Skechers USA (SKX: $40/share) – Closing Long Position – Up 34% vs. S&P +29%

When selected as a Long Idea on 4/20/16, SKX earned our Very Attractive rating. Our investment thesis highlighted consistent after-tax profit (NOPAT) growth, improving return on invested capital (ROIC), diversification of customers and suppliers, and low market expectations despite its double-digit revenue and profit growth in each of the prior three years.

We reaffirmed our long thesis on the stock on July 25, 2016 after it fell over 20% on an earnings miss, and we added it to our Focus List on November 3, 2017. The stock is up 28% since its addition to the Focus List vs. 5% for the S&P 500.

Despite significant volatility, SKX has outperformed as a long idea, gaining 34% while the S&P rose 29% during the subsequent 699-day holding period. SKX has since been downgraded to Neutral on 3/3/18 after our Robo-Analyst[1] parsed the most recent 10-K.

The company’s NOPAT growth slowed to just 4% in 2017 while its invested capital increased by 22%. As a result, ROIC fell from 15% to 13%. The elevated stock price makes the company’s valuation less attractive. It now has a price to economic book value (PEBV) of 1.5.

Several positives for the stock remain noteworthy. Customer and supplier concentration continues to decline, heightened investment may spur renewed growth, especially internationally, and the valuation remains reasonable compared to some of its peers. However, the fundamentals no longer look strong enough for us to continue recommending the stock as one of our top long ideas, so we are closing this position with respectable gains and outperformance.

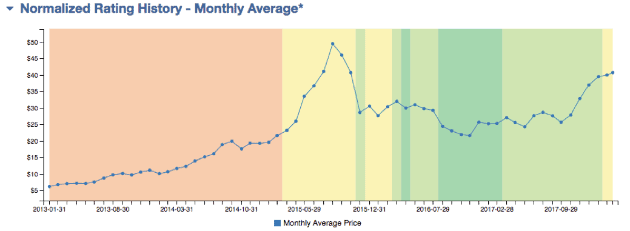

Figure 1: SKX Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

This article originally published on March 21, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.