Rocket Companies (RKT) – Closing Short Position – down 55% vs. S&P up 15%

We warned investors about Rocket Companies (RKT: $9/share) in August 2020, shortly after the company went public. RKT earned our Neutral rating at the time of the report. We pointed out that, unlike other IPOs at the time, Rocket Companies was profitable. However, the stock’s risk/reward proposition was poor because expectations baked into the stock price were overly optimistic and not supported by a sober analysis of the company’s fundamentals and future business prospects.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

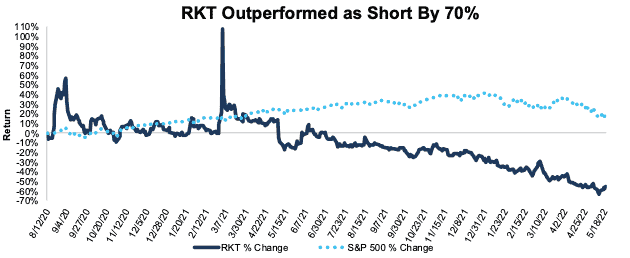

During the nearly two-year holding period RKT outperformed as a short position, falling 55% compared to a 15% gain for the S&P 500.

Rocket Companies saw its revenue and profitability soar in 2020, a year in which it achieved record closed loan origination and net rate lock volume. While profitability in 2021 couldn’t top the heights of 2020, Rocket Companies does indeed remain highly profitable. Over the trailing-twelve-months (TTM), Rocket Companies earns a top-quintile 45% return on invested capital (ROIC) and generated $239 million in Core Earnings. Demand is likely to fall in the short-term due to rising rates, but the combination of improved profitability and falling stock price mean RKT is no longer a quality short position. As a result of this change, we’re closing this Danger Zone pick.

Figure 1: RKT vs. S&P 500 – Price Return – Successful Danger Zone Pick

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 19, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.