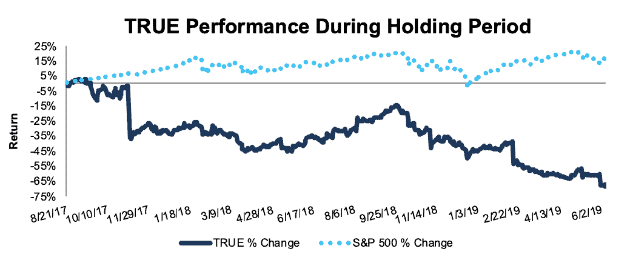

TrueCar Inc. (TRUE: $5/share) – Closing Short Position – down 67% vs. S&P up 18%

TrueCar (TRUE) was originally selected as a Danger Zone Idea on 8/21/17. At the time of the initial report, the stock received an Unattractive rating. Our short thesis noted the firm’s broken business model, diminishing value to consumers, and overvalued stock price.

During the 658-day holding period, TRUE outperformed as a short position, declining 67% compared to an 18% gain for the S&P 500.

We first put TRUE in the Danger Zone in August 2017 when we noted its business model couldn’t profitably serve two user groups with conflicting interests. We reiterated TrueCar’s downside risk in March 2019 after the company doubled down on this broken business model. The stock remains overvalued, but its risk/reward profile shifted after CEO Chip Perry announced his retirement. Perry was one of the driving forces behind TrueCar’s prioritization of dealers at the expense of consumers. Now, shares could respond positively if TrueCar replaces him with a more consumer-focused CEO.

Given the management change (and potential business model change) we believe it is time to take the robust gains and close this short position.

Figure 1: TRUE vs. S&P 500 – Price Return – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on June 10, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.