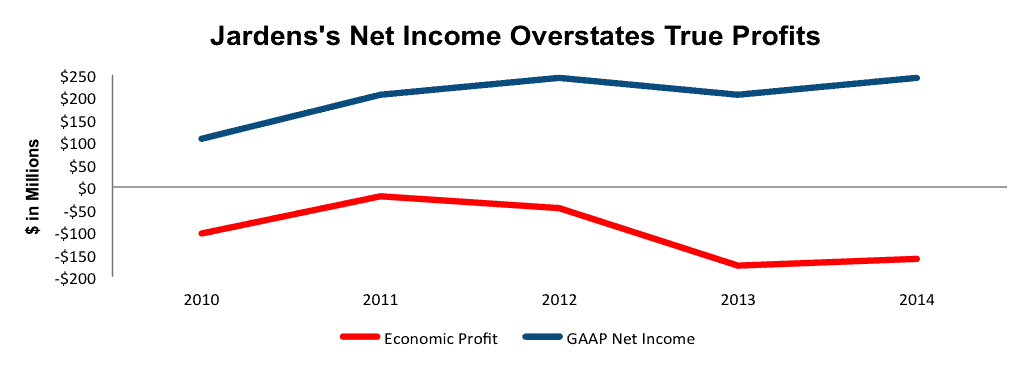

EPS is simply not consistent with cash flow or shareholder value creation. Many empirical studies have featured this fact for some time. Jarden provides an excellent example of how using EPS to measure performance is a mistake. From 2010-2014, Jarden Corporation reported a cumulative net income of $1 billion while cumulative economic earnings are -$507 million. See Figure 1. This situation parallels the one that led us to put InnerWorkings (INWK), another acquisition driven business, in the Danger Zone in September 2013. INWK is down 32% since that report while the S&P 500 is up 19%.

Figure 1: Economic Profit Remains Negative

Sources: New Constructs, LLC and company filings

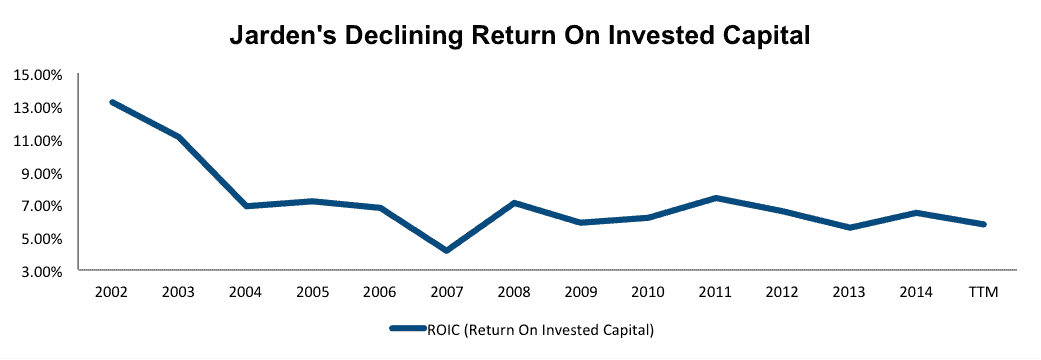

The big disconnect here comes from the lack of analytical rigor around acquisitions, most of which are very costly while creating the illusion of profits through EPS growth. This issue is best known as the High-Low Fallacy, which is an accounting loophole that allows companies to show acquisitions as earnings accretive with no regard to the underlying economics of the business. As you can see in Figure 2, the roll-up strategy has not benefited Jarden’s true bottom line: return on invested capital (ROIC).

Figure 2: Acquisition’s Are Becoming Less Profitable

Sources: New Constructs, LLC and company filings

Wall Street Wins Too…Investors Still lose

Wall Street investment banks benefit greatly from Jarden’s roll-up merger scheme because (1) M&A fees are quite lucrative and (2) the scheme requires the company raise large amounts of capital. Meanwhile, existing shareholders see the value of their investment diluted with each new round of equity or debt. Note: if Jarden were making as much money as it reports, why would it need so much additional capital?

From 2002-2014, Jarden’s weighted average diluted shares outstanding increased from 14.3 million to 189.8 million, which is an increase of over 1200% or 24% compounded annually. In 2015, Jarden has announced two new stock offerings and as of 3Q15, its weighted average diluted shares outstanding had grown to 195.4 million.

Additionally, the company’s debt has risen nearly 2300%, or 30% compounded annually, from $230 million in 2002 to $5.5 billion on a trailing twelve-month (TTM) basis. Much like we noted in our recent report on Netflix, investment banks are more than happy to help raise extra capital as these deals mean big profits for said banks.

Competition From Every Angle

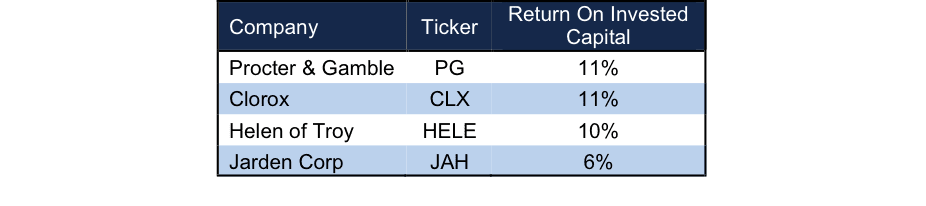

In large part due to the many costly acquisitions, Jarden operates less profitably than its competition, as evidenced by its 6% ROIC. While Jarden owns over 120 brands ranging from outdoor equipment, to toasters, to baby care products, it faces competition in multiple different markets. As Figure 3 Shows, some of the largest home good competitors operate much more profitability than Jarden, which gives them many competitive advantages, including pricing power. It is hard to see how Jarden will be able to raise its ROIC considering the intense competition in this industry.

Figure 3: Jarden Is Less Profitable Than Competition

Sources: New Constructs, LLC and company filings

Bull Case Running Out Of Room

The bull case for Jarden rests upon the company’s ability to continue growing top and bottom lines at double digit rates each year. Bulls tout how prudent management has been in making past acquisitions (under the illusion highlighted above) as reason to believe Jarden will be able to repeat this success going forward. I think you can see how this movie ends

Making matters worse, as can be seen in Figure 2 above, Jarden’s acquisitions have become an increasingly less efficient use of capital. Jarden’s ROIC has fallen from 13% in 2002 to 6% on a TTM basis. In its effort to continue growing EPS, Jarden has been forced to make acquisitions that are successively less profitable. This trend must be reversed, by a large margin, if the bull case is to be believed.

Buyout Seems Unlikely

While Jarden has certainly been on the purchasing side of M&A activity, it seems unlikely that a suitor would surface and purchase Jarden outright. Jarden is conglomerate of many different consumer goods, ranging from vacuums, camping supplies, baseball gloves, to candles. With so many different product lines operating under one roof, any potential suitor would have to be willing to run or integrate a vast array of different businesses, which is inherently expensive and difficult. Additionally, as noted above, Jarden has significant amounts of debt, $5.5 billion in all (52% of market cap), a net deferred tax liability over $1 billion, and shares that are greatly overvalued, as we’ll show below.

Inflated Valuation Has Significant Downside

The profit illusion created by Jarden’s corporate strategy has driven shares up over 230% in the past five years, to the point where the company’s underlying business simply cannot justify the share price. To justify the current price of $47/share, Jarden must grow NOPAT by 13% compounded annually for the next 16 years, at which point, Jarden would be generating over $66 billion in revenue. To put this in perspective, consumer goods giant PepsiCo (PEP) generated $66 billion revenue in 2014 and retail leaders TJX Companies (TJX) and Nike (NKE) only generated a combined $60 billion in revenue in their last fiscal years.

Even if we assume that Jarden is able to find acceptable acquisition targets, shares are still overvalued. If Jarden can maintain its current 11% pre-tax margin, which is unlikely as acquisitions become harder to come by, and grow NOPAT by 9% compounded annually for the next decade, the stock is only worth $23/share today – a 51% downside.

However, if acquisition growth fails and investors are left with just the organic growth of Jarden, it could be a rough ride. If Jarden can grow NOPAT by 4% compounded annually for the next decade, shares are only worth $7/share today – an 85% downside.

Asset Write-Downs and Share Dilution Will Sink Shares

First, as Jarden moves into larger and more risky acquisitions to meet the lofty expectations it has created, the company will face further issues. As we noted in our special report on goodwill/asset write-downs, the larger the acquisition, the more likely write-downs occur. As of 2014, the company has already recorded cumulative $516 million in asset-write downs. Jarden has $2.9 billion in goodwill and another $2.6 billion in intangible assets, which represent 51% of total assets. With such a significant portion of assets wrapped up in goodwill and no profits to show, Jarden could be in store for more shareholder destructive write-downs in the near future.

Second, in order to fund these larger acquisitions, Jarden will need to raise additional capital, as noted earlier. Further shareholder dilution posses a large risk to existing shareholders and could cause many to dump their investment before the momentum in JAH runs out.

Insider Sales/Short Interest Raise Red Flags

Over the past 6 months 26,000 shares have been purchased and 670,000 shares have been sold for a net effect of 644,000 insider shares sold. These sales represent <1% of shares outstanding and 5% of insider shares held. Additionally, there are 10.9 million shares sold short, or 5% of shares outstanding. It looks like insiders and some short sellers already see the writing on the wall.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Jarden’s 2014 10-K. The adjustments are:

Income Statement: we made $1.1 billion of adjustments with a net effect of removing $336 million of non-operating expenses (9% of revenue). We made $391 million non-operating income adjustments and $727 million non-operating expense adjustments.

Balance Sheet: we made $3.1 billion of balance sheet adjustments to calculated invested capital with a net increase of $286 million. The most notable adjustment was the inclusion of $516 million in asset write-downs. This adjustment represented 6% of reported net assets.

Valuation: we made $6.9 billion of valuation adjustments with a net effect of decreasing shareholder value by $6.3 billion. The most notable adjustment to shareholder value was the removal of $1 billion in net deferred tax liabilities. This adjustment represents 11% of Jarden’s market cap.

Dangerous Funds That Hold JAH

The following fund receives our Dangerous rating and allocates significantly to Jarden.

- Advisors’ Inner Circle Fund: FMC Strategic Value Fund (FMSVX) – 4.6% allocation and Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Mike Mozart (Flickr)