We closed this position on March 21, 2018. A copy of the associated Position Update report is here.

The distinctions between growth and value styles are largely irrelevant. To achieve long-term returns for shareholders, you need both. Growth without value – i.e. generating positive economic earnings – does nothing for investors. Conversely, value without growth offers limited upside.

Investors should be excited about a new addition to our Most Attractive Stocks list: Skechers (SKX: $29/share). This stock offers a unique combination of growth potential, strong profitability, and a valuation with low market expectations. Investors have overreacted to one bad quarter, and many still seem skeptical of management after the “Shape-Ups” debacle in 2010/2011.

However, a deep dive into the numbers shows that Skechers has meaningfully improved its business operations. The stock has dropped over 50% in the past eight months, and even if the firm’s growth slows dramatically and margins shrink, the stock’s cheap valuation makes it a safe stock with high potential upside.

Rebuilding Investor Confidence

Many in the market simply don’t trust Skechers’ management after some debacles in the recent past. Most notably, the company made a big bet on its Shape-Ups fitness shoes a few years ago, going so far as to air a Super Bowl ad featuring Kim Kardashian in 2011 to promote the shoes.

This investment quickly went south for the company as its medical claims surrounding the shoes were proven to be false, and it had to settle for $40 million with the FTC. Consumers quickly fell out of love with the clunky-looking footwear, inventories piled up, and Skechers ended up selling millions at a discount.

Fortunately for investors, the company appears to be learning from its mistakes, diversifying its brands and executing a broad-based growth strategy that doesn’t rely on any one fad or channel to drive increases in sales.

Increasing Diversification

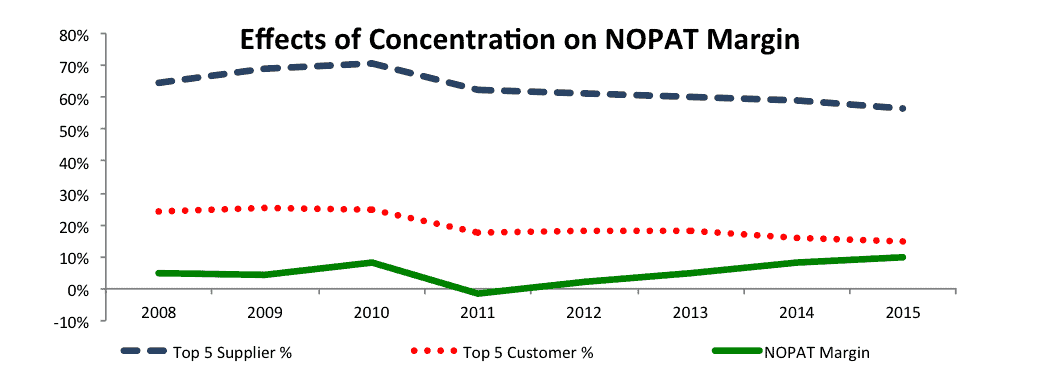

Not only has Skechers diversified its offerings, it has also done an excellent job in recent years of diversifying its suppliers and customers. Figure 1 shows that Skechers has decreased the share of inventory and sales coming from its top five suppliers and customers. This reduced concentration increases the company’s leverage and gives it more pricing power, manifesting in its growing operating profit (NOPAT) margins.

Figure 1: Lower Share For Top Five Suppliers And Customers Increases Pricing Power

Sources: New Constructs, LLC and company filings.

The share of Skechers’ goods coming from its five largest suppliers decreased from a peak of 70.6% in 2010 to 56.5% in 2015[1]. The share of its sales coming from its five largest customers fell from a peak of 25.1% in 2009 to 14.6% in 2015.

The customer diversification comes from a significant increase in online, outlet, and international sales as opposed to the reliance on large wholesalers. The supplier diversification is the result of a concerted effort by the company to contract with different factories. Not only does this diversification increase the company’s pricing power, it also reduces the risk that issues with one customer or supplier will drastically impact results.

Sustainable Growth Strategy

Skechers’ revenue growth has been strong in recent years. The company grew sales by 18% in 2013, 29% in 2014, and 32% last year. We certainly don’t see 30+% growth continuing for the long-term, but the company looks able to sustain a low double-digit growth rate for some time to come.

Most notably, growth over the past three years has not been fueled by the same marketing binge that saw a spike in sales during the Shape-Ups peak in 2010. That year, Skechers spent almost 8% of its revenue on advertising, well above its usual rate. In the past few years, advertising costs have declined back down to the long-term historical average of around 6%.

Growth has come primarily from expansion in Europe and Asia, more online sales, and the opening of specialty concept and outlet stores. The company has seen growth across a wide range of lifestyle, sport, and performance brand shoes.

The Skechers brand may not have the cultural cache of a Nike (NKE) or UnderArmour (UA), but it has a range of affordable shoes that appeal to a broad base of customers. As it continues to reach new markets and find new distribution channels, Skechers has room to leverage that appeal and continue its healthy rate of growth.

Better Fundamentals And Cheaper Valuation Than Peers

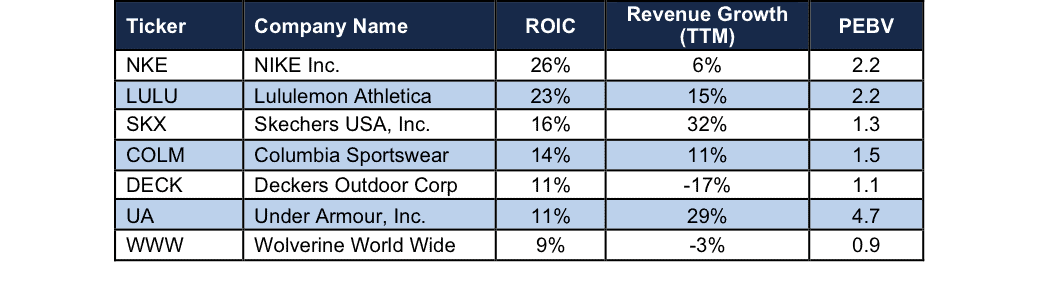

Figure 2 compares Skechers to a number of other shoe/apparel companies in the “Athleisure” segment across measures of profitability, growth, and valuation. It shows that while Skechers earns a superior return on invested capital (ROIC) compared to most of its peers and had the highest growth rate last year, its price to economic book value (PEBV) looks more like the laggard of the group.

Figure 2: Profit, Growth, And Value Comparison For “Athleisure” Stocks

Sources: New Constructs, LLC and company filings.

Based on profitability and growth rate, Skechers looks the most like UnderArmour in Figure 2. However, the market has it valued much more like Deckers (DECK), which saw a 17% decline in revenue over the past twelve months and has a long-term downtrend in ROIC.

Low Market Expectations Create An Attractive Risk/Reward Profile

Skechers’ PEBV of just 1.2 means that the market expects the company to increase NOPAT by no more than 20% from its current level for the remainder of its corporate life.

We don’t think such a pessimistic scenario is particularly likely, especially as Skechers has grown NOPAT by 14% compounded annually over the past 15 years.

Even with relatively modest assumptions, Skechers has significant upside. If we assume 9% compounded annual NOPAT growth for the next decade while the company maintains its 15% ROIC, the stock has a fair value of $39/share today. That’s a 42% gain from the current market value.

Investing In Growth Rather Than Buying Back Stock

Skechers has a healthy balance sheet that should allow it to keep investing in growth. The company’s stated goal to increase its retail store count by 25% in 2016 means investors shouldn’t expect a slowdown anytime in the near future. Management’s decision to invest profits into new growth opportunities rather than buying back stock or paying dividends should create long-term value for investors.

Short Interest Could Be A Positive Catalyst

Short interest currently stands at ~11 million shares, or 8% of shares outstanding. A look at the recent history of short interest in SKX shows that this could be a positive contrarian indicator. Shorts bet heavily against the stock last April right before it doubled. Short interest hit its lowest point on October 15, just a couple days before the company missed its 3Q revenue projections and the price fell 40%.

With its cheap valuation and strong fundamentals, Skechers could be set for another short squeeze this year to create significant gains for shareholders.

Bear Case Ignores Positive Developments

Bears continue to deride Skechers as being overly reliant on “fads” and primed for another collapse in its sales and profits. These critiques seem to be aimed at the company that existed five years ago, not the version of Skechers that exists today.

Today’s Skechers enjoys success in walking shoes, kids shoes, casual, work footwear, and a variety of other categories. It’s not going to sink or swim based on any one trend.

The company has also become more disciplined about planning for obsolescence and maintaining plenty of new products in the pipeline. Bears will argue that its products are often derivatives of more popular styles, but Skechers’ ability to create mass-market versions of these styles at a more affordable price represents a real value proposition to consumers. The “fast follower” strategy can work as well in retail is it does in technology.

Issues To Watch

We’re unconvinced by the typical bear arguments against Skechers, but the company still does come with some concerns that investors should monitor.

- Insider Selling: CEO Robert Greenberg raised eyebrows last summer when he sold $74 million worth of stock shortly before the share price tanked. These sales are part of a long-term trend for Greenberg and probably have more to do with estate planning (Greenberg is 75) than a lack of confidence in the company, especially as most insiders continue to amass more shares than they sell. Still, the unusual timing and size of Greenberg’s sale warrants close scrutiny of future insider transactions.

- Executive Compensation: Stock awards to executives are granted primarily on the basis of sales growth. We would prefer to see a more shareholder value-oriented compensation plan that rewards executives for improving ROIC, but the company’s recent track record reassures us somewhat.

- Days In Inventory: After multiple years where average days in inventory for Skechers declined, they ticked back up slightly in 2015, from 70 to 72. This slight increase is no cause for panic, but given the company’s inventory management issues in the past, it’s worth keeping a close eye on inventories going forward.

Impact Of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Skechers’ 2015 10-K. The adjustments are:

- Income Statement: We made $104 million worth of adjustments to net income with a net effect of removing $76 million (2% of revenue) in non-operating expenses. This included $17 million of reported non-operating expenses, $43 million in implied interest due to operating leases, and $300 thousand from a hidden increase in reserves.

- Balance Sheet: We made $1.3 billion of balance sheet adjustments to calculate invested capital. Most of that total came from adding back $850 million in off-balance sheet debt and removing $350 million in excess cash.

- Valuation Adjustments: We made $1.3 billion in valuation adjustments, accounting for the excess cash, debt, and $50 million in minority interests. The net impact was a roughly $650 million decrease in shareholder value.

Attractive Funds That Hold SKX

The following fund receives our Attractive-or-better rating and allocates significantly to Skechers

- ICON Consumer Discretionary Fund (ICCCX) – 4.5% allocation and Attractive rating.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

[1] The graph only goes back to 2008 because SKX only reported the share of its top four suppliers in the years prior. SKX’s reliance on its top five suppliers in 2015 is comparable to the reliance on its top four suppliers in the early 2000’s.

Click here to download a PDF of this report.

Photo Credit:Thomas Hawk (Flickr)

3 replies to "Long Idea: Skechers (SKX)"

SKX up 15% as CEO Robert Greenberg, disclosed that he purchased 500,000 shares on Wednesday.

SXK soars 20% after 4Q sales surpass expectations. International wholesale business led year over year growth in sales and comparable store sales.

SKX up 35% after reporting record sales during 3Q17 and beating bottom line expectations.