Oclaro (OCLR: $10/share) – Closing Long Position – Up 39% vs. S&P -6%

Oclaro was originally selected as a Long Idea on 1/17/18. At the time of the report, the stock received a Very Attractive rating. Our investment thesis highlighted dramatic economic earnings growth, a significant technological advantage, overstated concerns about China, and a valuation that implied a permanent 30% decline in after-tax profit (NOPAT). We added the stock to our Focus List on 1/18/18.

We stated in our long thesis that an acquisition by Finisar (FNSR) or Lumentum (LITE) could be an immediate upside catalyst. Sure enough, LITE made an acquisition offer on March 12 at a 27% premium to OCLR’s stock price at the time. We kept the position open for a few weeks in the hopes that FNSR might come in with a higher bid, but enough time has elapsed that this no longer seems likely, so we are closing our OCLR position.

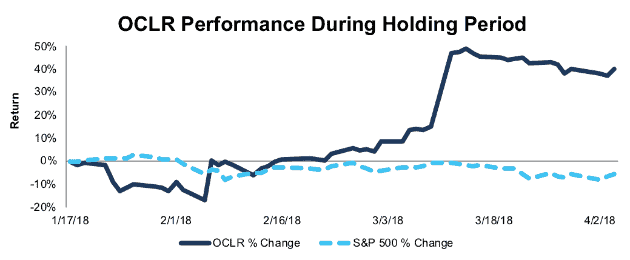

Oclaro outperformed as a long idea over the 77-day holding period, gaining 39% while the S&P fell by 6%.

Figure 1: OCLR vs. S&P 500 – Price Return

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

We think this acquisition is a good deal for LITE. Based on OCLR’s current NOPAT, LITE will earn a return on invested capital (ROIC) of 7.4% on the acquisition, which is greater than its weighted average cost of capital (WACC) of 5.6%. Despite its strong fundamentals, LITE’s expensive valuation means it only earns a Neutral Risk/Reward rating.

This article originally published on April 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.