We closed this position on June 10, 2019. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

The last time we saw a business model as fundamentally flawed as TrueCar (TRUE: $17/share) was four years ago, when we put Angie’s List (ANGI) in the Danger Zone. In fact, TrueCar today looks very similar to Angie’s List in the summer of 2013, just before the stock plummeted over 50%.

- Just like ANGI in 2013, TRUE has no history of profitability.

- TRUE faces a similar declining return on its marketing spending.

- The competition from Amazon that hurt ANGI looks to be coming for TRUE as well.

Most importantly, TrueCar shares the same fatal flaw that sunk Angie’s List. As a middleman, it has to appeal to consumers while remaining valuable to its actual customers, car dealers. In trying to balance the needs of these two opposing sides, TrueCar is conflicted and struggles to provide value to either.

Scrambling Back And Forth On The See-Saw

No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. -Matthew 6:24

TrueCar operates a consumer-facing website that promises to help car buyers find the best price. However, it gets substantially all its revenue from car dealers. TrueCar only gets paid if it’s good for the dealers’ bottom line.

This dichotomy has caused numerous headaches for TrueCar in the past. Early on, the company positioned itself firmly on the side of consumers. Car buyers could easily find the lowest price on TrueCar, and the company ran ads that promoted the stereotype of the sleazy, greedy car dealer.

As a result, the dealers revolted and dropped TrueCar en masse. Founder Scott Painter made an effort to find a balance between consumers and dealers, going so far as to install a giant seesaw in the office with Consumer written on one end and Dealer on the other. Employees would stand on both sides and try to find a balance.

Painter was never able to strike that balance, and in 2015, industry veteran Chip Perry replaced him as CEO. As Figure 1 shows, Perry has heavily prioritized dealers over consumers so far during his tenure.

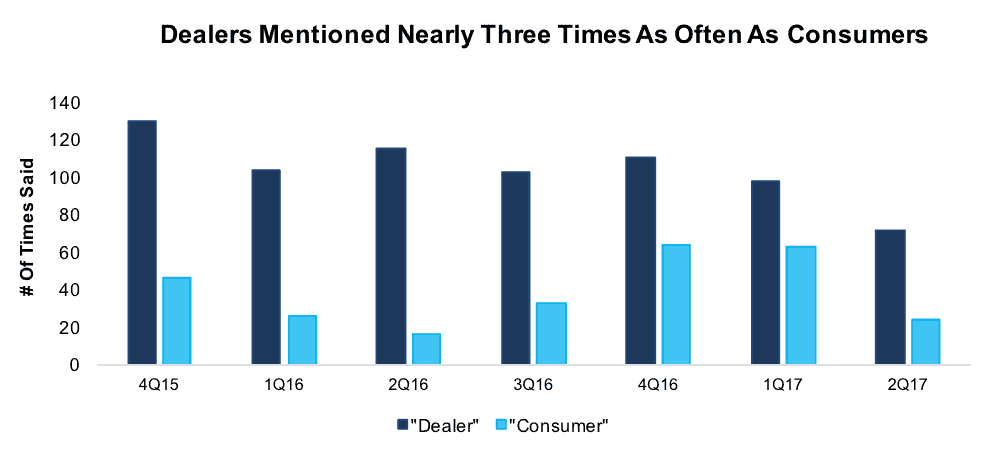

Figure 1: Number of Times The Words “Dealer” And “Consumer” Have Been Said On Each Earnings Call

Sources: Seeking Alpha Earnings Call Transcripts

In the seven earnings calls Perry has participated in since becoming CEO, executives and analysts on the calls have said the word “dealer” 733 times, nearly three times as often as the word “consumer”. Perry has worked hard to regain the trust of dealers, even at the expense of serving consumers.

“We’re doing that (displaying cars on the website) in a way that enables the dealers to price in a way they can still make money,” Perry said at the National Automobile Dealers Association Convention earlier this year. “We want them to know that you don’t have to be the lowest price, and we’re not promoting the lowest price on TrueCar.”

Under Perry, TrueCar has moved all the way to the dealer side of the seesaw, and it risks leaving consumers high and dry. If TrueCar cannot engage consumers, then how will it add any value to dealers?

Diminishing Value To Consumers

TrueCar made a name for itself by promising to get car buyers the best possible price, which made it an extremely attractive service. Now that the company is more focused on the dealer’s bottom line, it offers significantly less value to consumers.

A quick Google search turns up numerous accounts of consumers who were able to significantly beat the TrueCar price on their own. For instance, one account from April of this year describes the consumer finding a Jeep Cherokee for almost $3,000 cheaper than the TrueCar price at a dealer outside the TrueCar network.

TrueCar still offers a great deal of convenience to car buyers, but it’s hard to imagine that convenience is worth $3,000, especially when consumers can get similar services from competitors such as Kelly Blue Book and Edmunds.com.

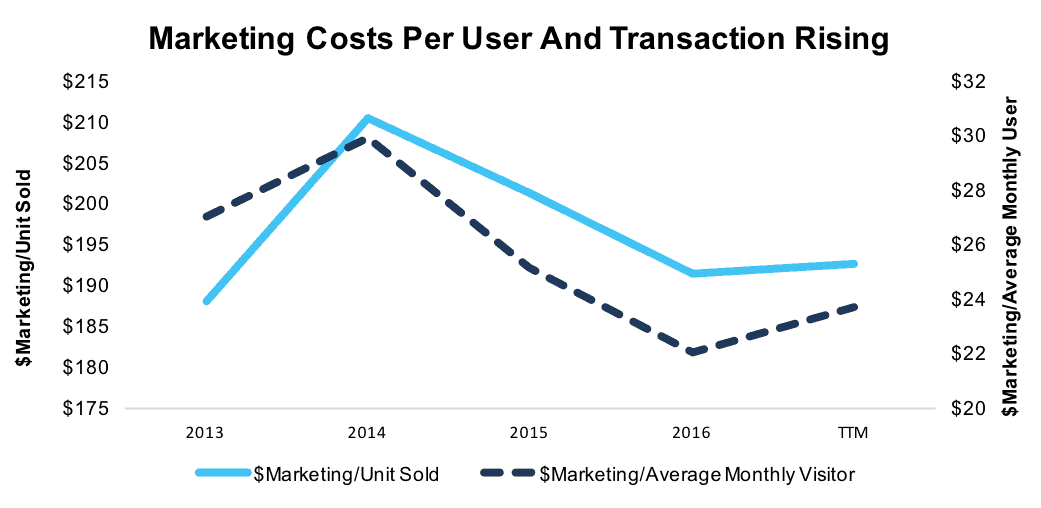

Figure 2 shows that as the site becomes less valuable to consumers, TrueCar has to spend more on marketing to keep driving new users and transactions. If the trend of rising marketing costs continues, TrueCar’s path to profitability will only grow more difficult.

Figure 2: Rising Marketing Costs Per Visitor And Unit

Sources: New Constructs, LLC and company filings.

Non-GAAP Metrics Mislead Investors

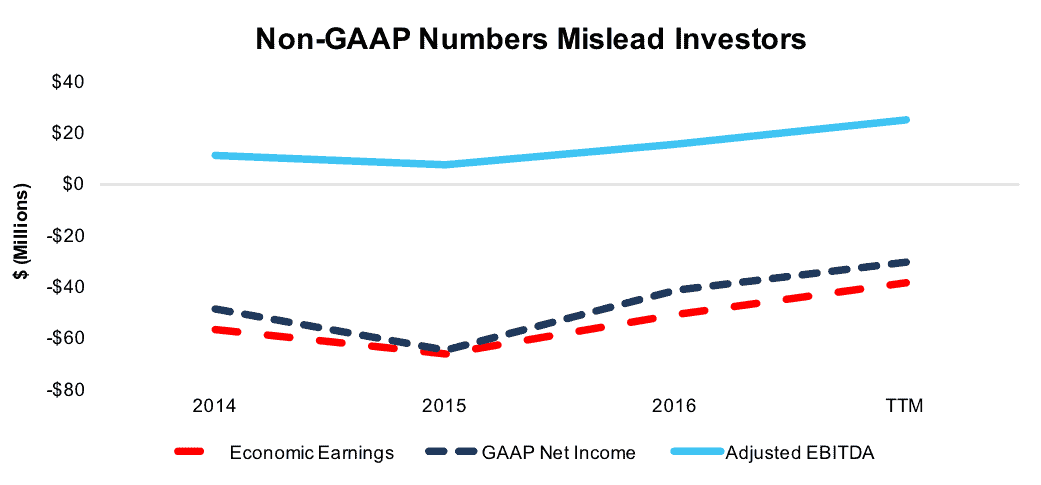

As with many other tech firms, TrueCar uses non-GAAP metrics to create the illusion that it’s already a profitable business. The company promotes its Adjusted EPS and Adjusted EBITDA metrics to investors, both of which fail to tell the whole story.

The Adjusted EBITDA number is especially concerning, as it allows the company to exclude real costs such as depreciation and amortization and stock-based compensation. Over the past twelve months, the entirety of TrueCar’s $25 million in Adjusted EBITDA would be wiped out just by adding back stock-based compensation.

Figure 3 shows just how much Adjusted EBITDA overstates the company’s profitability. Since 2014, the company has consistently reported positive Adjusted EBITDA despite its negative GAAP net income and economic earnings.

Figure 3: Adjusted EBITDA Creates False Profits

Sources: New Constructs, LLC and company filings.

Making matters worse, the company ties a significant portion of short-term executive bonuses to Adjusted EBITDA and revenue growth. These bonus targets incentivize excessive stock compensation and wasteful capital allocation. As we’ve shown in numerous case studies, ROIC, not adjusted EBITDA or revenue, is the primary driver of shareholder value creation. Without major changes to this compensation plan (e.g. emphasizing ROIC), investors should expect continued value destruction.

Competitive Landscape Weakens TrueCar’s Potential

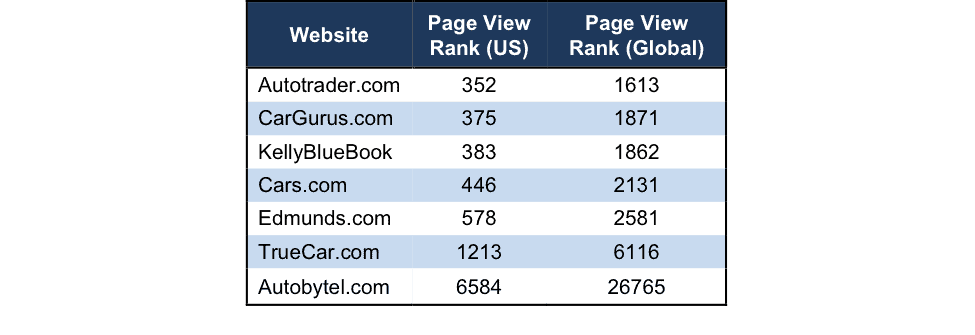

TrueCar operates in a crowded and highly-fragmented industry. The company receives outsized attention due to its status as one of the only public companies in the online automotive retail industry. In truth, TrueCar is one of the smallest companies in the market. Figure 4 shows that, among the websites TrueCar lists as direct competitors in its most recent 10-K, all but one rank above it in terms of page views.

Figure 4: TrueCar Ranks Near The Bottom On Page Views

Sources: Alexa.com

A large portion of TrueCar’s user traffic comes from its affinity groups. Large institutions, such as USAA, Consumer Reports, and American Express, partner with TrueCar to run their car buying services. In 2016, TrueCar’s affinity partnership with USAA represented 32% of its unit sales.

Lately, competitors have been encroaching on this key segment. Edmunds.com announced its first affinity relationship with insurance giant State Farm back in March. If these other, more popular, websites make inroads with TrueCar’s affinity group relationships, the company’s growth trajectory will stall out quickly.

Threat From Amazon Looms Large and Diminishes Bull Case

As TrueCar struggles to strike a balance between the needs of dealers and consumers, it faces an existential threat to its business from a competitor that can bypass that problem altogether.

With Amazon’s scale, it could push dealers around and force them to accept lower prices the same way it did with publishers. Laws and regulations in the U.S. would make it almost impossible for Amazon to eliminate dealers entirely, but it could provide a customer base too large for dealers to ignore.

Amazon has already experimented with limited car sales in Italy, and now it plans to roll out the program throughout Europe. Amazon has shown time and again that it plans to dominate every consumer category. When it inevitably announces online car sales in the U.S., TrueCar’s stock price could plummet. Until then, the market’s expectations baked into TrueCar’s stock price imply that the firm will immediately achieve profitability and significant profit growth, as we’ll show below.

Valuation Implies Unreasonable Growth Expectations

Even if TrueCar can stabilize its precarious business model and ward off the threat of competition, the stock has limited upside due to its expensive valuation. It’s hard to imagine the company achieving a level of growth and profitability that would justify its current valuation of $17/share, much less a higher valuation.

The best example we have of a company operating profitably as an online middleman between buyers and sellers is eBay (EBAY), which currently earns a net operating profit after tax (NOPAT) margin of 8%. Even if we assume TRUE – which again has never earned positive NOPAT – could immediately hit those margins, it would still need to grow revenue by 25% compounded annually for the next 10 years to justify a $17/share valuation today. Keep in mind TRUE’s TTM NOPAT margin is -5% and consensus revenue growth estimates expect 18% and 14% revenue growth in 2017 and 2018 respectively.

If we scale down expectations to a more realistic level, we can see the significant potential downside for TRUE investors. If the company immediately earns a NOPAT margin of 4% – roughly what Autobytel (ABTL) has earned in the past few years – and grows revenue at 12% compounded annually for the next decade, the stock is worth just $1/share, – a 93% downside.

Each of these scenarios also assumes TRUE is able to grow revenue, NOPAT and FCF without increasing working capital or investing in fixed assets. This assumption is unlikely but allows us to create optimistic scenarios that demonstrate just how high expectations embedded in the current valuation really are. For reference, TRUE’s invested capital has grown on average $43 million (15% of revenue) per year over the last two years.

Dealer Network Offers No Advantage to Potential Acquirers

TrueCar has a fundamentally flawed business model and unrealistic growth expectations baked into its stock price. The company’s only path to creating shareholder value might be through being acquired by a larger company. The largest risk to our bear thesis is what we call “stupid money risk”, which means an acquirer comes in and pays for TRUE at the current, or higher, share price despite the stock being overvalued.

Amazon or some other company looking to break into online automotive retail might see an acquisition as the best way to gain immediate access to thousands of dealer relationships. However, we see an acquisition as possible only if an acquiring firm is willing to ignore prudent stewardship of capital and destroy substantial shareholder value.

To begin, TrueCar has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $195 million in outstanding stock option liabilities (12% of market cap)

- $67 million in off-balance-sheet operating leases (4% of market cap)

- $3 million in deferred tax liabilities (<1% of market cap)

In addition to these liabilities, TrueCar’s lack of competitive advantage also detracts from the company’s value to a potential acquirer. In fact, due to its aggressive marketing and price competition in its early history, the company is at a bit of a disadvantage. Even with its hard turn in the past two years to court dealers, TrueCar is still playing catchup to competitors with more firmly established relationships.

Currently, TrueCar claims a dealer network of roughly 15,000 franchise and local dealers. Cars.com has strategic relationships with over 20,000 dealers. Autobytel (ABTL) has over 24,000 dealers in its network. Why would an acquirer pay $2 billion for TRUE when it can get ABTL and its larger dealer network for $100 million?

Catalysts Abound: TRUE Could Sink to More Rational Levels

We’ve previously mentioned two big threats to TRUE’s business prospects. If Amazon enters the U.S. auto market, it could significantly shift the entire landscape. Similarly, if competitors continue to create new affinity relationships, TRUE’s business could suffer. In both cases, the stock price would fall to more realistic levels given TrueCar’s competitive disadvantages.

Meanwhile, the auto industry as a whole faces a risk from the weakness in the deep subprime auto loan market. Delinquency rates in the deep subprime market have reached 2007 levels, which could lead to a tightening of credit standards that would hurt car sales.

Even without an immediate catalyst, the momentum is already against TRUE. The stock has dropped 25% in the past month due in part to lowering its growth forecasts for the third quarter. As the company attempts to spend more to add new users, it could ultimately struggle to add users and grow its transaction volume, which would lead to more disappointing forecasts and a falling stock price.

TrueCar Offers No Shareholder Yield

TrueCar does not currently pay a cash dividend nor have a buyback program in place. As such, the stock offers none of the downside protection that a solid shareholder yield can provide. Given the level of risk we see in the valuation and forward expectations, this downside protection could be sorely missed.

Insider Selling and High Short Interest Raises Red Flags

In the past twelve months, TRUE insiders have dumped 7.9 million shares while acquiring just 300 thousand shares, for a net disposition of 7.6 million shares (8% of shares outstanding). Additionally, there are 16.5 million shares sold short (17% of shares outstanding). It’s clear that many investors understand the risks associated with TRUE while insiders understand how overvalued shares are and are cashing in.

Impact of Footnotes Adjustments and Forensic Accounting

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to TrueCar’s 2016 10-K:

Income Statement: we made $14 million of adjustments with a net effect of removing $14 million in non-operating expenses (5% of revenue). See all adjustments made to TRUE’s income statement here.

Balance Sheet: we made $151 million of adjustments to calculate invested capital with a net decrease of $4 million. The most notable adjustment was $67 million in off-balance sheet debt. See all adjustments to TRUE’s balance sheet here.

Valuation: we made $398 million of adjustments with a net effect of decreasing shareholder value by $188 million. Our largest single adjustment was the removal of $195 million (12% of market cap) in employee stock option liability. TRUE’s significant ESO liability not only limits the upside on the stock, it creates the risk of a death spiral, as a crashing stock price could make employees’ options worthless, and in turn force the company to dilute existing shareholders even further to keep employees on board.

Unattractive Funds That Hold TRUE

The following fund receives our Unattractive-or-worse rating and allocate significantly to TRUE.

- Riley Diversified Equity Fund (BRDAX): 3.9% allocation to TRUE and Very Unattractive rating.

This article originally published August 21, 2017.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

4 replies to "TrueCar Can’t Serve Two Masters"

TRUE falls 20% AH as earnings and guidance below expectations. Now down over 23% since original Danger Zone report while S&P 500 is up 7%

TRUE falls 8% after 4Q17 and full year earnings. Now down over 33% since original Danger Zone report while the S&P is up 13%.

TRUE down nearly 20% after hours after 4Q18 earnings miss expectations. Now down over 50% since our original Danger Zone report while the S&P is up 13%.

TRUE down ~14% after the company announces CEO Chip Perry’s retirement. Now down over 66% since our original Danger Zone report while the S&P is up 13%.